444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The Electronics Logging Device (ELD) market is experiencing significant growth and transformation in recent years. ELDs are electronic devices used in the transportation industry to record and monitor drivers’ hours of service (HOS) compliance. These devices are designed to replace traditional paper logbooks and offer accurate and automated data collection, improving efficiency and safety in the industry.

Meaning

An Electronics Logging Device (ELD) is a hardware device that connects to a vehicle’s engine and records data related to the operation and movement of the vehicle. It captures information such as engine hours, distance traveled, and the driver’s HOS. This data is then transmitted to a central server or a cloud-based platform for analysis and reporting. ELDs provide real-time information and automate the process of keeping records, ensuring compliance with regulatory requirements.

Executive Summary

The Electronics Logging Device (ELD) market is witnessing steady growth due to the increasing focus on improving road safety, reducing accidents, and ensuring HOS compliance in the transportation industry. ELDs offer numerous benefits such as accurate data recording, improved fleet management, and streamlined operations. The market is highly competitive, with several key players offering a wide range of ELD solutions to meet the diverse needs of the industry.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

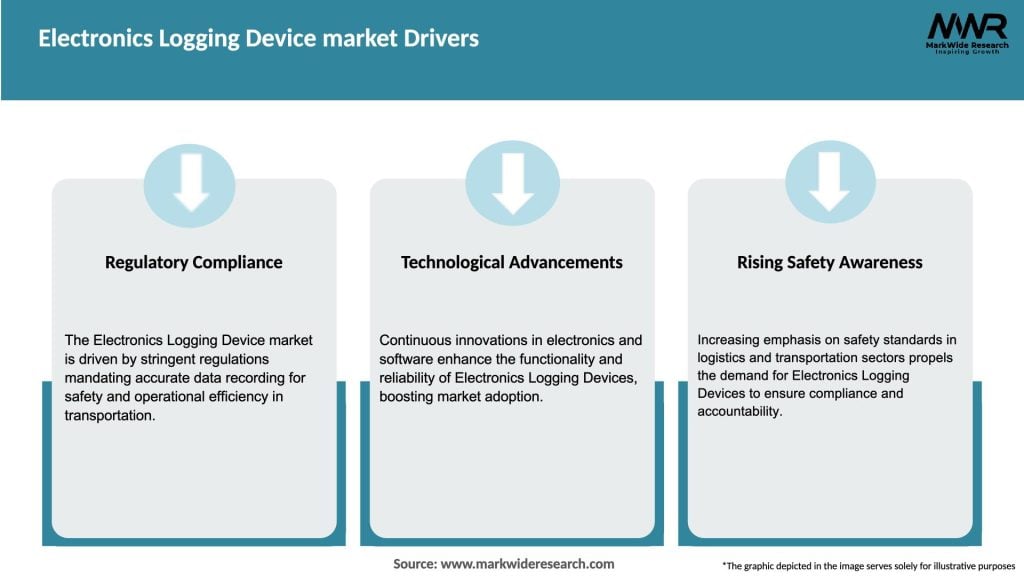

The Electronics Logging Device (ELD) market is characterized by dynamic factors that impact its growth and evolution. These dynamics include regulatory developments, technological advancements, competitive landscape, and changing customer preferences.

Regulatory developments play a crucial role in shaping the ELD market. Government mandates and regulations drive the adoption of ELDs by fleet operators, creating a favorable environment for market growth. Technological advancements, such as the integration of ELDs with other telematics solutions, GPS tracking, and cloud-based platforms, enhance the capabilities and functionalities of ELD systems, driving market demand.

The competitive landscape of the ELD market is highly fragmented, with several players offering a wide range of ELD solutions. Key market players compete on parameters such as product features, pricing, reliability, and customer service. Strategic partnerships, mergers, and acquisitions are common strategies employed by market players to strengthen their market position.

Changing customer preferences also influence the dynamics of the ELD market. Customers are increasingly seeking comprehensive fleet management solutions that integrate ELDs with other telematics systems. They are also demanding user-friendly interfaces, data analytics capabilities, and seamless integration with existing fleet management software.

Regional Analysis

The Electronics Logging Device (ELD) market exhibits regional variations in terms of adoption, regulatory landscape, and market dynamics. The market is divided into several regions, including North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa.

Competitive Landscape

Leading Companies in the Electronics Logging Device Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The Electronics Logging Device (ELD) market can be segmented based on several factors, including:

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

The adoption of Electronics Logging Devices (ELDs) offers several benefits to industry participants and stakeholders:

SWOT Analysis

A SWOT analysis of the Electronics Logging Device (ELD) market provides insights into its strengths, weaknesses, opportunities, and threats:

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic had a mixed impact on the Electronics Logging Device (ELD) market. While the initial phase of the pandemic resulted in disruptions and uncertainties in the transportation industry, it also accelerated certain trends that positively affected the ELD market.

