444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The global refractive surgery devices market refers to the medical devices used in surgical procedures to correct refractive errors in the eye, such as myopia, hyperopia, astigmatism, and presbyopia. These devices play a crucial role in improving visual acuity and reducing the dependency on corrective lenses. The market for refractive surgery devices has witnessed significant growth in recent years, driven by technological advancements, increasing prevalence of refractive errors, and growing patient preference for minimally invasive procedures.

Meaning

Refractive surgery devices are specialized tools and instruments used by ophthalmologists and eye surgeons to perform refractive surgeries. Refractive surgery is a branch of ophthalmology that aims to correct common vision problems, enabling patients to achieve clear vision without the need for eyeglasses or contact lenses. The devices used in these surgeries are designed to reshape the cornea or lens of the eye, altering its focusing ability and thus improving visual acuity.

Executive Summary

The global refractive surgery devices market is experiencing steady growth, driven by several factors such as the rising incidence of refractive errors, advancements in surgical techniques, and increasing patient awareness about the benefits of refractive surgeries. The market is characterized by intense competition among key players, who are continually investing in research and development activities to introduce innovative and technologically advanced devices. North America and Europe currently dominate the market, owing to well-established healthcare infrastructure and a higher adoption rate of refractive surgeries.

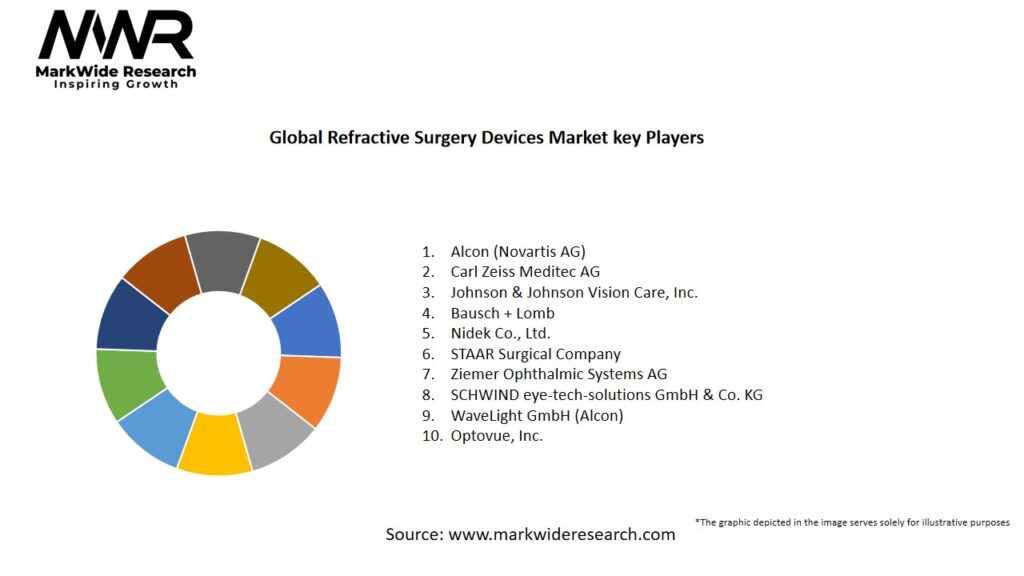

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

The following factors are driving the growth of the global refractive surgery devices market:

Market Restraints

Despite the promising growth prospects, the global refractive surgery devices market faces certain challenges that may impede its expansion. The key market restraints include:

Market Opportunities

The global refractive surgery devices market presents several opportunities for growth and expansion. The following factors are expected to drive market opportunities:

Market Dynamics

The global refractive surgery devices market is characterized by dynamic and evolving dynamics. Several factors influence the market, including technological advancements, changing patient demographics, regulatory landscape, and competitive strategies. Understanding the market dynamics is crucial for industry participants to make informed decisions and stay competitive.

Technological advancements play a significant role in shaping the refractive surgery devices market. Innovations in laser technologies, diagnostic devices, and implantable lenses have transformed refractive surgeries, improving treatment outcomes and patient satisfaction. Manufacturers that invest in research and development activities to bring new and advanced devices to market gain a competitive edge.

The changing demographics, particularly the aging population, contribute to the market dynamics. The rising prevalence of age-related vision problems and the desire for improved quality of life drive the demand for refractive surgeries. Manufacturers need to cater to the specific needs of older adults, such as offering solutions for presbyopia correction.

The regulatory landscape also influences the market dynamics. Stringent regulations and approval processes impact the development, manufacturing, and commercialization of refractive surgery devices. Manufacturers need to navigate these regulations effectively to ensure compliance and timely market entry.

Competitive rivalry among market players is intense, with several established and emerging companies vying for market share. Manufacturers employ strategies such as new product launches, strategic collaborations, acquisitions, and geographical expansion to strengthen their market position. The ability to offer a diverse portfolio of high-quality devices and maintain strong relationships with healthcare providers is crucial for sustained success.

Regional Analysis

The global refractive surgery devices market can be analyzed based on various regions, including North America, Europe, Asia-Pacific, Latin America, and the Middle East and Africa.

North America: North America currently dominates the refractive surgery devices market, accounting for a significant share. The region’s well-established healthcare infrastructure, increasing adoption of advanced technologies, and higher disposable incomes contribute to its market dominance. The United States holds the largest share in North America, with a substantial number of refractive surgeries performed each year.

