444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The shale gas market has experienced significant growth in recent years, and one key factor contributing to this growth is the use of foam-based hydraulic fracturing fluids. These innovative fluids have revolutionized the shale gas extraction process by enhancing efficiency and productivity. Foam-based hydraulic fracturing fluids offer numerous advantages over traditional fluid systems, making them a preferred choice for many companies operating in the shale gas industry. This article provides a comprehensive analysis of foam-based hydraulic fracturing fluids for the shale gas market, highlighting their meaning, market insights, drivers, restraints, opportunities, dynamics, regional analysis, competitive landscape, segmentation, category-wise insights, benefits for industry participants and stakeholders, SWOT analysis, key trends, impact of Covid-19, key industry developments, analyst suggestions, future outlook, and concludes with a summary.

Meaning

Foam-based hydraulic fracturing fluids are specially formulated mixtures used in the hydraulic fracturing process to stimulate the extraction of shale gas. These fluids are created by incorporating a surfactant into a base fluid, typically water. The addition of a surfactant generates foam, which exhibits unique properties beneficial for shale gas extraction. Foam-based fluids possess excellent proppant carrying capacity, viscosity control, and gas mobility control, thereby improving the effectiveness of hydraulic fracturing operations.

Executive Summary

The shale gas market has witnessed substantial growth due to the adoption of foam-based hydraulic fracturing fluids. These fluids have transformed the shale gas extraction process, enhancing productivity and operational efficiency. This article provides a detailed analysis of the foam-based hydraulic fracturing fluids market for shale gas, covering various aspects such as market insights, drivers, restraints, opportunities, regional analysis, competitive landscape, and key trends. Additionally, it explores the impact of the Covid-19 pandemic on the market and offers future outlook and analyst suggestions for industry participants. Overall, foam-based hydraulic fracturing fluids have emerged as a game-changer in the shale gas industry, offering numerous advantages over traditional fluid systems.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The foam-based hydraulic fracturing fluids market for shale gas is driven by a combination of factors, including technological advancements, environmental concerns, regulatory landscape, and market competition. Key market dynamics include:

Regional Analysis

The foam-based hydraulic fracturing fluids market exhibits regional variations based on shale gas reserves, industry infrastructure, and regulatory frameworks. Key regions analyzed in this market include:

Competitive Landscape

Leading Companies in the Foam Based Hydraulic Fracturing Fluids for Shale Gas Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

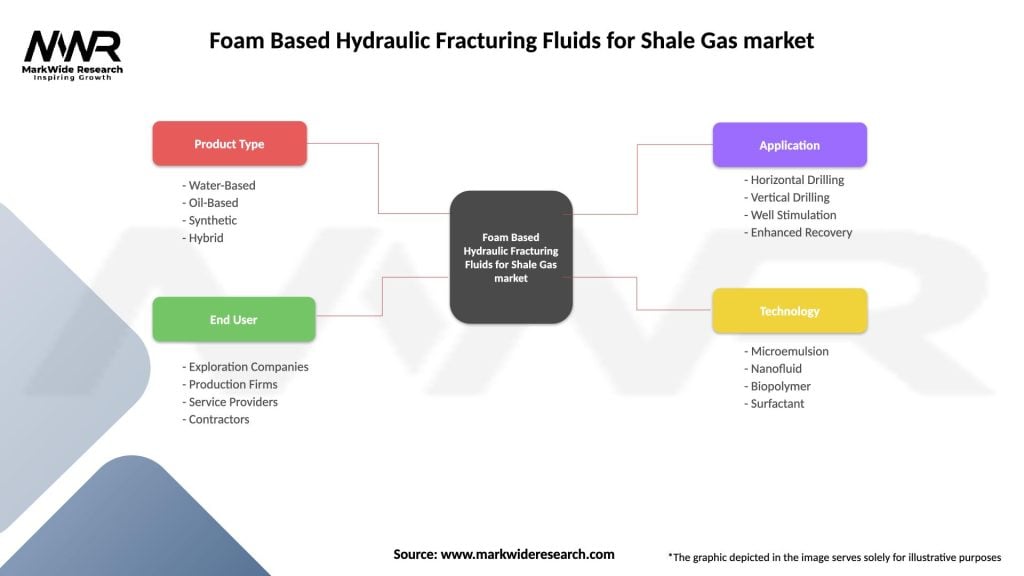

Segmentation

The foam-based hydraulic fracturing fluids market can be segmented based on various factors, includingfluid type, application, and region.

Segmenting the market allows for a more detailed analysis of specific product categories and their respective market dynamics.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

A SWOT analysis provides an evaluation of the strengths, weaknesses, opportunities, and threats in the foam-based hydraulic fracturing fluids market for shale gas.

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic had a significant impact on the foam-based hydraulic fracturing fluids market for shale gas. The pandemic-induced disruptions, including lockdowns, travel restrictions, and reduced economic activities, temporarily impacted the overall shale gas industry. However, the market showed resilience and demonstrated a swift recovery as the industry adapted to the new normal.

