Segmentation

-

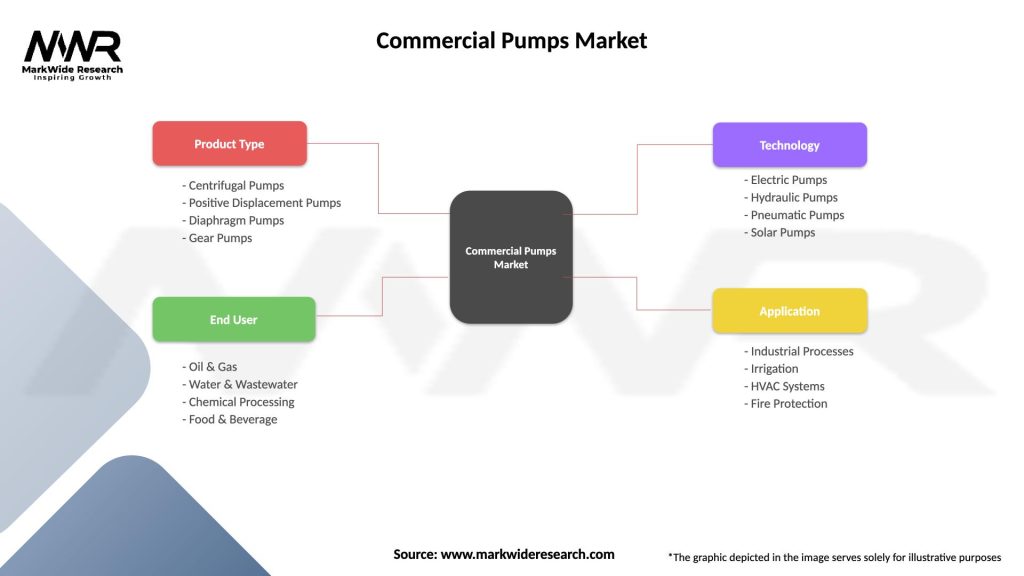

By Pump Type: Centrifugal; Positive Displacement (gear, screw, diaphragm); Booster Pumps; Submersible Pumps; Specialty Pumps

-

By Drive Technology: Fixed Speed; Variable‑Speed (VSD/Inverter)

-

By Application: HVAC & Chilled Water; Water Supply & Booster; Sewage & Drainage; Fire Protection; Process Water & Dosing

-

By Industry Vertical: Commercial Real Estate; Hospitality; Healthcare; Retail; Education & Public Buildings

-

By Region: Western Europe; Northern Europe; Southern Europe; Eastern Europe

Category‑wise Insights

-

HVAC Pumps: Dominant segment, accounting for over 35% of commercial pump installations; energy savings potential drives VSD uptake.

-

Booster Pumps: Critical for high‑rise buildings; modular, skid‑mounted booster packages simplify installation and maintenance.

-

Sewage & Drainage Pumps: Growing demand in mixed‑use developments and underground car parks for wastewater management.

-

Fire‑Protection Pumps: Stringent safety codes mandate diesel or electric fire pumps, driving stable replacement demand.

-

Dosing & Process Pumps: Niche but fast‑growing in commercial water treatment and swimming‑pool applications.

Key Benefits for Industry Participants and Stakeholders

-

Operational Efficiency: High‑efficiency pumps and VSDs can reduce energy consumption by up to 50% in variable‑load applications.

-

Lifecycle Cost Reduction: Predictive maintenance and remote monitoring minimize unplanned downtime and service costs.

-

Regulatory Compliance: Certified pumps ensure adherence to Ecodesign and local building codes, reducing risk of non‑compliance fines.

-

Enhanced Comfort & Safety: Reliable water circulation and fire‑protection systems support occupant well‑being and asset protection.

-

Sustainability Credentials: Adoption of green pump technologies aligns with corporate ESG goals and improves building certification scores.

SWOT Analysis

Strengths:

-

Well‑established OEMs with robust R&D, service networks, and brand reputations.

