444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The global insurance claims software market is witnessing significant growth as insurance companies strive to streamline their claims processing operations and enhance customer experience. Insurance claims software refers to the technology solutions designed to automate and manage the end-to-end claims management process, from reporting the claim to settlement. It offers various features such as claims intake, documentation management, workflow automation, fraud detection, and analytics. The market is driven by the increasing adoption of digital solutions, rising insurance frauds, the need for efficient claims processing, and the growing emphasis on customer satisfaction.

Meaning

Insurance claims software is a comprehensive system that enables insurance companies to effectively manage and process claims. It automates manual tasks, reduces paperwork, improves accuracy, and enhances the overall claims handling process. The software allows insurers to streamline their operations, reduce costs, and provide faster and more efficient claims settlement for policyholders.

Executive Summary

The global insurance claims software market is experiencing robust growth due to the rising demand for digital solutions in the insurance industry. Insurance companies are increasingly adopting claims software to enhance their operational efficiency, reduce claim processing time, improve fraud detection, and provide a seamless customer experience. The market is characterized by the presence of both established software providers and emerging players offering innovative solutions. Key market players are focusing on product enhancements, strategic partnerships, and acquisitions to strengthen their market position.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The global insurance claims software market is characterized by intense competition among key players. The market is witnessing strategic collaborations, partnerships, and acquisitions as companies aim to expand their product portfolios and geographical presence. Rapid advancements in technology, such as AI, machine learning, and data analytics, are driving innovation in claims software solutions. Insurance companies are also focusing on customer-centric approaches, leveraging claims software to provide personalized services and improve customer satisfaction.

Regional Analysis

The insurance claims software market is geographically segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa. North America holds a significant share in the market due to the presence of major insurance companies and advanced technological infrastructure. Europe is also a prominent market, driven by stringent regulations and the need for efficient claims management. The Asia Pacific region is witnessing rapid growth due to the increasing adoption of digital solutions and the growing insurance sector in emerging economies.

Competitive Landscape

Leading Companies in Global Insurance Claims Software Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

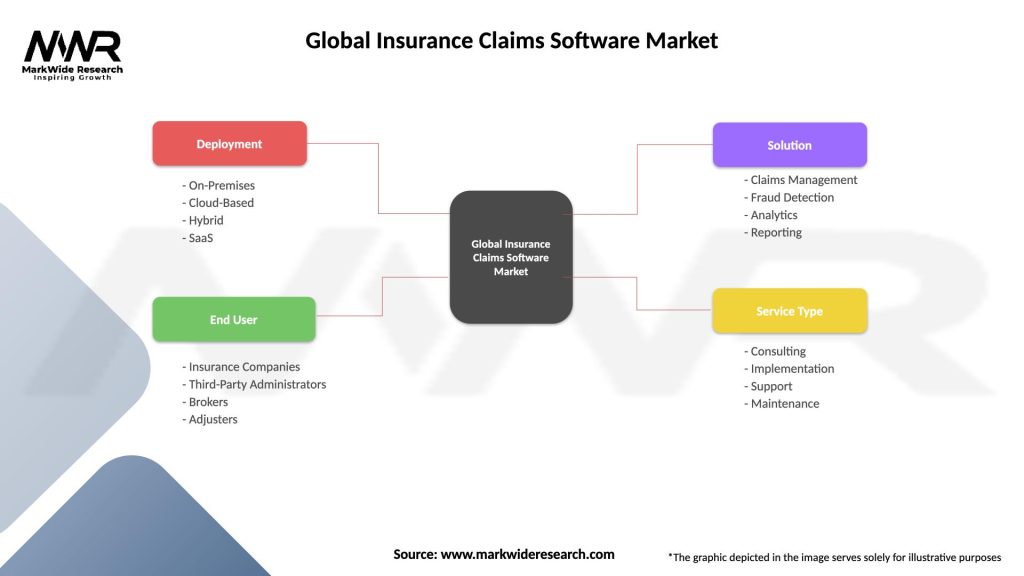

Segmentation

The insurance claims software market can be segmented based on deployment type, organization size, and end-user industry. Deployment types include on-premises and cloud-based solutions. Organization size segments comprise small and medium-sized enterprises (SMEs) and large enterprises. End-user industries include insurance carriers, third-party administrators (TPAs), and insurance brokers.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths

Weaknesses

Opportunities

Threats

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic has accelerated the adoption of digital solutions in the insurance industry, including claims software. Remote work and social distancing measures have highlighted the need for seamless digital claims processing and customer communication. Claims software has facilitated remote collaboration, reduced dependency on physical paperwork, and enabled insurers to provide uninterrupted services to policyholders during the pandemic.

Key Industry Developments

Analyst Suggestions

Future Outlook

The global insurance claims software market is poised for significant growth as insurance companies recognize the need for efficient claims management, fraud detection, and customer-centric services. Advancements in technology, such as AI, machine learning, and data analytics, will continue to drive innovation in claims software solutions. The market is expected to witness strategic partnerships, acquisitions, and product enhancements as companies strive to expand their market presence and offer advanced solutions.

Conclusion

The global insurance claims software market is witnessing substantial growth driven by the increasing demand for efficient claims management, fraud detection, and enhanced customer experience. Claims software streamlines the claims handling process, automates manual tasks, and incorporates advanced analytics and fraud detection capabilities. Insurance companies are adopting claims software to improve operational efficiency, reduce costs, and provide faster and more accurate claims settlement. The market is characterized by the integration of AI and machine learning technologies, the rise of cloud-based solutions, and a focus on customer-centric approaches. As the insurance industry continues to evolve, claims software will play a crucial role in optimizing claims management processes and meeting the evolving needs of insurers and policyholders.

What is Insurance Claims Software?

Insurance Claims Software refers to digital solutions designed to streamline the claims process for insurance companies. These tools help manage claims efficiently, improve customer service, and reduce processing times.

What are the key players in the Global Insurance Claims Software Market?

Key players in the Global Insurance Claims Software Market include Guidewire Software, Duck Creek Technologies, and Verisk Analytics, among others. These companies provide innovative solutions that enhance claims management and operational efficiency.

What are the main drivers of growth in the Global Insurance Claims Software Market?

The main drivers of growth in the Global Insurance Claims Software Market include the increasing demand for automation in claims processing, the need for improved customer experience, and the rising adoption of digital technologies in the insurance sector.

What challenges does the Global Insurance Claims Software Market face?

Challenges in the Global Insurance Claims Software Market include data security concerns, the complexity of integrating new software with existing systems, and the need for continuous updates to meet regulatory requirements.

What opportunities exist in the Global Insurance Claims Software Market?

Opportunities in the Global Insurance Claims Software Market include the potential for AI and machine learning integration, the expansion of cloud-based solutions, and the growing trend of personalized insurance services.

What trends are shaping the Global Insurance Claims Software Market?

Trends shaping the Global Insurance Claims Software Market include the increasing use of mobile applications for claims submission, the rise of data analytics for better decision-making, and the focus on enhancing user experience through intuitive interfaces.

Global Insurance Claims Software Market

| Segmentation Details | Description |

|---|---|

| Deployment | On-Premises, Cloud-Based, Hybrid, SaaS |

| End User | Insurance Companies, Third-Party Administrators, Brokers, Adjusters |

| Solution | Claims Management, Fraud Detection, Analytics, Reporting |

| Service Type | Consulting, Implementation, Support, Maintenance |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in Global Insurance Claims Software Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at