444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2150

Market Overview

The India Buy Now Pay Later (BNPL) Services Market has witnessed significant growth in recent years. With the rise of e-commerce and the changing consumer behavior towards online shopping, the demand for BNPL services has surged. BNPL services provide consumers with the flexibility to make purchases and pay for them in installments, without the need for a credit card or upfront payment. This payment model has gained popularity among Indian consumers, particularly millennials and Gen Z, who prefer convenient and flexible payment options.

Meaning

Buy Now Pay Later services refer to the payment model where consumers can make a purchase and defer the payment for a later date. Instead of paying the entire amount upfront, customers can opt for installment-based payments over a specified period. These services are typically offered by fintech companies or e-commerce platforms, and they have gained immense popularity in recent years due to their convenience and affordability.

Executive Summary

The India Buy Now Pay Later Services Market has experienced exponential growth in the past few years. The market has been driven by the increasing adoption of e-commerce, the growing preference for convenient payment options, and the rise of fintech companies offering innovative BNPL solutions. However, there are challenges and opportunities that need to be addressed to sustain and further expand the market.

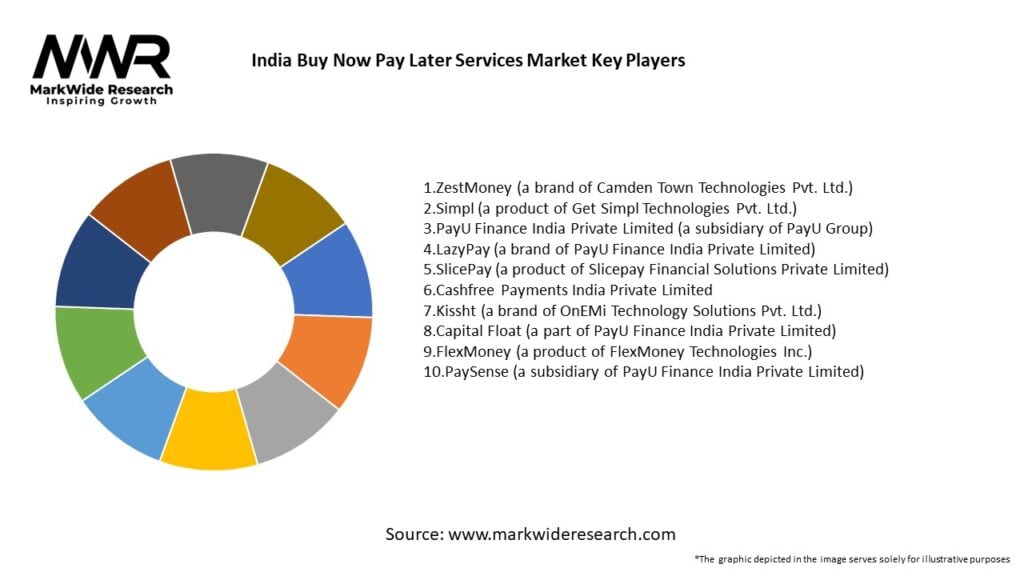

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

The India BNPL services market is driven by several factors:

Market Restraints

While the India BNPL services market has witnessed significant growth, there are certain challenges and restraints that need to be considered:

Market Opportunities

The India BNPL services market presents several opportunities for growth and expansion:

Market Dynamics

The India BNPL services market is characterized by intense competition, evolving consumer preferences, and technological advancements. Fintech companies and e-commerce platforms are constantly innovating to differentiate themselves in the market. User experience, affordability, and convenience are key factors driving customer adoption. As the market matures, regulatory interventions and responsible lending practices will play a crucial role in shaping the future dynamics of the industry.

Regional Analysis

The India BNPL services market is witnessing growth across various regions. Major metropolitan cities such as Mumbai, Delhi, Bengaluru, and Chennai are the primary hubs for fintech companies and e-commerce platforms offering BNPL services. These cities have a higher concentration of tech-savvy consumers and a well-established e-commerce ecosystem. However, there is significant potential for growth in tier-2 and tier-3 cities, where the adoption of digital payments and e-commerce is rapidly increasing.

Competitive Landscape

Leading Companies in the India Buy Now Pay Later Services Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The India BNPL services market can be segmented based on various factors:

Segmenting the market based on these factors enables companies to target specific customer segments and tailor their offerings to meet their unique needs.

Category-wise Insights

Each category presents unique opportunities and challenges for BNPL service providers, and understanding the specific dynamics of each sector is crucial for sustained growth and success.

