444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview

The Canada food colorants market is witnessing significant growth, driven by various factors such as increasing consumer demand for visually appealing food products, rising awareness about the benefits of natural colorants, and the growing food and beverage industry in the country. Food colorants are substances that are added to food and beverages to enhance their visual appeal, improve product acceptance, and compensate for color losses during processing. They are available in various forms, including liquid, powder, and gel, and can be either natural or synthetic.

Meaning

Food colorants play a crucial role in the food industry, as they have the power to influence consumer perception and preference. The colors of food products often evoke certain emotions and expectations, and companies use colorants to create visually appealing products that stand out on store shelves. Food colorants are not only used in processed foods but also in beverages, dairy products, confectionery, bakery items, and other food applications. They can be used to add vibrant colors, replicate natural hues, or mask color changes caused by processing or storage.

Executive Summary

The Canada food colorants market is experiencing steady growth, with an increasing number of food manufacturers incorporating colorants into their products. The market is characterized by the presence of both domestic and international players offering a wide range of colorants to cater to the diverse needs of the industry. The demand for natural colorants is on the rise due to consumer preferences for clean-label and healthier food options. However, synthetic colorants still dominate the market, owing to their stability, cost-effectiveness, and versatility.

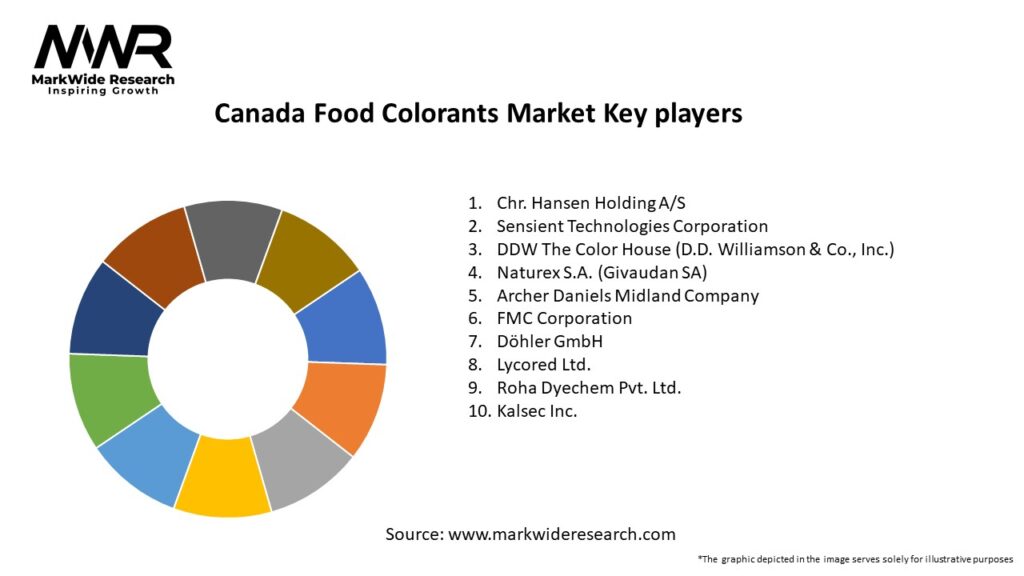

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The Canada food colorants market is highly dynamic, influenced by consumer preferences, industry trends, government regulations, and technological advancements. The market is characterized by intense competition among key players, who strive to offer a diverse range of colorants with improved stability, solubility, and sensory properties. The shift towards natural colorants is driven by the growing demand for clean-label products and the increasing awareness of the potential health risks associated with synthetic colorants. Manufacturers are investing in research and development to discover new sources of natural colorants and develop innovative formulations to cater to changing consumer demands.

Regional Analysis

The Canada food colorants market exhibits regional variations in terms of consumption patterns, regulatory frameworks, and consumer preferences. Major cities and metropolitan areas have higher demand for food colorants, driven by a larger population, diverse food culture, and higher disposable income. Western Canada, particularly British Columbia and Alberta, has a significant presence of food and beverage manufacturers, leading to a higher demand for colorants in this region. Additionally, the concentration of research institutions and industry associations in Ontario and Quebec fosters innovation and product development in the food colorants market.

