444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview

Brazil’s retail banking market has undergone significant growth and transformation in recent years. Retail banking refers to the provision of financial services, such as deposits, loans, and payment services, to individual customers rather than corporations or institutional clients. It plays a crucial role in driving economic growth and financial inclusion in Brazil. The market is highly competitive, with numerous domestic and international players vying for a larger share of the market.

Meaning

Retail banking is an essential component of the overall banking sector, focusing on serving individual customers and their financial needs. It involves offering a wide range of banking products and services tailored to the requirements of retail consumers. This can include basic services like savings accounts, personal loans, mortgages, credit cards, and investment options.

Executive Summary

The retail banking market in Brazil has experienced steady growth over the past decade, driven by factors such as increasing disposable income, rising financial literacy, and the government’s efforts to promote financial inclusion. The market has become more competitive, with both traditional banks and digital banking players striving to attract and retain customers. This report provides insights into the key trends, drivers, restraints, and opportunities shaping the retail banking market in Brazil.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The retail banking market in Brazil is characterized by intense competition, evolving consumer preferences, and rapid technological advancements. Traditional banks face the challenge of adapting to the changing landscape and competing with agile and customer-centric fintech players. Consumer expectations for seamless digital experiences, personalized services, and competitive interest rates continue to shape the dynamics of the market.

Regional Analysis

The retail banking market in Brazil exhibits regional variations in terms of market penetration and consumer preferences. Major metropolitan areas, such as São Paulo and Rio de Janeiro, are key hubs for banking activities, with a higher concentration of branches and digital banking users. However, there is also significant potential for market growth in emerging regions, where financial inclusion initiatives are being prioritized.

Competitive Landscape

Leading Companies in the Brazil Retail Banking Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

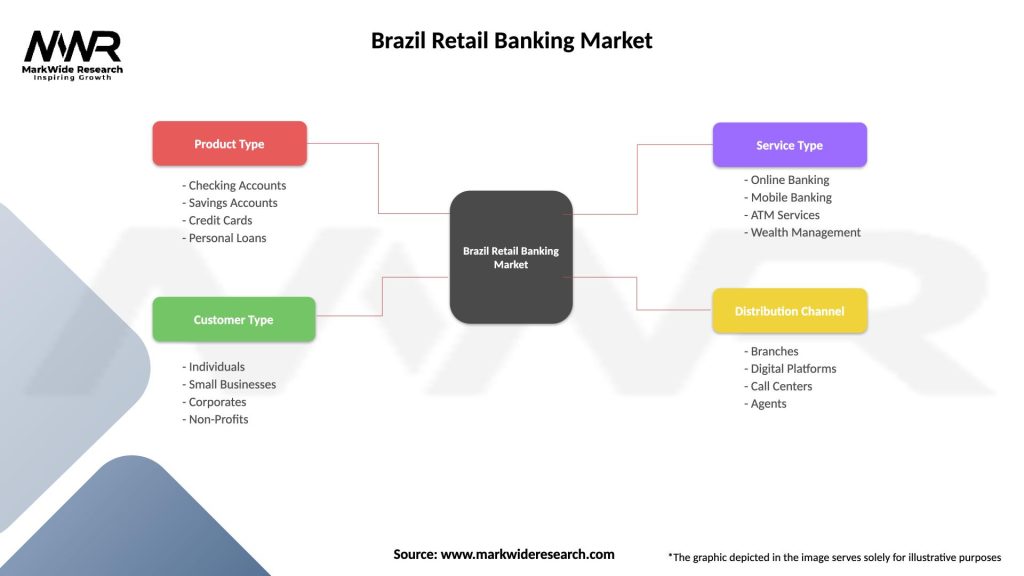

Segmentation

The retail banking market in Brazil can be segmented based on product offerings, customer demographics, and distribution channels. Product-wise segmentation includes deposits, loans, credit cards, insurance, and investment services. Demographic segmentation focuses on different customer segments such as individuals, small and medium enterprises (SMEs), and high-net-worth individuals (HNWIs). Distribution channels encompass brick-and-mortar branches, online banking, mobile apps, and ATMs.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic has significantly impacted Brazil’s retail banking market. The economic slowdown, job losses, and reduced consumer spending have affected credit demand and loan quality. Banks have faced challenges in managing credit risk and implementing relief measures for borrowers. However, the pandemic has also accelerated the adoption of digital banking, as customers sought contactless banking solutions and remote access to financial services.

Key Industry Developments

Analyst Suggestions

Future Outlook

The future of Brazil’s retail banking market appears promising, driven by digitalization, expanding customer base, and increasing financial awareness. Banks that successfully adapt to the changing landscape and embrace technological advancements are likely to gain a competitive edge. Continued efforts towards financial inclusion, regulatory reforms, and sustainability practices will shape the future of the market.

Conclusion

Brazil’s retail banking market is witnessing significant growth and transformation, driven by factors such as increasing disposable income, technological advancements, and changing customer preferences. The market presents numerous opportunities for industry participants to expand their customer base, enhance customer experience, and drive revenue growth. However, challenges such as economic volatility, regulatory compliance, and cybersecurity risks need to be addressed. By embracing digital transformation, focusing on financial education, and leveraging partnerships with fintech startups, banks can position themselves for future success in Brazil’s dynamic retail banking market.

What is Brazil Retail Banking?

Brazil Retail Banking refers to the services provided by banks to individual consumers, including savings accounts, personal loans, credit cards, and mortgages. It encompasses a wide range of financial products tailored to meet the needs of the general public.

What are the key players in the Brazil Retail Banking Market?

Key players in the Brazil Retail Banking Market include Banco do Brasil, Itaú Unibanco, Bradesco, and Santander Brasil. These institutions dominate the sector by offering a variety of financial services and products to consumers, among others.

What are the growth factors driving the Brazil Retail Banking Market?

The Brazil Retail Banking Market is driven by factors such as increasing digital banking adoption, a growing middle class, and rising consumer demand for credit products. Additionally, advancements in technology are enhancing customer experience and accessibility.

What challenges does the Brazil Retail Banking Market face?

The Brazil Retail Banking Market faces challenges such as regulatory compliance, high competition among banks, and economic fluctuations that can impact consumer spending. These factors can create uncertainty for financial institutions operating in the market.

What opportunities exist in the Brazil Retail Banking Market?

Opportunities in the Brazil Retail Banking Market include the expansion of fintech solutions, increased focus on sustainable banking practices, and the potential for financial inclusion of underserved populations. These trends can lead to innovative service offerings and new customer segments.

What trends are shaping the Brazil Retail Banking Market?

Trends shaping the Brazil Retail Banking Market include the rise of mobile banking, the integration of artificial intelligence in customer service, and the growing importance of cybersecurity. These innovations are transforming how banks interact with customers and manage their operations.

Brazil Retail Banking Market

| Segmentation Details | Description |

|---|---|

| Product Type | Checking Accounts, Savings Accounts, Credit Cards, Personal Loans |

| Customer Type | Individuals, Small Businesses, Corporates, Non-Profits |

| Service Type | Online Banking, Mobile Banking, ATM Services, Wealth Management |

| Distribution Channel | Branches, Digital Platforms, Call Centers, Agents |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Brazil Retail Banking Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at