444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The Global Enterprise Architecture Tools market is experiencing significant growth and is poised to witness substantial expansion in the coming years. Enterprise architecture tools play a crucial role in assisting organizations in effectively managing their complex business operations and enhancing overall efficiency. These tools provide a systematic approach to aligning various components of an enterprise, such as processes, systems, and data, with its overall strategic objectives.

Meaning

Enterprise architecture tools refer to software applications that facilitate the development, management, and visualization of enterprise architectures. These tools help organizations in designing and implementing a coherent and integrated framework for their business processes, applications, and technology infrastructure. By providing a holistic view of the enterprise, these tools enable businesses to identify and address any gaps or inefficiencies in their operations, leading to improved decision-making and performance.

Executive Summary

The Global Enterprise Architecture Tools market is witnessing robust growth due to the increasing adoption of digital transformation initiatives by organizations across various industries. The rapid advancement of technology and the growing need for agility and flexibility in business operations are driving the demand for enterprise architecture tools. These tools enable companies to effectively manage their IT infrastructure, streamline processes, and align their business strategies with their IT capabilities.

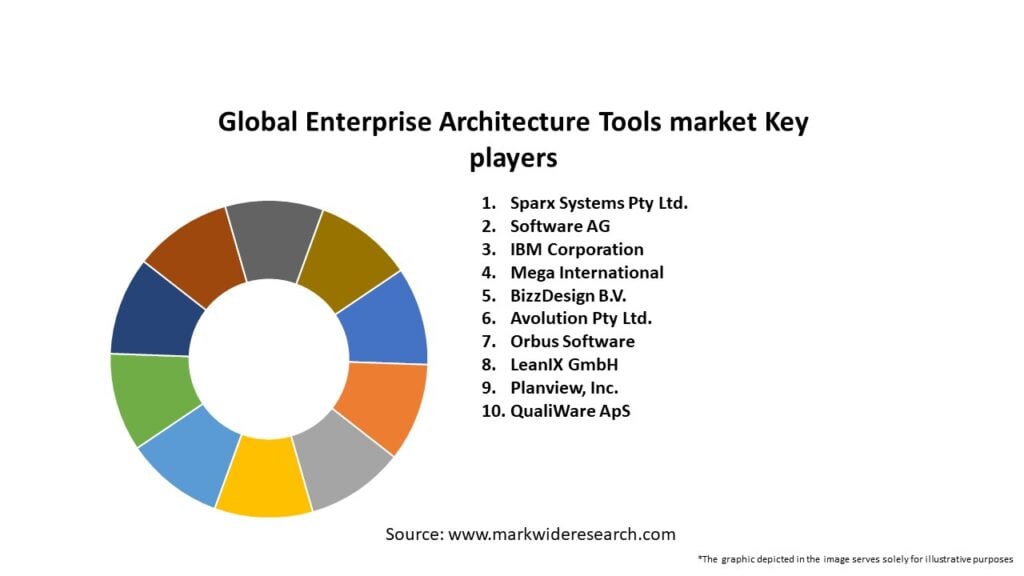

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

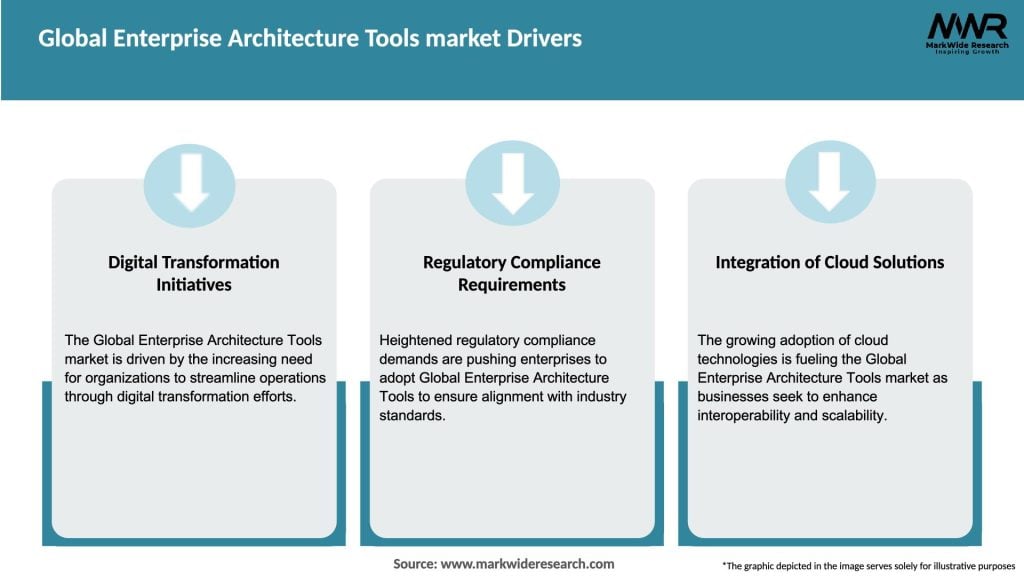

Market Drivers

Several factors fuel global growth:

Digital transformation momentum: Organizations undergoing modernization, cloud migration, and composable process initiatives need EA tools to plan and govern change.

Hybrid and multicloud complexity: Complex landscapes with legacy, cloud, on-premises, and third-party components require architectural visibility and scenario planning.

Need for strategic alignment: EA tools help link business objectives, capabilities, processes, and technology investments, enabling better outcomes.

Governance, risk & compliance expectations: Regulatory and security regimes—GDPR, SOX, cybersecurity frameworks—demand architectural documentation and traceability.

Shift to SaaS and AI augmentation: Cloud delivery lowers adoption friction, and AI-enabled features can speed modeling and analysis.

Market Restraints

The market faces several constraints:

Low organizational maturity: Many enterprises lack EA maturity, making tool adoption challenging and downstream value limited.

Integration complexity: EA data often needs to be federated from multiple sources—CMDBs, project data, cloud inventories—which complicates tool onboarding.

Data accuracy and maintenance overhead: Maintaining up-to-date repositories is manual-intensive, undermining trust.

Cost and perceived ROI: EA tools can be expensive and generate long-term ROI that is difficult to quantify.

Cultural resistance: EA initiatives may be perceived as bureaucratic by agile or delivery-focused teams, slowing adoption.

Market Opportunities

Key opportunities include:

Embedding EA into transformation suites: Integration with PPM, workflow, DevOps, and configuration tools enhances value and adoption.

AI-assisted automation: Automated discovery, suggestion, impact analysis, and narrative generation reduce manual overhead.

Outcome-based modeling: Tools focusing on business capabilities, value streams, revenue streams, and customer journeys align EA with strategy.

Cloud cost and architecture governance: Tools offering cost visibility, waste detection, and architectural guardrails for multicloud environments.

SaaS and agile deployment models: Subscription, quick-start templates, domain-driven EA, and self-service governance models increase uptake.

Market Dynamics

EA tool adoption is shifting from top-down planning to adaptive, outcome-driven practices. Early efforts focused on taxonomy building and documentation; now the demand is for frictionless integration with daily workflows, modeling of business viability, and governance tied to delivery execution. Vendors differentiate through connectors (cloud, service management, project tools), visualization simplicity, community-driven templates, and AI assistance. Buyers increasingly require fast time-to-value, co-managed models, and tangible insights into cost, risk, and strategic alignment.

Regional Analysis

North America: High adoption across financial services, tech, and healthcare; priority on digital transformation and enterprise agility.

Europe: Emphasis on regulatory alignment (GDPR, industry mandates), cloud migration, and sustainability (green IT) strategies.

Asia-Pacific: Fast-growing adoption, especially by government and large corporations; tools are needed for modernization and digital government initiatives.

Latin America: Selective uptake, particularly in banking and telecoms; reliance on consulting and cloud-assisted deployments.

Middle East & Africa: Initial adoption in government and energy sectors; constrained by budget and maturity, but growing via regional partners and cloud offerings.

