444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The Close-in Weapon Systems (CIWS) market refers to a segment of the defense industry that focuses on the development and deployment of advanced weapon systems designed to provide close-range protection to naval vessels and ground-based installations. These systems play a crucial role in safeguarding military assets against various threats, including anti-ship missiles, aircraft, unmanned aerial vehicles (UAVs), and other asymmetric threats.

Meaning

Close-in Weapon Systems (CIWS) are a type of defensive weapon system that is specifically designed to engage and destroy incoming threats at close range. These systems are typically mounted on naval vessels and are used to provide protection against missile attacks and other airborne threats. CIWS employ advanced tracking and fire control systems, along with rapid-firing guns or missile launchers, to detect, track, and engage hostile targets, ensuring the safety of the vessel and its crew.

Executive Summary

The Close-in Weapon Systems (CIWS) market has witnessed significant growth in recent years, driven by the rising security concerns and the increasing need for advanced defense systems across the globe. The proliferation of missile technology and the emergence of new threats have necessitated the deployment of effective CIWS to safeguard naval assets and critical infrastructure.

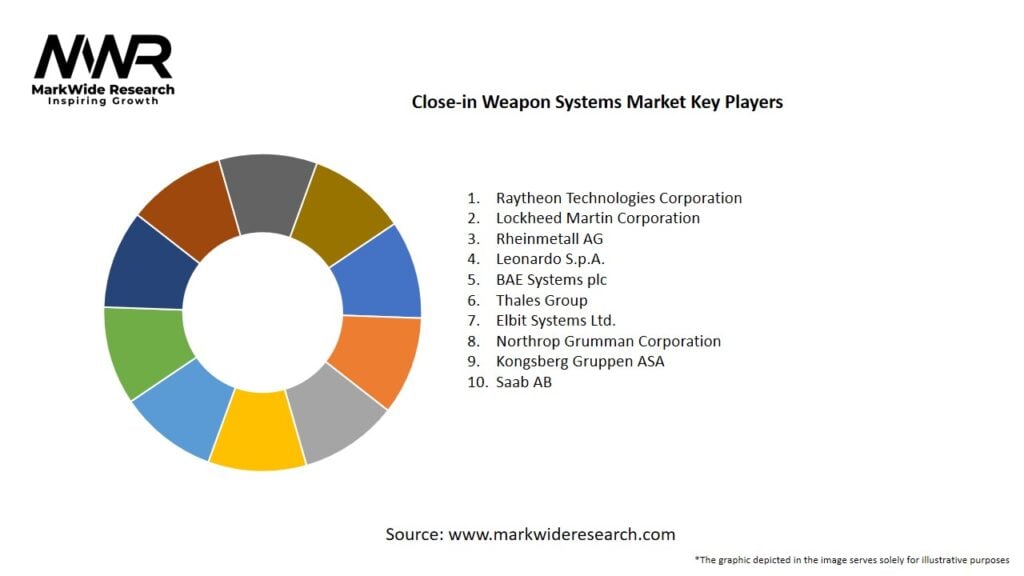

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The Close-in Weapon Systems (CIWS) market is driven by a combination of geopolitical factors, technological advancements, defense modernization programs, and evolving threat landscapes. The market is characterized by intense competition, with several global players vying for contracts and striving to develop cutting-edge CIWS solutions.

Regional Analysis

The CIWS market is segmented into various regions, including North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa. North America and Europe dominate the market due to their robust defense industries and significant investments in naval modernization programs. The Asia Pacific region is witnessing rapid growth in the CIWS market, driven by increasing defense spending and growing tensions in the South China Sea. Latin America, the Middle East, and Africa also present opportunities for market growth due to regional security concerns and ongoing defense modernization efforts.

Competitive Landscape

Leading Companies in the Close-in Weapon Systems Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The CIWS market can be segmented based on platform, component, type, and region. By platform, the market is categorized into naval vessels and ground-based installations. The component segment includes sensors, fire control systems, and guns/missile launchers. Based on type, the market can be segmented into gun-based CIWS and missile-based CIWS. Geographically, the market is divided into North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic had a mixed impact on the Close-in Weapon Systems (CIWS) market. While the initial disruption caused by supply chain disruptions and operational challenges impacted production and delivery schedules, the market quickly rebounded due to the resilient nature of defense spending. The pandemic highlighted the importance of robust defense systems, including CIWS, in ensuring national security and safeguarding critical assets, leading to sustained demand for these systems.

Key Industry Developments

Analyst Suggestions

Future Outlook

The Close-in Weapon Systems (CIWS) market is expected to witness sustained growth in the coming years, driven by the increasing security concerns and the need for advanced defense systems. Technological advancements, such as the integration of AI, directed energy weapons, and advanced sensors, will continue to shape the market landscape. Emerging markets, retrofit programs, and collaborations will offer significant growth opportunities, while the focus on cost-effective solutions and comprehensive support services will be crucial for market players to maintain a competitive edge.

Conclusion

The Close-in Weapon Systems (CIWS) market is experiencing steady growth due to the rising security concerns and the need for advanced defense systems. Technological advancements, such as advanced sensors, AI, and directed energy weapons, are driving the evolution of CIWS, making them more effective and reliable in countering threats. The market offers opportunities for industry participants to generate revenue, expand their global presence, and contribute to the defense capabilities of nations. However, challenges such as high costs, integration complexities, and limited range need to be addressed. Overall, the future outlook for the CIWS market is positive, with sustained growth expected in the coming years.

What is Close-in Weapon Systems?

Close-in Weapon Systems (CIWS) are defensive weapons designed to protect naval vessels from incoming threats such as missiles and aircraft. They typically include automated guns and missile systems that can engage targets at short ranges.

What are the key players in the Close-in Weapon Systems Market?

Key players in the Close-in Weapon Systems Market include Raytheon Technologies, BAE Systems, Northrop Grumman, and Thales Group, among others. These companies are known for their advanced technologies and innovations in defense systems.

What are the growth factors driving the Close-in Weapon Systems Market?

The growth of the Close-in Weapon Systems Market is driven by increasing defense budgets, rising geopolitical tensions, and the need for enhanced naval security. Additionally, advancements in technology are leading to more effective and reliable systems.

What challenges does the Close-in Weapon Systems Market face?

The Close-in Weapon Systems Market faces challenges such as high development costs, the complexity of integration with existing systems, and the rapid pace of technological change. These factors can hinder the timely deployment of new systems.

What opportunities exist in the Close-in Weapon Systems Market?

Opportunities in the Close-in Weapon Systems Market include the development of next-generation systems with improved automation and artificial intelligence capabilities. Additionally, increasing demand from emerging economies for naval defense solutions presents significant growth potential.

What trends are shaping the Close-in Weapon Systems Market?

Trends in the Close-in Weapon Systems Market include the integration of advanced radar and sensor technologies, the shift towards multi-role systems, and the growing emphasis on cyber resilience in defense systems. These trends are influencing the design and functionality of CIWS.

Close-in Weapon Systems Market

| Segmentation Details | Description |

|---|---|

| Product Type | Gun Systems, Missile Systems, Laser Systems, Torpedo Systems |

| Technology | Electromagnetic, Kinetic, Chemical, Optical |

| End User | Military, Defense Contractors, Government Agencies, Private Security |

| Installation | Land-Based, Naval, Aerial, Mobile |

Leading Companies in the Close-in Weapon Systems Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at