During the pandemic, the market witnessed a temporary decline in shale gas exploration and production activities due to reduced demand and uncertainties in the global energy markets. This led to a decrease in the demand for foam-based hydraulic fracturing fluids. However, as the economies reopened and energy demand recovered, the market rebounded, driven by the ongoing shale gas development projects and the adoption of efficient fracturing technologies.

The pandemic also emphasized the importance of sustainable practices in the shale gas industry. Environmental considerations gained more prominence, and there was an increased focus on eco-friendly foam-based fluids that minimize environmental impacts and address regulatory requirements.

Key Industry Developments

Analyst Suggestions

Future Outlook

The future outlook for foam-based hydraulic fracturing fluids in the shale gas market is optimistic. The increasing demand for natural gas, coupled with the ongoing development of shale gas reserves, will drive the adoption of foam-based fluids. Technological advancements and the focus on sustainable practices will continue to shape the market, with companies investing in research and development to enhance fluid performance, reduce environmental impacts, and meet regulatory requirements.

Collaborations and partnerships will play a crucial role in accelerating innovation and market growth. The expansion into emerging markets, especially in Asia-Pacific and Latin America, presents significant growth opportunities. Customized solutions tailored to specific reservoir conditions and environmental considerations will gain prominence, enabling operators to optimize well productivity and reduce costs.

While challenges remain, such as regulatory complexities and the need for water management, the foam-based hydraulic fracturing fluids market is expected to witness steady growth in the coming years. Continued advancements in fluid technology, increased emphasis on sustainability, and the resilience of the shale gas industry will drive the market’s future success.

Conclusion

Foam-based hydraulic fracturing fluids have transformed the shale gas industry, offering enhanced efficiency, cost savings, and reduced environmental impacts. These fluids provide superior proppant carrying capacity, gas mobility control, and viscosity control, resulting in improved well productivity and increased gas production rates. Despite challenges related to regulatory compliance and water availability, the market for foam-based fluids is poised for growth, driven by technological advancements, sustainability considerations, and the expansion into emerging markets.

The future outlook for foam-based hydraulic fracturing fluids in the shale gas market is positive, with continued investments in research and development, collaborations, and partnerships driving innovation and market growth. The industry’s resilience in the face of the Covid-19 pandemic and the increasing focus on sustainable practices reinforce the market’s potential for success. As companies prioritize environmental responsibility and tailor solutions to specific reservoir conditions, foam-based hydraulic fracturing fluids will remain a critical component of the shale gas extraction process, contributing to the energy transition and meeting the growing global demand for natural gas.

What is Foam Based Hydraulic Fracturing Fluids for Shale Gas?

Foam Based Hydraulic Fracturing Fluids for Shale Gas are specialized fluids used in the hydraulic fracturing process to extract natural gas from shale formations. These fluids utilize a combination of gas and liquid to create a foam that enhances the efficiency of the fracturing process while minimizing environmental impact.

What are the key companies in the Foam Based Hydraulic Fracturing Fluids for Shale Gas market?

Key companies in the Foam Based Hydraulic Fracturing Fluids for Shale Gas market include Halliburton, Schlumberger, Baker Hughes, and Weatherford, among others.

What are the growth factors driving the Foam Based Hydraulic Fracturing Fluids for Shale Gas market?

The growth of the Foam Based Hydraulic Fracturing Fluids for Shale Gas market is driven by the increasing demand for natural gas, advancements in fracturing technologies, and the need for more efficient and environmentally friendly extraction methods.

What challenges does the Foam Based Hydraulic Fracturing Fluids for Shale Gas market face?

Challenges in the Foam Based Hydraulic Fracturing Fluids for Shale Gas market include regulatory scrutiny regarding environmental impacts, the high cost of foam-based fluids compared to traditional methods, and the technical complexities involved in their application.

What opportunities exist in the Foam Based Hydraulic Fracturing Fluids for Shale Gas market?

Opportunities in the Foam Based Hydraulic Fracturing Fluids for Shale Gas market include the development of new formulations that enhance performance, increasing investments in shale gas exploration, and the potential for expanding applications in various geological formations.

What trends are shaping the Foam Based Hydraulic Fracturing Fluids for Shale Gas market?

Trends in the Foam Based Hydraulic Fracturing Fluids for Shale Gas market include a growing focus on sustainable practices, the integration of digital technologies for monitoring and optimization, and the increasing use of biodegradable additives to reduce environmental impact.

Foam Based Hydraulic Fracturing Fluids for Shale Gas market

| Segmentation Details | Description |

|---|---|

| Product Type | Water-Based, Oil-Based, Synthetic, Hybrid |

| End User | Exploration Companies, Production Firms, Service Providers, Contractors |

| Application | Horizontal Drilling, Vertical Drilling, Well Stimulation, Enhanced Recovery |

| Technology | Microemulsion, Nanofluid, Biopolymer, Surfactant |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at