Key Benefits for Industry Participants and Stakeholders

The India BNPL services market offers several benefits for industry participants and stakeholders:

SWOT Analysis

A SWOT analysis of the India BNPL services market reveals the following:

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic has had a significant impact on the India BNPL services market. While the initial phases of the pandemic led to a decline in consumer spending and a cautious approach towards discretionary purchases, the subsequent lockdowns and restrictions accelerated the adoption of BNPL services. The pandemic highlighted the need for affordable and flexible payment options, as consumers faced financial constraints and sought alternatives to traditional credit cards. BNPL services emerged as a lifeline for many individuals and businesses, allowing them to make essential purchases and manage their finances during the economicdownturn. The convenience and affordability of BNPL options became even more appealing to consumers, driving increased adoption and transaction volumes.

Furthermore, the pandemic also prompted a shift towards online shopping, as physical retail stores faced closures and restrictions. This shift created a fertile ground for BNPL services to thrive, as consumers sought seamless and contactless payment options. E-commerce platforms integrated BNPL services into their checkout processes, providing a convenient and safe payment solution for online shoppers.

The pandemic also highlighted the importance of responsible lending and risk management in the BNPL sector. As consumers faced financial uncertainties, the need for responsible borrowing and repayment practices became more critical. BNPL service providers implemented stricter credit assessments, set appropriate credit limits, and promoted financial literacy among users to ensure sustainable lending practices.

Overall, the COVID-19 pandemic acted as a catalyst for the growth of the India BNPL services market. It accelerated the adoption of BNPL services, drove the expansion of e-commerce, and underscored the need for flexible and affordable payment solutions in times of economic volatility.

Key Industry Developments

Analyst Suggestions

Future Outlook

The future of the India BNPL services market looks promising, with significant growth potential. Factors such as increasing internet penetration, smartphone adoption, and the government’s push for digital payments will continue to drive the adoption of BNPL services. The younger generation, comprising millennials and Gen Z, will remain a key target audience, as their preference for convenience and flexible payment options grows.

To sustain the market’s growth, industry participants need to address regulatory concerns and focus on responsible lending practices. Clear guidelines and industry standards will ensure consumer protection and the long-term sustainability of BNPL services. Moreover, expanding the availability of BNPL options in offline retail and rural areas will unlock new growth opportunities.

Technological advancements will play a crucial role in shaping the future of BNPL services. Integration with digital wallets, artificial intelligence-driven credit assessments, and personalized offerings will enhance the user experience and drive adoption. Additionally, collaborations and partnerships between BNPL service providers and industry stakeholders will fuel innovation and create new avenues for market expansion.

Conclusion

In conclusion, the India BNPL services market is poised for continued growth, driven by evolving consumer preferences, technological advancements, and the need for convenient and flexible payment solutions. By addressing regulatory concerns, promoting responsible lending practices, and leveraging partnerships and technology, industry participants can capitalize on the market’s potential and deliver enhanced payment experiences to Indian consumers.

What is Buy Now Pay Later Services?

Buy Now Pay Later Services refer to financial solutions that allow consumers to purchase goods and services immediately and defer payment over a specified period. This model is increasingly popular in e-commerce, retail, and travel sectors, enabling consumers to manage their cash flow more effectively.

What are the key players in the India Buy Now Pay Later Services Market?

Key players in the India Buy Now Pay Later Services Market include companies like ZestMoney, LazyPay, and Paytm Postpaid, which offer various financing options to consumers. These companies are competing to capture a growing segment of the market focused on flexible payment solutions, among others.

What are the growth factors driving the India Buy Now Pay Later Services Market?

The growth of the India Buy Now Pay Later Services Market is driven by increasing online shopping, a rise in consumer credit demand, and the convenience of flexible payment options. Additionally, the growing penetration of smartphones and digital payment platforms is enhancing accessibility for consumers.

What challenges does the India Buy Now Pay Later Services Market face?

The India Buy Now Pay Later Services Market faces challenges such as regulatory scrutiny, potential consumer debt risks, and competition from traditional credit providers. These factors can impact the sustainability and growth of BNPL services in the long term.

What opportunities exist in the India Buy Now Pay Later Services Market?

Opportunities in the India Buy Now Pay Later Services Market include expanding into underserved demographics, integrating with more retail partners, and leveraging technology for better risk assessment. The increasing acceptance of digital payments also presents a significant growth avenue.

What trends are shaping the India Buy Now Pay Later Services Market?

Trends shaping the India Buy Now Pay Later Services Market include the rise of embedded finance, partnerships between fintech and traditional retailers, and the growing emphasis on responsible lending practices. These trends are influencing how consumers engage with BNPL services.

India Buy Now Pay Later Services Market

| Segmentation Details | Description |

|---|---|

| Service Type | Instant Credit, Flexible Payment Plans, Interest-Free Options, Subscription Services |

| Customer Type | Millennials, Gen Z, Working Professionals, Small Business Owners |

| Distribution Channel | Online Retailers, Mobile Apps, E-commerce Platforms, Physical Stores |

| Payment Method | Credit Card, Debit Card, UPI, Digital Wallets |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the India Buy Now Pay Later Services Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at