During the lockdowns and restrictions imposed to curb the spread of the virus, the demand for transportation services declined significantly. This led to a temporary reduction in the adoption of ELDs as fleet operators faced financial constraints and operational challenges. However, as the economy gradually reopened and logistics activities resumed, the importance of ELDs became evident in ensuring efficient operations, driver safety, and compliance with regulations.

The pandemic highlighted the need for real-time tracking, remote monitoring, and contactless operations, all of which are facilitated by ELDs. Fleet operators recognized the value of ELDs in enabling efficient last-mile delivery, optimizing routes, and maintaining driver health and safety. This realization, coupled with the ongoing regulatory mandates for ELD adoption, drove the market demand.

The pandemic also accelerated the trend of digitization and the adoption of cloud-based solutions. ELD systems that offered cloud connectivity and remote access to data gained prominence as they allowed fleet operators to manage their operations efficiently, even with limited physical interactions.

Overall, while the pandemic initially posed challenges to the ELD market, it also acted as a catalyst for the adoption of ELDs in the long run, reinforcing the importance of compliance, safety, and technology-driven solutions in the transportation industry.

Key Industry Developments

Analyst Suggestions

Future Outlook

The future outlook for the Electronics Logging Device (ELD) market is highly positive, driven by factors such as regulatory mandates, technological advancements, and increasing focus on driver safety and operational efficiency. The market is expected to witness steady growth as fleet operators recognize the benefits of ELDs in ensuring compliance, improving safety, and streamlining operations.

The integration of ELDs with other telematics solutions, IoT technologies, and cloud-based platforms will further enhance the capabilities of ELD systems. Advanced functionalities, such as predictive maintenance, real-time driver coaching, and optimized route planning, will become standard features in ELD offerings.

The market will continue to evolve, with new entrants and established players competing to offer innovative solutions. Strategic partnerships, mergers, and acquisitions will shape the competitive landscape, allowing companies to expand their market reach and strengthen their product portfolios.

As the transportation industry continues to grow, especially in emerging markets, the demand for ELDs will increase. Governments worldwide are likely to introduce or reinforce regulations mandating the use of ELDs, further driving market demand.

Conclusion

In conclusion, the Electronics Logging Device (ELD) market is poised for significant growth, driven by regulatory requirements, technological advancements, and the need for improved safety and efficiency in the transportation industry. The market offers opportunities for innovation, collaboration, and market expansion, making it an exciting and dynamic sector to watch in the coming years.

What is Electronics Logging Device?

Electronics Logging Device refers to devices used for recording data related to electronic systems, often utilized in various industries for monitoring and compliance purposes. These devices can track parameters such as temperature, humidity, and voltage, ensuring accurate data collection and analysis.

What are the key players in the Electronics Logging Device market?

Key players in the Electronics Logging Device market include companies like Fluke Corporation, Omega Engineering, and National Instruments, which provide a range of logging devices for industrial and commercial applications, among others.

What are the growth factors driving the Electronics Logging Device market?

The Electronics Logging Device market is driven by the increasing demand for data accuracy in industries such as pharmaceuticals, food and beverage, and manufacturing. Additionally, the rise of IoT and automation technologies is enhancing the need for advanced logging solutions.

What challenges does the Electronics Logging Device market face?

Challenges in the Electronics Logging Device market include the high cost of advanced logging systems and the complexity of integrating these devices with existing infrastructure. Furthermore, data security concerns can hinder adoption in sensitive applications.

What opportunities exist in the Electronics Logging Device market?

Opportunities in the Electronics Logging Device market include the growing trend of smart manufacturing and the increasing regulatory requirements for data logging in various sectors. Innovations in wireless technology also present new avenues for product development.

What trends are shaping the Electronics Logging Device market?

Trends in the Electronics Logging Device market include the shift towards cloud-based data management solutions and the integration of AI for predictive analytics. Additionally, there is a growing focus on sustainability, with devices designed to minimize energy consumption.

Electronics Logging Device market

| Segmentation Details | Description |

|---|---|

| Product Type | Data Loggers, Temperature Loggers, Humidity Loggers, Voltage Loggers |

| Technology | Bluetooth, Wi-Fi, Cellular, USB |

| End User | Manufacturing, Transportation, Healthcare, Agriculture |

| Application | Cold Chain Monitoring, Environmental Monitoring, Equipment Monitoring, Quality Control |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Electronics Logging Device Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at