444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2150

Market Overview

India has witnessed a significant rise in the prevalence of diabetes over the years, leading to an increased demand for diabetes care drugs. Diabetes is a chronic metabolic disorder characterized by high blood sugar levels, and it requires lifelong management to prevent complications. The Indian diabetes care drugs market plays a vital role in providing effective treatment options and management solutions for individuals living with diabetes.

Meaning

Diabetes care drugs refer to medications and therapeutics designed to manage blood sugar levels in patients with diabetes. These drugs help in controlling blood glucose, improving insulin sensitivity, and preventing complications associated with diabetes. The market for diabetes care drugs in India includes various types of medications, such as insulin, oral antidiabetic drugs, and injectables, which are prescribed based on the patient’s condition and medical history.

Executive Summary

The India diabetes care drugs market has been experiencing substantial growth in recent years due to the increasing prevalence of diabetes and the growing awareness about the importance of diabetes management. The market is driven by factors such as a sedentary lifestyle, unhealthy dietary habits, rising obesity rates, and a lack of physical activity. Additionally, advancements in drug development and the introduction of innovative therapies have further fueled the market growth.

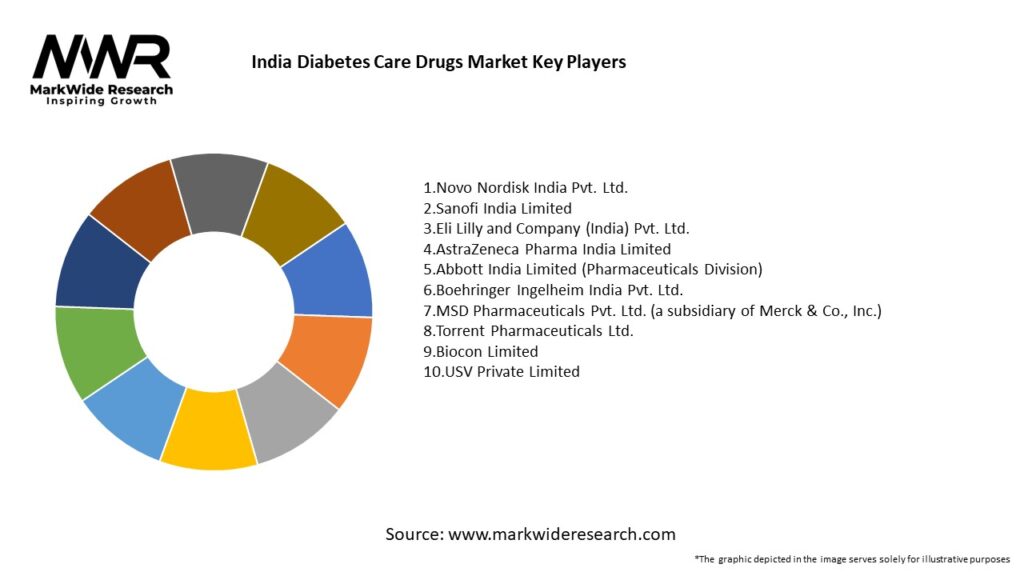

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The India diabetes care drugs market is characterized by intense competition among pharmaceutical companies striving to capture a significant market share. The market dynamics are influenced by factors such as increasing patient awareness, changing treatment paradigms, evolving regulatory landscape, and advancements in drug delivery technologies. Moreover, collaborations and strategic alliances play a crucial role in driving market growth and enhancing the distribution network for diabetes care drugs.

Regional Analysis

The diabetes care drugs market in India exhibits regional variations in terms of prevalence, treatment patterns, and access to healthcare facilities. The major metropolitan cities, such as Mumbai, Delhi, Chennai, and Bangalore, have higher concentrations of diabetes cases and better access to specialized healthcare services. However, rural areas face challenges in terms of healthcare infrastructure, accessibility to medications, and awareness about diabetes management.