Europe: Europe is another key market for refractive surgery devices, driven by factors such as a large patient pool, growing awareness about refractive surgeries, and favorable reimbursement policies. Countries such as Germany, the United Kingdom, and France are witnessing significant demand for refractive surgery devices.

Asia-Pacific: The Asia-Pacific region is expected to witness rapid growth in the refractive surgery devices market. Factors such as the presence of a large population, increasing disposable incomes, rising medical tourism, and improving healthcare infrastructure contribute to the market growth in this region. Countries such as China, India, and South Korea are emerging as lucrative markets for refractive surgery devices.

Latin America: Latin America represents a growing market for refractive surgery devices. The region’s improving healthcare infrastructure, rising patient awareness, and increasing demand for advanced treatment options drive the market growth. Brazil, Mexico, and Argentina are among the key contributors to the refractive surgery devices market in Latin America.

Middle East and Africa: The Middle East and Africa region are experiencing steady growth in the refractive surgery devices market. Factors such as increasing healthcare expenditure, growing medical tourism, and rising awareness about refractive surgeries contribute to the market growth. Countries like the United Arab Emirates, Saudi Arabia, and South Africa are witnessing a rise in the adoption of refractive surgery devices.

Competitive Landscape

Leading Companies in Global Refractive Surgery Devices Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The refractive surgery devices market can be segmented based on product type, surgery type, end-user, and geography.

By Product Type:

By Surgery Type:

By End-User:

By Geography:

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

The refractive surgery devices market offers several benefits for industry participants and stakeholders:

SWOT Analysis

A SWOT (Strengths, Weaknesses, Opportunities, and Threats) analysis of the refractive surgery devices market provides valuable insights into the internal and external factors impacting the industry.

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

The refractive surgery devices market is influenced by several key trends that shape its growth and direction:

Covid-19 Impact

The COVID-19 pandemic has had a significant impact on the healthcare industry, including the refractive surgery devices market. The pandemic led to temporary closures of ophthalmic clinics, restrictions on elective surgeries, and disruptions in the supply chain. However, the impact varied across different regions and time periods.

During the height of the pandemic, many refractive surgeries were postponed or canceled due to safety concerns and prioritization of urgent medical needs. This resulted in a decline in the demand for refractive surgery devices. However, as the situation improved and healthcare services resumed, the market gradually recovered.

The pandemic also highlighted the importance of contactless consultations and telemedicine. Virtual consultations and remote monitoring became prevalent, allowing ophthalmologists to assess patients’ suitability for refractive surgeries remotely. This trend is expected to continue post-pandemic, offering convenience and accessibility to patients.

In terms of supply chain disruptions, manufacturers faced challenges related to raw material shortages, logistics delays, and reduced manufacturing capacities. These factors resulted in temporary disruptions in the production and distribution of refractive surgery devices. However, manufacturers took measures to mitigate these issues and ensure the availability of essential devices.

Overall, while the COVID-19 pandemic presented short-term challenges for the refractive surgery devices market, the long-term outlook remains positive. As healthcare systems stabilize and patient confidence improves, the demand for refractive surgeries and corresponding devices is expected to rebound.

Key Industry Developments

The refractive surgery devices market has witnessed several key industry developments that have shaped its landscape:

Analyst Suggestions

Based on market trends and dynamics, industry analysts offer the following suggestions to industry participants:

Future Outlook

The future outlook for the global refractive surgery devices market remains positive, with several factors driving its growth. Technological advancements, increasing patient awareness, and the growing prevalence of refractive errors will continue to fuel the demand for refractive surgeries and corresponding devices.

The integration of artificial intelligence, machine learning, and digital platforms into refractive surgery devices and diagnostic tools will further enhance surgical precision, treatment outcomes, and patient experiences. Manufacturers will continue to invest in research and development to introduce innovative devices that address unmet needs and offer enhanced safety and efficacy.

The Asia-Pacific region is expected to witness significant growth due to its large population, increasing healthcare expenditure, and rising medical tourism. Developing economies in the region offer lucrative market opportunities for refractive surgery device manufacturers.

Conclusion

The global refractive surgery devices market is witnessing significant growth driven by factors such as increasing prevalence of refractive errors, technological advancements, and rising patient awareness. The market offers lucrative opportunities for manufacturers and stakeholders to cater to the growing demand for refractive surgeries and devices.

Technological innovations, particularly in femtosecond lasers, diagnostic devices, and implantable lenses, have revolutionized the field of refractive surgery. These advancements have improved surgical outcomes, patient satisfaction, and safety. Furthermore, the integration of artificial intelligence and machine learning is expected to further enhance surgical precision and personalized treatment planning.

Global Refractive Surgery Devices market

| Segmentation Details | Description |

|---|---|

| Product Type | Laser Systems, Intraocular Lenses, Diagnostic Equipment, Surgical Instruments |

| End User | Hospitals, Clinics, Ambulatory Surgical Centers, Eye Care Centers |

| Technology | LASIK, PRK, SMILE, Femtosecond Laser |

| Application | Vision Correction, Cataract Surgery, Refractive Error Treatment, Corneal Reshaping |

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at