444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview The global mortgage/loan brokers market has witnessed significant growth in recent years. Mortgage brokers act as intermediaries between borrowers and lenders, helping individuals and businesses secure loans for purchasing real estate properties or funding other financial needs. They play a crucial role in connecting borrowers with the most suitable loan options from a wide range of lenders. This comprehensive article aims to provide key insights into the global mortgage/loan brokers market, including its meaning, market drivers, restraints, opportunities, regional analysis, competitive landscape, segmentation, category-wise insights, key benefits for industry participants and stakeholders, SWOT analysis, market key trends, impact of COVID-19, key industry developments, analyst suggestions, future outlook, and conclusion.

Meaning Mortgage/loan brokers are professionals who act as intermediaries between borrowers and lenders. They assist individuals and businesses in obtaining loans, particularly mortgage loans, by assessing their financial situation, recommending suitable loan options, and facilitating the loan application and approval process. Mortgage brokers work with a network of lenders, including banks, credit unions, and other financial institutions, to find the best loan terms and interest rates for their clients. They provide valuable expertise and guidance throughout the loan process, ensuring that borrowers make informed decisions and secure loans that meet their financial needs.

Executive Summary The global mortgage/loan brokers market is experiencing significant growth due to the increasing demand for home loans, the complexity of loan products, and the convenience of using mortgage brokers. The mortgage/loan brokerage industry plays a vital role in facilitating access to loans and ensuring a smooth loan application process for borrowers. This article provides a comprehensive analysis of the market, highlighting key market drivers, restraints, opportunities, and future trends that will shape the global mortgage/loan brokers market.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics The global mortgage/loan brokers market is driven by factors such as the increasing demand for home loans, the complexity of loan products, and the convenience and personalized service offered by mortgage brokers. However, the market also faces challenges, including regulatory requirements, competition from direct loan services, and economic uncertainties. Mortgage/loan brokers need to adapt to changing market dynamics, embrace technology-driven solutions, and maintain high ethical standards to thrive in the competitive landscape.

Regional Analysis North America dominates the global mortgage/loan brokers market, primarily driven by the well-established mortgage market, high homeownership rates, and the widespread use of mortgage brokers. Europe follows closely, with a significant market share. The Asia Pacific region offers growth opportunities, fueled by the increasing demand for homeownership and the growing adoption of mortgage/loan brokerage services.

Competitive Landscape

Leading Companies in the Global Mortgage/Loan Brokers Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

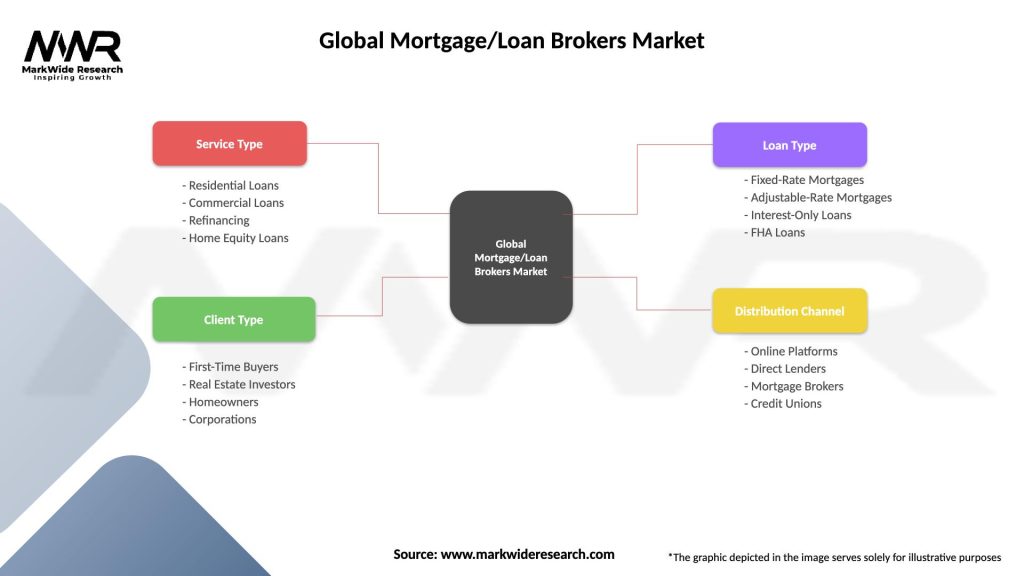

Segmentation The mortgage/loan brokers market can be segmented based on loan type, service type, and end-user. By loan type, the market includes home loans, commercial loans, personal loans, and others. Service types offered by mortgage/loan brokers encompass loan origination, loan processing, loan consulting, and other related services. The end-users of mortgage/loan brokerage services comprise individuals, businesses, and investors.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Market Key Trends