Competitive Landscape

Leading Companies in Global Enterprise Architecture Tools Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

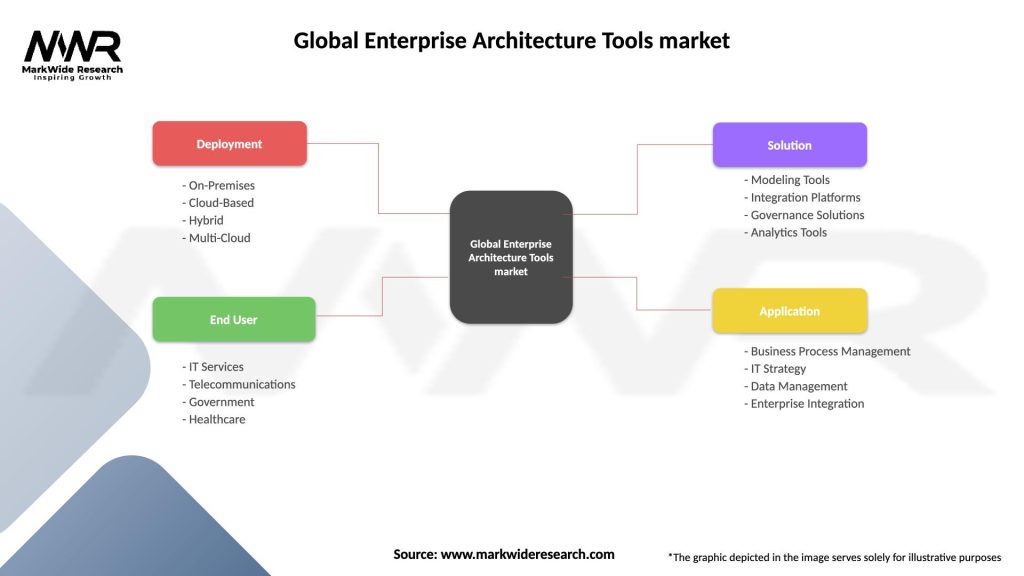

Segmentation

The Global Enterprise Architecture Tools market can be segmented based on deployment type, organization size, industry vertical, and region. By deployment type, the market can be categorized into on-premises and cloud-based solutions. Based on organization size, the market can be divided into small and medium-sized enterprises (SMEs) and large enterprises. The industry vertical segment includes BFSI, healthcare, retail, manufacturing, IT and telecom, and others.

Category-wise Insights

The BFSI sector is one of the major adopters of enterprise architecture tools. These tools assist banks and financial institutions in managing their complex IT infrastructure, complying with regulatory requirements, and mitigating risks. The healthcare sector is also witnessing increased adoption of enterprise architecture tools to streamline processes, improve patient care, and ensure compliance with data privacy regulations. In the manufacturing industry, these tools help optimize supply chain management, enhance operational efficiency, and drive innovation.

Key Benefits for Industry Participants and Stakeholders

The adoption of enterprise architecture tools offers several benefits for industry participants and stakeholders. Firstly, these tools enable organizations to gain a holistic view of their business operations, which helps in identifying inefficiencies and optimizing processes. Secondly, enterprise architecture tools facilitate better decision-making by providing accurate and up-to-date information about the organization’s IT infrastructure and capabilities. Additionally, these tools enhance collaboration and communication between different departments and teams, leading to improved efficiency and productivity. Finally, enterprise architecture tools help organizations in complying with regulatory requirements and mitigating risks, particularly in highly regulated industries such as BFSI and healthcare.

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Several key trends are shaping the Global Enterprise Architecture Tools market. One of the prominent trends is the integration of AI and ML capabilities into these tools. AI and ML algorithms can analyze vast amounts of data, identify patterns, and provide valuable insights for decision-making and strategic planning. Another trend is the shift towards cloud-based solutions, driven by the need for scalability, flexibility, and cost-effectiveness. Additionally, the use of visualization and modeling techniques is gaining traction, as it helps stakeholders understand and communicate complex enterprise architectures more effectively.

