444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview

The Canada prepaid cards market has experienced significant growth in recent years, driven by the increasing adoption of digital payment solutions and the convenience offered by prepaid cards. Prepaid cards are a form of payment card that allows users to load a specific amount of money onto the card in advance, which can then be used for purchases and transactions. These cards are widely accepted by merchants and can be used for online shopping, bill payments, and in-store purchases.

Meaning

Prepaid cards are a type of payment card that is loaded with a predetermined amount of money by the cardholder before it can be used for transactions. Unlike credit cards, which allow users to borrow money up to a certain limit, prepaid cards only allow users to spend the amount of money that has been loaded onto the card. These cards provide a convenient and secure payment method for consumers, as they eliminate the need to carry cash and can be easily replaced if lost or stolen.

Executive Summary

The Canada prepaid cards market has witnessed substantial growth in recent years, driven by factors such as the increasing adoption of digital payment solutions, the convenience offered by prepaid cards, and the rise in e-commerce transactions. The market is highly competitive, with several key players vying for market share. However, there are also significant opportunities for new entrants to capitalize on the growing demand for prepaid cards in Canada.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The Canada prepaid cards market is dynamic and evolving, influenced by various factors such as changing consumer preferences, technological advancements, regulatory developments, and competitive forces. Companies operating in this market need to stay abreast of these dynamics to effectively navigate the landscape and capitalize on emerging opportunities.

Regional Analysis

The Canada prepaid cards market exhibits regional variations in terms of adoption and acceptance. Urban areas, such as major cities and metropolitan regions, have higher levels of acceptance and usage of prepaid cards due to factors such as greater access to digital infrastructure and a higher concentration of merchants. However, there is also growing adoption in suburban and rural areas, driven by increasing awareness and the expansion of digital payment solutions.

Competitive Landscape

Leading Companies in the Canada Prepaid Cards Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

