444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The Dibutyl Maleate (DBM) market has witnessed significant growth in recent years, driven by its widespread applications in various industries. Dibutyl maleate is an ester compound derived from maleic acid and is commonly used as a monomer or co-monomer in the production of resins, adhesives, and polymers. It offers excellent solubility, low volatility, and good adhesion properties, making it a valuable ingredient in many end-use applications.

Meaning

Dibutyl maleate, often abbreviated as DBM, is a chemical compound belonging to the ester family. It is derived from the reaction between maleic acid and butanol. Dibutyl maleate is a clear, colorless liquid with a characteristic fruity odor. It is primarily used as a chemical intermediate in the production of resins, adhesives, and polymers.

Executive Summary

The Dibutyl Maleate (DBM) market has experienced steady growth due to the increasing demand for adhesives, resins, and polymers in various industries. DBM offers excellent compatibility, solubility, and adhesion properties, making it a preferred choice for manufacturers. The market is expected to witness continued expansion as key industries such as paints and coatings, adhesives, and textiles continue to grow.

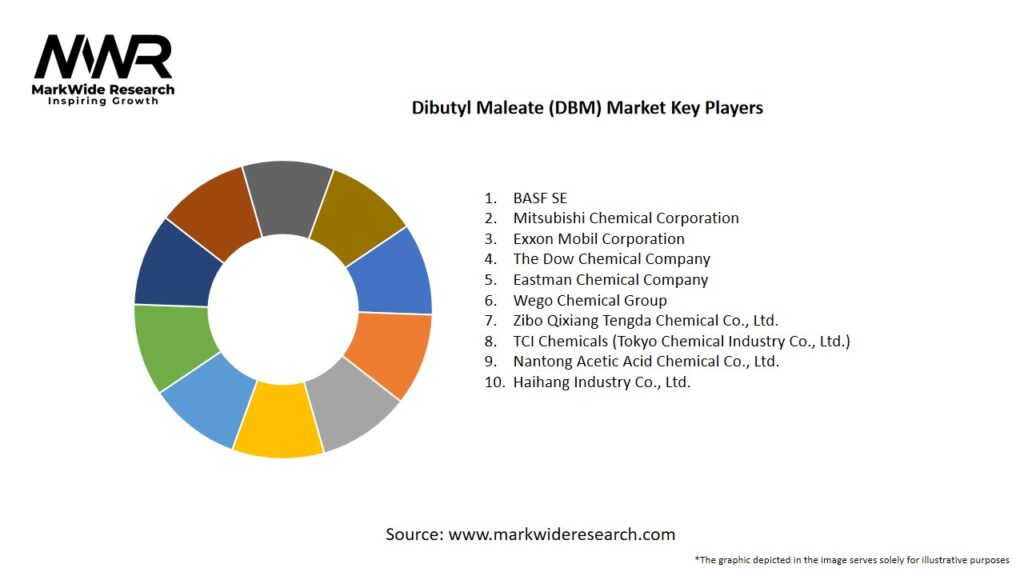

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The Dibutyl Maleate (DBM) market is driven by the increasing demand for adhesives, polymers, and construction materials. Factors such as technological advancements, shifting consumer preferences towards sustainable materials, and growing construction activities contribute to market growth. However, the market faces challenges such as volatile raw material prices, stringent regulations, competition from substitutes, and limited awareness in certain regions. Manufacturers can capitalize on opportunities such as the demand for eco-friendly products, expansion in emerging markets, technological advancements, and collaboration with end-use industries to drive market growth.

Regional Analysis

The DBM market exhibits regional variations in terms of consumption and production. Currently, regions such as North America, Europe, and Asia-Pacific dominate the market due to their well-established industrial sectors and infrastructure development. These regions are major consumers of adhesives, coatings, and polymers, driving the demand for DBM. However, there is untapped potential in emerging economies in Latin America, the Middle East, and Africa, where increasing construction activities and industrial growth offer opportunities for market expansion.

Competitive Landscape

Leading Companies in the Dibutyl Maleate (DBM) Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The DBM market can be segmented based on application and end-use industry.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic has impacted the Dibutyl Maleate (DBM) market, primarily due to disruptions in the global supply chain and temporary closures of manufacturing facilities. The construction industry and other end-useindustries experienced a slowdown, leading to a decrease in the demand for DBM. However, as economies recover and construction activities resume, the market is expected to regain momentum. Additionally, the growing focus on sustainability and eco-friendly materials is expected to drive the demand for DBM in the post-pandemic period.

Key Industry Developments

Analyst Suggestions

Future Outlook

The future of the Dibutyl Maleate (DBM) market looks promising, driven by the increasing demand for adhesives, polymers, and coatings in various industries. Technological advancements, sustainable initiatives, and collaborations with end-use industries will shape the market landscape. The market is expected to witness steady growth, with opportunities in emerging markets and the development of innovative DBM-based solutions. However, challenges such as volatile raw material prices and regulatory compliance will need to be managed effectively. Overall, the DBM market will continue to evolve, driven by changing consumer preferences, industry advancements, and the push towards sustainability.

Conclusion

The Dibutyl Maleate (DBM) market has experienced significant growth, driven by its widespread applications in adhesives, polymers, and coatings. DBM offers excellent compatibility, adhesion, and film-forming properties, making it a valuable ingredient in various industries. The market is characterized by opportunities such as the growing demand for sustainable solutions, expansion in emerging markets, technological advancements, and collaborations with end-use industries. However, challenges such as volatile raw material prices, regulatory compliance, competition from substitutes, and limited awareness in certain regions need to be addressed. Manufacturers should focus on sustainable practices, invest in research and development, strengthen partnerships, and explore untapped markets to stay competitive and capitalize on market opportunities.

Dibutyl Maleate (DBM) Market

| Segmentation Details | Description |

|---|---|

| Product Type | Plasticizers, Coatings, Adhesives, Sealants |

| End Use Industry | Automotive, Construction, Consumer Goods, Electronics |

| Application | Flexible PVC, Paints, Inks, Textiles |

| Packaging Type | Drums, IBC Containers, Bags, Bulk |

Leading Companies in the Dibutyl Maleate (DBM) Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at