Covid-19 Impact

The Covid-19 pandemic has had a significant impact on the Global Enterprise Architecture Tools market. The crisis highlighted the importance of digital transformation and the need for organizations to adapt quickly to changing market conditions. As a result, many companies accelerated their digital initiatives, including the adoption of enterprise architecture tools, to improve operational resilience and enable remote work. The pandemic also increased the demand for cloud-based solutions, as organizations sought scalability and flexibility to support their remote workforce.

Key Industry Developments

In recent years, the Global Enterprise Architecture Tools market has witnessed several key industry developments. Vendors are focusing on product innovation to stay competitive in the market. For example, some companies have integrated AI and ML capabilities into their tools to provide advanced analytics and automation features. Strategic collaborations and partnerships between enterprise architecture tool providers and other technology vendors are also common, as they enable the development of integrated solutions that cater to specific industry needs. Moreover, mergers and acquisitions have become prevalent, with larger players acquiring smaller ones to expand their market presence and offer a comprehensive suite of enterprise architecture tools.

Analyst Suggestions

Industry analysts suggest that vendors in the Global Enterprise Architecture Tools market should focus on the following strategies to stay competitive:

Future Outlook

The Global Enterprise Architecture Tools market is expected to witness continued growth in the coming years. The increasing complexity of business operations, coupled with the need for effective management and optimization, will drive the demand for these tools. Cloud-based solutions are likely to dominate the market, as they offer scalability, cost-effectiveness, and ease of implementation. The integration of AI and ML capabilities will further enhance the functionality and value of enterprise architecture tools. Additionally, the adoption of these tools will extend beyond large enterprises to SMEs, as they recognize the benefits of streamlining their operations and aligning their strategies with their IT capabilities.

Conclusion

The Global Enterprise Architecture Tools market is experiencing significant growth and offers promising opportunities for vendors and service providers. These tools enable organizations to effectively manage their complex business operations, optimize processes, and align their strategies with their IT infrastructure. Despite the challenges of high implementation costs and the skills gap, the market is driven by factors such as the increasing complexity of business operations, the need for improved decision-making, and the growing emphasis on regulatory compliance. With the integration of AI and ML capabilities, the adoption of cloud-based solutions, and the development of industry-specific tools, the market is expected to witness continued expansion in the future.

What is Enterprise Architecture Tools?

Enterprise Architecture Tools are software solutions that help organizations design, analyze, and manage their IT architecture. They facilitate alignment between business goals and IT strategy, enabling better decision-making and resource allocation.

What are the key players in the Global Enterprise Architecture Tools market?

Key players in the Global Enterprise Architecture Tools market include companies like Sparx Systems, Bizzdesign, and Orbus Software, which provide various tools for modeling, analysis, and governance of enterprise architecture among others.

What are the main drivers of growth in the Global Enterprise Architecture Tools market?

The growth of the Global Enterprise Architecture Tools market is driven by the increasing need for digital transformation, the demand for improved operational efficiency, and the necessity for better alignment between IT and business strategies.

What challenges does the Global Enterprise Architecture Tools market face?

The Global Enterprise Architecture Tools market faces challenges such as the complexity of integrating these tools with existing systems, resistance to change within organizations, and the need for skilled professionals to effectively utilize these tools.

What opportunities exist in the Global Enterprise Architecture Tools market?

Opportunities in the Global Enterprise Architecture Tools market include the rise of cloud-based solutions, the growing importance of data analytics in decision-making, and the increasing adoption of agile methodologies in enterprise architecture practices.

What trends are shaping the Global Enterprise Architecture Tools market?

Trends shaping the Global Enterprise Architecture Tools market include the integration of artificial intelligence for enhanced analytics, the shift towards collaborative tools that support remote work, and the emphasis on sustainability in IT architecture planning.

Global Enterprise Architecture Tools market

| Segmentation Details | Description |

|---|---|

| Deployment | On-Premises, Cloud-Based, Hybrid, Multi-Cloud |

| End User | IT Services, Telecommunications, Government, Healthcare |

| Solution | Modeling Tools, Integration Platforms, Governance Solutions, Analytics Tools |

| Application | Business Process Management, IT Strategy, Data Management, Enterprise Integration |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in Global Enterprise Architecture Tools Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at