444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The global prepaid cards market has witnessed significant growth in recent years and is expected to continue its upward trajectory. Prepaid cards, also known as stored-value cards or prepaid debit cards, are payment cards that are pre-loaded with a specific amount of money. These cards are widely accepted by merchants, both online and offline, and can be used for various purposes, including shopping, bill payments, travel expenses, and gift-giving. The market for prepaid cards has expanded rapidly due to their convenience, security, and versatility.

Meaning

Prepaid cards are payment cards that allow users to spend a pre-loaded amount of money. Unlike traditional debit or credit cards, which are linked to a bank account or credit line, prepaid cards are not connected to a specific bank account. Users can load funds onto the card in advance, either by depositing money or by receiving funds from an employer or other sources. Prepaid cards offer the convenience of plastic payment cards without the need for a traditional banking relationship.

Executive Summary

The global prepaid cards market has experienced remarkable growth in recent years, driven by factors such as increasing financial inclusion, the rise of e-commerce, and the need for secure and convenient payment options. Prepaid cards provide individuals with a flexible and accessible payment solution, allowing them to make purchases, manage expenses, and conduct financial transactions without the need for a traditional bank account. The market is characterized by a wide range of prepaid card providers, diverse card offerings, and innovative features that enhance the user experience.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The global prepaid cards market is dynamic and influenced by various factors. Increasing financial inclusion, the rise of e-commerce, and the need for secure and convenient payment options drive market growth. The market is characterized by a competitive landscape, with numerous prepaid card providers offering diverse card options and innovative features. Limited acceptance and merchant support, along with regulatory challenges and consumer protection measures, pose restraints. Opportunities exist through collaborations with fintech companies and targeting underserved markets.

Regional Analysis

The prepaid cards market can be analyzed based on regional segments, including North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa. North America currently dominates the market, attributed to the high adoption of prepaid cards, advanced payment infrastructure, and a robust banking ecosystem. However, the Asia Pacific region is expected to witness significant growth, driven by increasing digital payment adoption, rising disposable incomes, and a large unbanked population.

Competitive Landscape

Leading Companies in Global Prepaid Cards Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

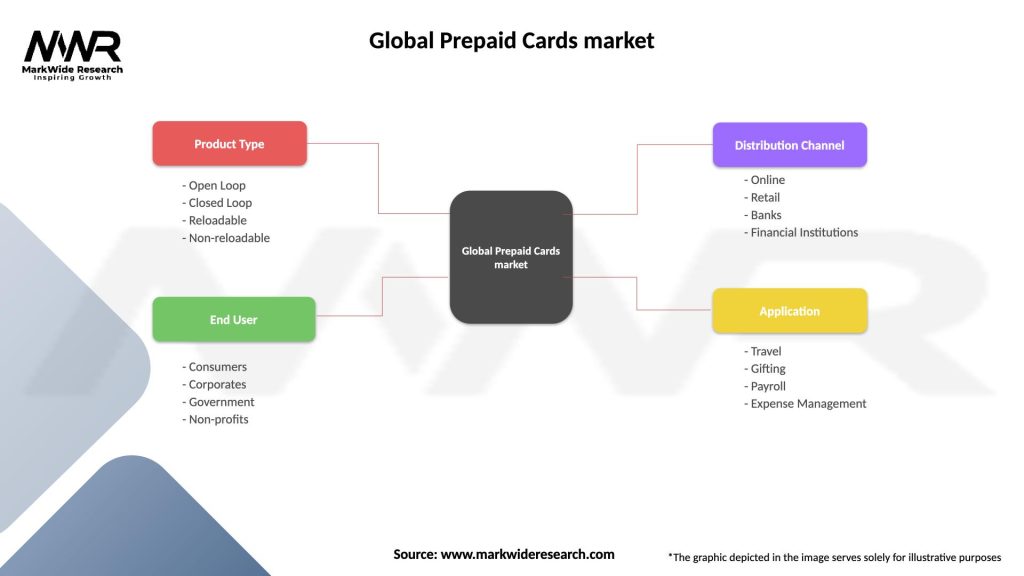

Segmentation

The prepaid cards market can be segmented based on card type, card functionality, and industry vertical.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths

Weaknesses

Opportunities

Threats

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic has had a mixed impact on the prepaid cards market. While the initial lockdowns and restrictions affected consumer spending and led to a decline in card usage, the pandemic has also accelerated the shift towards digital payments and contactless transactions. Prepaid cards have played a significant role in enabling remote payments, online shopping, and reducing the dependence on cash transactions during the pandemic.

Key Industry Developments

Analyst Suggestions

Future Outlook

The future of the global prepaid cards market looks promising, driven by factors such as increasing financial inclusion, the rise of e-commerce, and the need for secure and convenient payment options. The market offers opportunities for collaborations with fintech companies, targeting underserved markets, and expanding acceptance networks. However, challenges related to limited acceptance and regulatory compliance need to be addressed. With a focus on customization, integration with digital platforms, and enhanced security measures, the prepaid cards market is expected to witness continued growth.

Conclusion

The global prepaid cards market has witnessed significant growth, driven by increasing financial inclusion, the rise of e-commerce, and the need for secure and convenient payment options. Prepaid cards offer individuals a flexible and accessible payment solution, providing convenience, security, and budget management benefits. The market is characterized by diverse card offerings, innovative features, and a competitive landscape. Collaboration with fintech companies, targeting underserved markets, and expanding acceptance networks present opportunities for prepaid card providers. Challenges include limited acceptance and regulatory compliance requirements. The market is expected to evolve with trends such as integration with digital wallets, customization options, and enhanced security measures. The COVID-19 pandemic has influenced the adoption of prepaid cards, accelerating the shift towards digital payments. With a focus on user-friendly interfaces, education, and innovation, the global prepaid cards market is poised for future growth and development.

What is Prepaid Cards?

Prepaid cards are payment cards that are preloaded with a specific amount of money, allowing users to make purchases without the need for a bank account or credit line. They are commonly used for budgeting, gifting, and travel expenses.

What are the key players in the Global Prepaid Cards market?

Key players in the Global Prepaid Cards market include companies like Visa, Mastercard, American Express, and PayPal, which offer a variety of prepaid card solutions for consumers and businesses, among others.

What are the main drivers of growth in the Global Prepaid Cards market?

The growth of the Global Prepaid Cards market is driven by increasing consumer demand for cashless transactions, the rise of e-commerce, and the need for financial inclusion among unbanked populations.

What challenges does the Global Prepaid Cards market face?

The Global Prepaid Cards market faces challenges such as regulatory compliance issues, competition from digital wallets, and concerns regarding fraud and security.

What opportunities exist in the Global Prepaid Cards market?

Opportunities in the Global Prepaid Cards market include the expansion of mobile payment solutions, partnerships with fintech companies, and the growing trend of virtual prepaid cards for online shopping.

What trends are shaping the Global Prepaid Cards market?

Trends in the Global Prepaid Cards market include the increasing adoption of contactless payment technology, the integration of loyalty programs with prepaid cards, and the rise of cryptocurrency-backed prepaid cards.

Global Prepaid Cards market

| Segmentation Details | Description |

|---|---|

| Product Type | Open Loop, Closed Loop, Reloadable, Non-reloadable |

| End User | Consumers, Corporates, Government, Non-profits |

| Distribution Channel | Online, Retail, Banks, Financial Institutions |

| Application | Travel, Gifting, Payroll, Expense Management |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in Global Prepaid Cards Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at