444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview

The Germany residential real estate market is a dynamic and vibrant sector that encompasses the buying, selling, and renting of residential properties across the country. It plays a vital role in meeting the housing needs of the population, providing individuals and families with a place to live, and serving as an investment opportunity for property owners. The market is influenced by factors such as economic conditions, demographic trends, government policies, and consumer preferences. Residential properties range from single-family homes to apartments, condominiums, and multi-unit complexes, catering to a diverse range of housing needs and preferences.

Meaning

The Germany residential real estate market refers to the industry involved in the buying, selling, and renting of residential properties. It includes a wide range of property types, such as single-family homes, townhouses, apartments, and condominiums. The market involves various stakeholders, including real estate developers, agents, brokers, property owners, investors, and tenants.

Executive Summary

The Germany residential real estate market continues to be a robust and attractive sector, driven by factors such as population growth, urbanization, favorable interest rates, and government policies that support homeownership and rental housing. The market offers opportunities for property buyers, sellers, investors, and developers, with a diverse range of residential properties available to cater to different budgets, preferences, and lifestyle needs. However, challenges such as housing affordability, limited inventory, and regulatory complexities need to be addressed to ensure the market’s sustainability and accessibility for all.

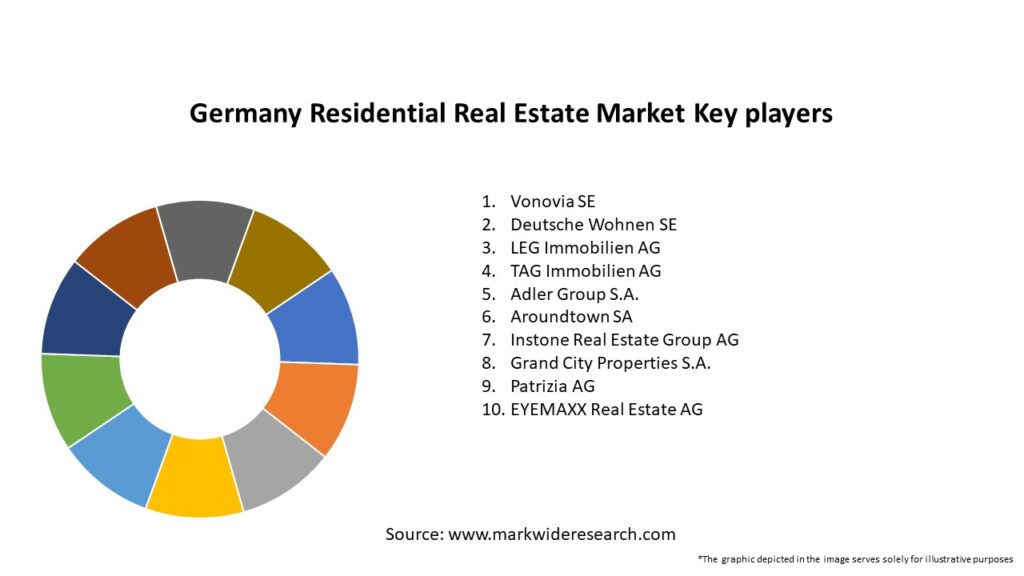

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The Germany residential real estate market is influenced by various dynamics, including economic conditions, demographic trends, interest rates, government policies, and consumer sentiment. Market conditions can vary by region, with urban areas typically experiencing higher demand and price growth compared to rural or less densely populated areas.

Regional Analysis

The residential real estate market in Germany exhibits regional variations, with major cities and metropolitan areas experiencing higher demand and price appreciation compared to rural or less urbanized regions. Factors such as economic activity, employment opportunities, infrastructure, and lifestyle amenities contribute to regional disparities in the market.

Competitive Landscape

Leading Companies in the Germany Residential Real Estate Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The Germany residential real estate market can be segmented based on various factors, including property types, location, price range, and target demographic:

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic had varying effects on the Germany residential real estate market. While there were short-term disruptions due to lockdowns and reduced market activity, the market rebounded strongly in many areas as demand for housing remained resilient. The pandemic highlighted the importance of homes as safe and comfortable spaces, leading to increased interest in homebuying and home improvements.

Key Industry Developments

Analyst Suggestions

Future Outlook

The future outlook for the Germany residential real estate market is optimistic, driven by factors such as population growth, urbanization, and changing lifestyle preferences. Demand for housing is expected to remain strong, particularly in urban areas and regions with employment opportunities and infrastructure development. The market will continue to evolve, influenced by sustainability trends, technological advancements, and government policies aimed at addressing housing needs and promoting accessibility and affordability.

Conclusion

The Germany residential real estate market is a dynamic sector, offering a wide range of housing options for individuals and families. The market is driven by population growth, urbanization, favorable interest rates, and government policies that support homeownership and rental housing. While challenges such as housing affordability and limited inventory exist, opportunities arise from sustainable housing initiatives, affordable housing programs, and the growing rental market. By embracing sustainable practices, digital transformation, and addressing affordability concerns, the residential real estate market in Germany can continue to thrive, providing quality housing options and contributing to the country’s social and economic well-being.

Germany Residential Real Estate Market Segmentation

| Segment | Description |

|---|---|

| Type | Apartments, Houses, Condominiums, Others |

| Price Range | Affordable Housing, Mid-Segment Housing, Luxury Housing |

| Region | Berlin, Munich, Hamburg, Frankfurt, Others |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Germany Residential Real Estate Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at