444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The global blood product market is a crucial segment of the healthcare industry, dedicated to meeting the demand for blood and its components. Blood products are derived from whole blood or plasma and are used for transfusions in various medical procedures and conditions. These products play a vital role in saving lives, treating diseases, and supporting patients in critical situations.

Meaning

Blood products refer to the components derived from whole blood or plasma that are used for transfusions or other therapeutic purposes. These products include red blood cells, platelets, plasma, and clotting factors. They are essential for addressing medical conditions such as anemia, bleeding disorders, immune deficiencies, and trauma-related injuries.

Executive Summary

The global blood product market has witnessed significant growth in recent years, driven by the rising prevalence of chronic diseases, increasing surgical procedures, and advancements in healthcare infrastructure. This market offers immense opportunities for key stakeholders, including blood banks, hospitals, pharmaceutical companies, and research institutions. However, it also faces challenges such as stringent regulatory requirements, limited availability of blood donors, and the risk of infectious diseases.

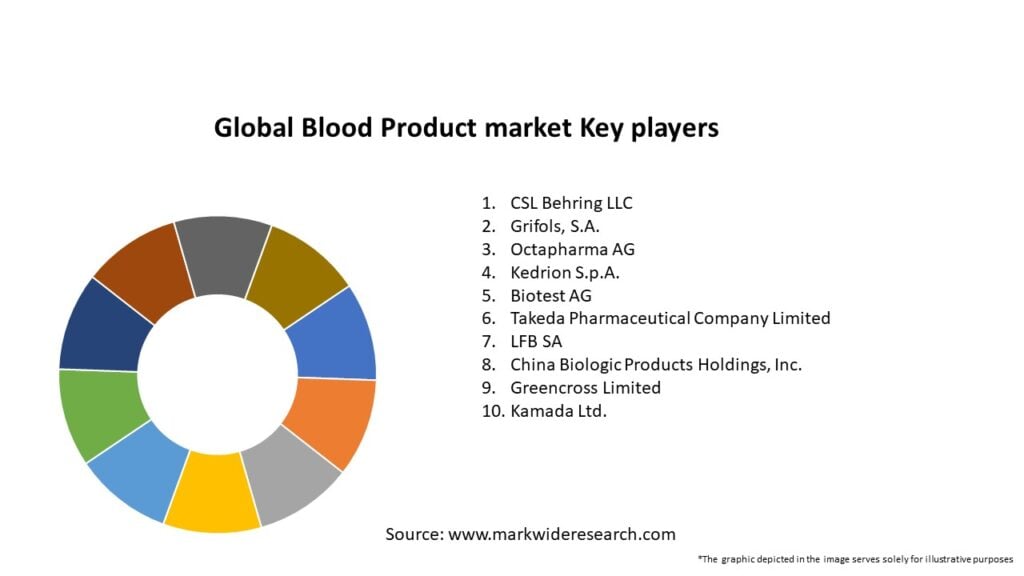

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The global blood product market is dynamic and influenced by various factors, including healthcare policies, technological advancements, patient demographics, and disease prevalence. The market is highly regulated, with stringent quality and safety standards to ensure patient welfare. Additionally, collaborations among blood banks, hospitals, and research institutions play a crucial role in advancing the development and availability of blood products.

Regional Analysis

The global blood product market is segmented into several regions, including North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa. North America and Europe dominate the market due to well-established healthcare infrastructure, high awareness about blood donation, and strong regulatory frameworks. However, Asia Pacific is expected to witness significant growth, driven by increasing healthcare expenditure, a large patient population, and growing investments in healthcare infrastructure.

Competitive Landscape

Leading Companies in the Global Blood Product Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The global blood product market can be segmented based on product type, application, end-user, and region. The product types include red blood cells, platelets, plasma, and clotting factors. Applications range from transfusion therapy to the treatment of specific medical conditions. End-users include hospitals, clinics, blood banks, and research institutions.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic has significantly impacted the blood product market. The implementation of lockdowns, travel restrictions, and social distancing measures led to a decline in blood donations, resulting in blood shortages in many regions. Additionally, the diversion of healthcare resources towards Covid-19 management affected the availability of blood products for non-Covid-19 medical interventions. However, efforts were made to ensure the safety of blood donations and maintain the supply of blood products by implementing strict screening measures and promoting the use of convalescent plasma in Covid-19 treatment.

Key Industry Developments

Analyst Suggestions

Future Outlook

The future of the global blood product market looks promising, with opportunities for growth and advancements in technology. The increasing demand for blood products, advancements in blood processing techniques, and the expansion of healthcare infrastructure in emerging markets are expected to drive market growth. However, overcoming challenges such as donor scarcity, regulatory requirements, and infectious disease risks will be crucial for sustained market development.

Conclusion

The global blood product market plays a vital role in meeting the demand for blood and its components in various medical interventions. The market is driven by the increasing prevalence of chronic diseases, technological advancements, and growing awareness about the importance of blood donation. Despite challenges, such as regulatory requirements and limited availability of blood donors, the market presents significant opportunities for industry participants and stakeholders. Collaboration, technological innovation, and strategic partnerships will be key to ensuring the availability of safe and high-quality blood products in the future, improving patient care, and driving market growth.

Global Blood Product market

| Segmentation Details | Description |

|---|---|

| Product Type | Plasma Derivatives, Red Blood Cells, Platelets, White Blood Cells |

| End User | Hospitals, Blood Banks, Research Laboratories, Emergency Services |

| Application | Transfusion, Surgical Procedures, Hematology, Therapeutic Apheresis |

| Delivery Mode | Intravenous, Subcutaneous, Intraosseous, Topical |

Leading Companies in the Global Blood Product Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at