Covid-19 Impact The COVID-19 pandemic had a mixed impact on the global mortgage/loan brokers market. While the initial disruptions in the real estate market and economic uncertainties affected loan demand and application volumes, the low-interest rate environment and government stimulus measures supported mortgage refinancing and home purchases. Mortgage/loan brokers adapted to remote work arrangements and utilized digital platforms to continue serving clients during lockdowns.

Key Industry Developments

1. Rise of Digital Mortgage Brokers

The increasing use of AI-powered mortgage brokerage platforms is transforming the industry, improving customer experience and efficiency.

2. Regulatory Changes Impacting Mortgage Brokers

New compliance requirements in various regions are influencing how brokers operate, emphasizing transparency and borrower protection.

3. Expansion of Non-Bank Lending Options

Alternative financing options, such as crowdfunding and peer-to-peer lending, are gaining traction, providing new opportunities for brokers.

4. Mergers and Acquisitions in the Brokerage Industry

Leading mortgage brokers are expanding their market presence through mergers, acquisitions, and strategic partnerships.

Analyst Suggestions

Future Outlook The global mortgage/loan brokers market is expected to witness steady growth in the coming years. The increasing demand for loans, the complexity of loan products, and the convenience of using mortgage/loan brokers will continue to drive market expansion. However, mortgage/loan brokers will face challenges related to regulatory compliance, competition, and changing market dynamics. Adapting to technological advancements, maintaining high ethical standards, and offering personalized services will be crucial for sustained success in the competitive landscape.

Conclusion The global mortgage/loan brokers market presents significant opportunities for industry participants and stakeholders. With the increasing demand for loans and the complexity of loan products, mortgage/loan brokers play a vital role in connecting borrowers with suitable loan options and facilitating the loan application process. By embracing technology, maintaining compliance with regulations, and providing personalized services, mortgage/loan brokers can thrive in the dynamic market and contribute to the growth of the global mortgage/loan brokers industry.

What is Mortgage/Loan Brokers?

Mortgage/Loan Brokers are professionals who help clients secure financing for real estate purchases by connecting them with lenders. They provide guidance on loan options, interest rates, and the application process, ensuring clients find the best mortgage solutions for their needs.

What are the key players in the Global Mortgage/Loan Brokers Market?

Key players in the Global Mortgage/Loan Brokers Market include Quicken Loans, LoanDepot, and Better.com. These companies offer a range of mortgage products and services, catering to various consumer needs and preferences, among others.

What are the main drivers of growth in the Global Mortgage/Loan Brokers Market?

The main drivers of growth in the Global Mortgage/Loan Brokers Market include increasing demand for home ownership, favorable interest rates, and the rise of digital mortgage solutions. Additionally, the growing awareness of various financing options is contributing to market expansion.

What challenges does the Global Mortgage/Loan Brokers Market face?

The Global Mortgage/Loan Brokers Market faces challenges such as regulatory changes, fluctuating interest rates, and increased competition from online lenders. These factors can impact broker profitability and client acquisition strategies.

What opportunities exist in the Global Mortgage/Loan Brokers Market?

Opportunities in the Global Mortgage/Loan Brokers Market include the expansion of digital platforms, the integration of advanced technologies like AI for personalized services, and the potential for growth in underserved markets. These trends can enhance customer experience and broaden market reach.

What trends are shaping the Global Mortgage/Loan Brokers Market?

Trends shaping the Global Mortgage/Loan Brokers Market include the increasing use of technology for streamlined applications, a shift towards remote consultations, and a focus on sustainable lending practices. These trends are transforming how brokers operate and engage with clients.

Global Mortgage/Loan Brokers Market

| Segmentation Details | Description |

|---|---|

| Service Type | Residential Loans, Commercial Loans, Refinancing, Home Equity Loans |

| Client Type | First-Time Buyers, Real Estate Investors, Homeowners, Corporations |

| Loan Type | Fixed-Rate Mortgages, Adjustable-Rate Mortgages, Interest-Only Loans, FHA Loans |

| Distribution Channel | Online Platforms, Direct Lenders, Mortgage Brokers, Credit Unions |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Global Mortgage/Loan Brokers Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at