-

Mature regulatory framework driving efficiency upgrades and service contracts.

Weaknesses:

-

High capital costs and integration complexity can delay project approvals.

-

Dependence on skilled labor for installation and maintenance.

Opportunities:

-

Growth in subscription‑based service models offering predictable OPEX for end users.

-

Emerging commercial real estate projects in Eastern Europe requiring complete MEP (mechanical, electrical, plumbing) solutions.

Threats:

-

Raw‑material price volatility increasing BOM (bill‑of‑materials) costs.

-

Competition from low‑cost, non‑EU manufacturers in price‑sensitive segments.

Market Key Trends

-

Digital Twins: Virtual models of pump systems enable performance simulations and maintenance planning.

-

Edge Analytics: On‑pump embedded analytics for real‑time fault detection without cloud dependencies.

-

Modular Skid Systems: Pre‑assembled, plug‑and‑play pump packages reduce installation time and site labor.

-

Wireless Sensor Networks: Battery‑powered gauges and flow meters simplify retrofitting of legacy systems.

-

Hydraulic Optimization Software: AI‑driven selection tools ensure right‑sizing of pump hydraulics to application demands.

Covid-19 Impact

-

Supply‑Chain Disruptions: Initial component and logistics bottlenecks in 2020–21 led to extended lead times and inventory shortages.

-

Maintenance Deferrals: Facility lockdowns postponed retrofit and service projects, delaying replacement cycles.

-

Digital Acceleration: Remote monitoring and virtual commissioning tools gained adoption as on‑site access was restricted.

-

Health & Safety Focus: Heightened attention to water hygiene in healthcare and hospitality drove increased demand for reliable booster and circulation pumps.

Key Industry Developments

-

Grundfos GO2 Cloud Launch: Expansion of cloud‑based pump monitoring with AI‑driven anomaly detection.

-

Xylem Acquires Apex Pump Technologies: Strengthening its presence in HVAC and booster pump segments in Europe.

-

Pentair Smart BoosteRRS: Introduction of a wireless monitoring module for booster pump controllers in commercial buildings.

-

Wilo‑Siemens Partnership: Joint development of integrated pump drives with Simatic control integration for automated facilities.

-

Sulzer Retrofit Kits: Roll‑out of sensor‑based retrofit packages for legacy centrifugal pumps to enable digital monitoring.

Analyst Suggestions

-

Prioritize Retrofit Solutions: Develop low‑cost, plug‑and‑play upgrade kits for existing pump fleets to accelerate efficiency improvements.

-

Expand Service Contracts: Bundle remote monitoring, preventive maintenance, and spare‑parts logistics into recurring‑revenue offerings.

-

Leverage Data Analytics: Use performance data to demonstrate ROI and secure long‑term service agreements with building owners.

-

Customize Modular Packages: Offer pre‑configured pump skids for common commercial applications to reduce project lead times.

-

Strengthen Eastern Europe Focus: Tailor mid‑range product lines and financing schemes to capture growing commercial construction in emerging markets.

Future Outlook

The Europe Commercial Pumps Market is set for continued moderate growth, driven by renovation of aging building stock, stricter energy regulations, and the rise of smart building standards. Breakthroughs in digitalization—such as edge analytics and modular IoT platforms—will transform maintenance paradigms and create new value streams. Subscription‑based and circular economy business models will further alter traditional sales channels, fostering closer OEM‑end‑user partnerships. Manufacturers that combine hydraulic expertise with software capabilities and local service excellence will lead in this evolving, high‐value market.

Conclusion

Commercial pumps are the unsung workhorses of Europe’s built environment, enabling vital HVAC, water, and safety functions. As regulations tighten and digital innovation accelerates, pump OEMs and service providers must adapt through energy‐efficient designs, smart monitoring solutions, and flexible business models. By focusing on retrofit enablement, data‑driven services, and regional growth pockets, stakeholders can capture robust opportunities and maintain resilient operations in the dynamic Europe commercial pumps landscape.