Competitive Landscape

Leading Companies: Canada Food Colorants Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The Canada food colorants market can be segmented based on type, form, application, and source. By type, the market can be categorized into natural colorants and synthetic colorants. Natural colorants can further be classified into plant-based colorants, animal-based colorants, and mineral-based colorants. Synthetic colorants include FD&C colorants, D&C colorants, and others. Based on form, colorants are available as liquid, powder, and gel. Application-wise, the market can be divided into beverages, bakery and confectionery, dairy and frozen products, meat and seafood, and others. Sources of natural colorants include fruits and vegetables, spices and herbs, and others.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths

Weaknesses

Opportunities

Threats

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic had a mixed impact on the Canada food colorants market. During the initial stages of the pandemic, the market experienced disruptions in the supply chain and manufacturing processes due to lockdowns and restrictions. However, as the situation stabilized, the market witnessed a rebound, driven by the increased consumption of packaged and processed food products. The pandemic highlighted the importance of food safety and hygiene, leading to a greater emphasis on clean-label and natural ingredients, including colorants.

Key Industry Developments

Analyst Suggestions

Future Outlook

The Canada food colorants market is expected to witness steady growth in the coming years. The demand for visually appealing food products and the shift towards clean-label and natural ingredients will continue to drive the market. Natural colorants are projected to experience significant growth, supported by increasing consumer awareness of health and environmental concerns. However, synthetic colorants will remain dominant due to their stability, cost-effectiveness, and versatility. Technological advancements in colorant manufacturing processes and collaborations between industry players and research institutions will further contribute to market growth.

Conclusion

The Canada food colorants market is undergoing significant changes, driven by consumer preferences, industry trends, and regulatory factors. The demand for visually appealing food products and clean-label options is fueling the growth of the market. Manufacturers are responding to these demands by offering a diverse range of natural and synthetic colorants to cater to different food and beverage applications. With continuous innovation, collaborations, and adherence to regulatory standards, the market is expected to flourish in the coming years, offering ample opportunities for industry participants and stakeholders.

What is Food Colorants?

Food colorants are substances used to enhance the color of food and beverages, making them more visually appealing. They can be derived from natural sources or synthesized chemically and are widely used in various food products, including candies, beverages, and baked goods.

What are the key players in the Canada Food Colorants Market?

Key players in the Canada Food Colorants Market include companies like Givaudan, Sensient Technologies, and D.D. Williamson, which are known for their innovative color solutions and extensive product portfolios, among others.

What are the growth factors driving the Canada Food Colorants Market?

The growth of the Canada Food Colorants Market is driven by increasing consumer demand for visually appealing food products, the rise in the popularity of natural colorants, and the expansion of the food and beverage industry.

What challenges does the Canada Food Colorants Market face?

The Canada Food Colorants Market faces challenges such as regulatory scrutiny regarding the safety of synthetic colorants, consumer preference shifting towards natural ingredients, and potential supply chain disruptions affecting raw material availability.

What opportunities exist in the Canada Food Colorants Market?

Opportunities in the Canada Food Colorants Market include the growing trend of clean label products, increasing demand for organic and natural colorants, and innovations in color technology that enhance product stability and performance.

What trends are shaping the Canada Food Colorants Market?

Trends shaping the Canada Food Colorants Market include a shift towards plant-based colorants, the use of colorants in functional foods, and the increasing incorporation of colorants in health-oriented products to attract health-conscious consumers.

Canada Food Colorants Market

| Segmentation Details | Description |

|---|---|

| Product Type | Natural Colorants, Synthetic Colorants, Organic Colorants, Inorganic Colorants |

| Application | Beverages, Bakery Products, Dairy Products, Confectionery |

| End User | Food Manufacturers, Beverage Producers, Retailers, Restaurants |

| Form | Liquid, Powder, Gel, Granular |

Leading Companies: Canada Food Colorants Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at