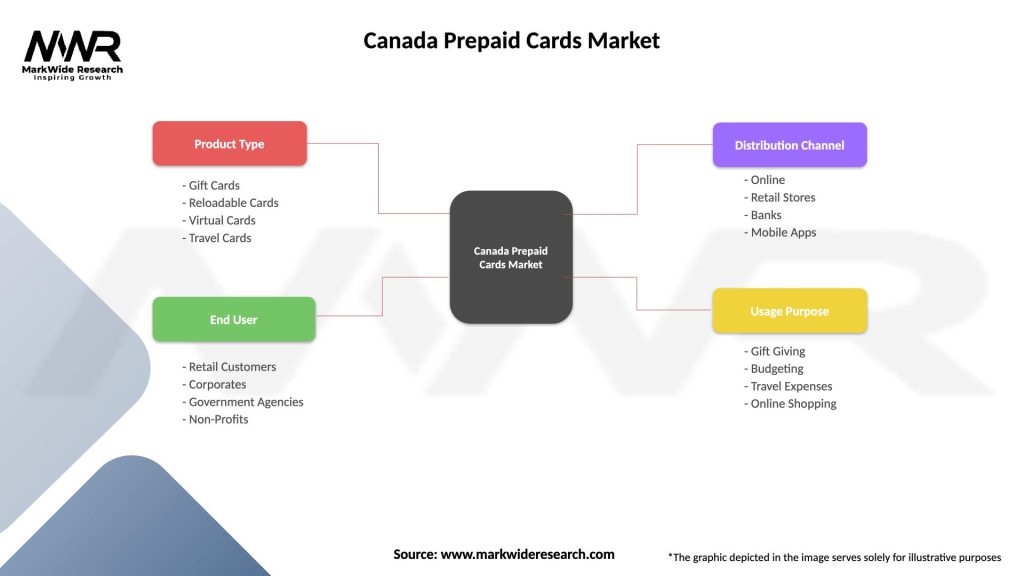

Segmentation

The Canada prepaid cards market can be segmented based on various factors, including card type, usage, and industry verticals. Card types may include open-loop prepaid cards, closed-loop prepaid cards, and virtual prepaid cards. Usage segments may consist of general purpose prepaid cards, payroll cards, travel cards, and gift cards. Industry verticals can encompass retail, hospitality, transportation, and healthcare, among others.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic has had a significant impact on the Canada prepaid cards market. The restrictions imposed to curb the spread of the virus, such as lockdowns and social distancing measures, led to a surge in e-commerce transactions. This shift towards online shopping and the preference for contactless payments have accelerated the adoption of prepaid cards. Additionally, the pandemic highlighted the convenience and safety aspects of prepaid cards, as they eliminate the need for physical contact and cash handling.

Key Industry Developments

Analyst Suggestions

Future Outlook

The future outlook for the Canada prepaid cards market remains positive, with continued growth expected in the coming years. The increasing adoption of digital payment solutions, the convenience offered by prepaid cards, and the expanding acceptance by merchants are all factors that will contribute to market growth. As technology continues to advance, prepaid cards will become more integrated into the digital payment ecosystem, offering enhanced features and functionalities.

Conclusion

The Canada prepaid cards market has experienced significant growth in recent years, driven by factors such as the adoption of digital payment solutions, the convenience offered by prepaid cards, and the increasing acceptance by merchants. The market presents several opportunities for industry participants and stakeholders, including the expansion of prepaid card usage in unbanked and underbanked populations, integration with mobile wallets, and targeted marketing efforts. While there are challenges such as limited acceptance in some locations and the perceived lack of rewards and benefits, the overall outlook for the prepaid cards market in Canada remains positive. By staying abreast of key market trends, embracing digital transformation, and addressing consumer needs, companies can position themselves for success in this dynamic and evolving market.

What is Prepaid Cards?

Prepaid cards are payment cards that are preloaded with a specific amount of money, allowing users to make purchases without the need for a bank account or credit line. They are commonly used for budgeting, gifting, and online shopping.

What are the key players in the Canada Prepaid Cards Market?

Key players in the Canada Prepaid Cards Market include companies like PayPal, NetSpend, and Green Dot, which offer various prepaid card solutions for consumers and businesses. These companies provide services that cater to different needs, such as travel, online shopping, and payroll, among others.

What are the growth factors driving the Canada Prepaid Cards Market?

The Canada Prepaid Cards Market is driven by factors such as the increasing adoption of cashless transactions, the rise in e-commerce activities, and the growing demand for financial inclusion among unbanked populations. Additionally, the convenience and security offered by prepaid cards contribute to their popularity.

What challenges does the Canada Prepaid Cards Market face?

Challenges in the Canada Prepaid Cards Market include regulatory compliance issues, competition from traditional banking services, and concerns regarding fees and card usability. These factors can impact consumer trust and adoption rates.

What opportunities exist in the Canada Prepaid Cards Market?

Opportunities in the Canada Prepaid Cards Market include the potential for innovation in digital wallets and mobile payment solutions, as well as the expansion of prepaid card offerings tailored for specific demographics, such as students and travelers. The growing trend of online shopping also presents new avenues for growth.

What trends are shaping the Canada Prepaid Cards Market?

Trends in the Canada Prepaid Cards Market include the increasing integration of prepaid cards with mobile payment platforms, the rise of contactless payment options, and the growing focus on personalized financial services. These trends reflect changing consumer preferences and technological advancements.

Canada Prepaid Cards Market

| Segmentation Details | Description |

|---|---|

| Product Type | Gift Cards, Reloadable Cards, Virtual Cards, Travel Cards |

| End User | Retail Customers, Corporates, Government Agencies, Non-Profits |

| Distribution Channel | Online, Retail Stores, Banks, Mobile Apps |

| Usage Purpose | Gift Giving, Budgeting, Travel Expenses, Online Shopping |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Canada Prepaid Cards Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at