Competitive Landscape

Leading Companies in the India Diabetes Care Drugs Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The India diabetes care drugs market can be segmented based on drug type, including:

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

The India diabetes care drugs market offers several benefits for industry participants and stakeholders, including:

SWOT Analysis

A SWOT (Strengths, Weaknesses, Opportunities, and Threats) analysis of the India diabetes care drugs market provides valuable insights into the market’s internal and external factors:

Market Key Trends

Several key trends are shaping the India diabetes care drugs market:

Covid-19 Impact

The COVID-19 pandemic has had a significant impact on the India diabetes care drugs market. The pandemic’s implications include:

Key Industry Developments

The India diabetes care drugs market has witnessed several notable industry developments, including:

Analyst Suggestions

Based on the analysis of the India diabetes care drugs market, analysts make the following suggestions:

Future Outlook

The India diabetes care drugs market is expected to witness steady growth in the coming years. The rising prevalence of diabetes, coupled with increasing awareness about the importance of diabetes management, will continue to drive market demand. Technological advancements, personalized medicine approaches, and collaborations among industry stakeholders will shape the future of the market. The integration of digital health solutions, AI-driven technologies, and telemedicine will further enhancediabetes care and improve patient outcomes. However, challenges related to affordability, accessibility, and healthcare infrastructure need to be addressed to ensure comprehensive diabetes management for all segments of the population.

Conclusion

The India diabetes care drugs market is witnessing significant growth due to the increasing prevalence of diabetes and the growing awareness about the importance of diabetes management. The market offers a wide range of medications, including insulin, oral antidiabetic drugs, and injectables, to cater to the diverse needs of individuals with diabetes. Advancements in drug development, technology integration, and personalized medicine approaches are driving market growth and improving treatment outcomes.

While the market presents numerous opportunities, challenges such as affordability, accessibility, and healthcare infrastructure must be overcome to ensure effective diabetes care for all individuals. Collaborative efforts among pharmaceutical companies, healthcare providers, and government organizations are crucial in addressing these challenges and enhancing patient care.

Looking ahead, the India diabetes care drugs market is expected to continue its growth trajectory. Technological advancements, research and development initiatives, and patient-centric approaches will shape the future of the market. By leveraging innovative solutions, expanding distribution networks, and promoting patient education and support, the industry can make significant strides in diabetes management, improving the quality of life for individuals living with this chronic condition.

What is Diabetes Care Drugs?

Diabetes Care Drugs refer to medications used to manage diabetes, including insulin and oral hypoglycemic agents. These drugs help regulate blood sugar levels and prevent complications associated with diabetes.

What are the key players in the India Diabetes Care Drugs Market?

Key players in the India Diabetes Care Drugs Market include Sun Pharmaceutical Industries, Dr. Reddy’s Laboratories, and Novo Nordisk, among others.

What are the main drivers of growth in the India Diabetes Care Drugs Market?

The main drivers of growth in the India Diabetes Care Drugs Market include the rising prevalence of diabetes, increasing awareness about diabetes management, and advancements in drug formulations and delivery systems.

What challenges does the India Diabetes Care Drugs Market face?

Challenges in the India Diabetes Care Drugs Market include high treatment costs, limited access to healthcare in rural areas, and the need for better patient education on diabetes management.

What opportunities exist in the India Diabetes Care Drugs Market?

Opportunities in the India Diabetes Care Drugs Market include the development of new drug therapies, increasing investment in healthcare infrastructure, and the potential for telemedicine solutions to enhance patient care.

What trends are shaping the India Diabetes Care Drugs Market?

Trends shaping the India Diabetes Care Drugs Market include the growing demand for personalized medicine, the rise of digital health technologies, and an increasing focus on preventive care and lifestyle management.

India Diabetes Care Drugs Market

| Segmentation Details | Description |

|---|---|

| Product Type | Insulin, Oral Hypoglycemics, GLP-1 Agonists, DPP-4 Inhibitors |

| Delivery Mode | Injectable, Oral, Inhalable, Transdermal |

| End User | Hospitals, Clinics, Homecare, Pharmacies |

| Therapy Area | Type 1 Diabetes, Type 2 Diabetes, Gestational Diabetes, Prediabetes |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the India Diabetes Care Drugs Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at