444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The biopharmaceutical bioseparation systems market plays a vital role in the biopharmaceutical industry by facilitating the separation and purification of complex biological molecules. These systems are crucial for the production of high-quality biopharmaceutical products and ensure the removal of impurities and contaminants, thereby ensuring the safety and efficacy of the final drug products. The market for biopharmaceutical bioseparation systems is witnessing significant growth due to the increasing demand for biopharmaceuticals, advancements in technology, and the need for efficient purification processes.

Meaning

Biopharmaceutical bioseparation systems refer to a range of technologies, processes, and equipment used to separate and purify biological molecules, such as proteins, peptides, and antibodies, in the production of biopharmaceuticals. These systems utilize various techniques, including chromatography, filtration, centrifugation, and membrane separation, to isolate and purify the target biomolecules from complex mixtures. The goal of bioseparation is to obtain highly pure and potent biopharmaceutical products that meet the strict quality standards and regulatory requirements of the industry.

Executive Summary

The biopharmaceutical bioseparation systems market is experiencing robust growth due to the rising demand for biopharmaceutical drugs and the need for efficient purification processes. The market is driven by technological advancements, increasing investments in research and development, and the expanding biopharmaceutical industry. However, challenges such as high costs associated with bioseparation systems and the complexity of separating and purifying biomolecules pose significant restraints. Despite these challenges, the market offers substantial opportunities for players to capitalize on emerging markets, advancements in separation technologies, and the growing demand for personalized medicine.

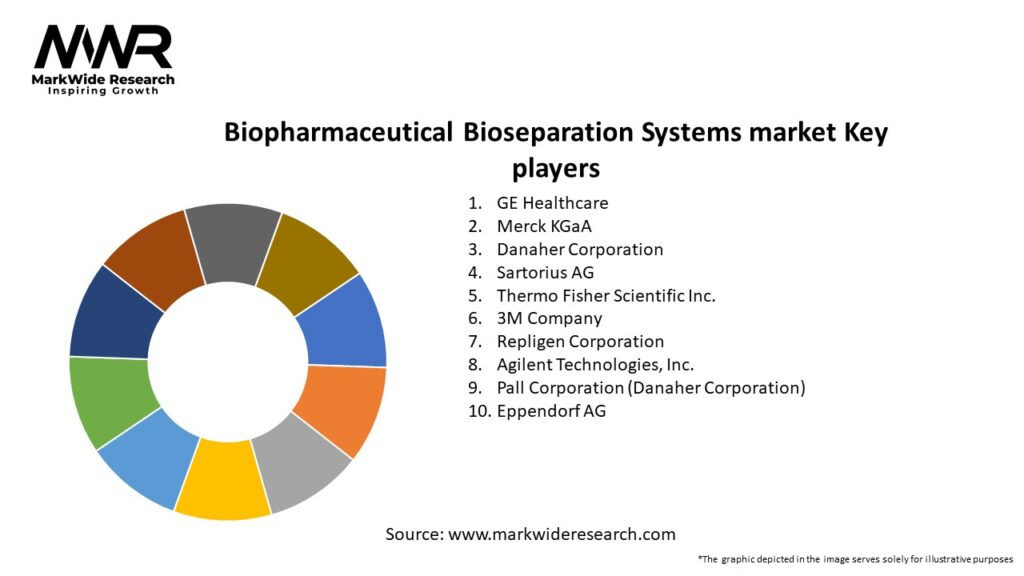

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The biopharmaceutical bioseparation systems market is driven by a combination of factors, including the increasing demand for biopharmaceutical drugs, advancements in separation technologies, and growing investments in R&D. However, the market faces challenges such as high costs, complexity in separating and purifying biomolecules, stringent regulatory requirements, and a shortage of skilled professionals. Despite these challenges, there are significant opportunities in emerging markets, the adoption of single-use and continuous manufacturing technologies, collaboration and partnerships, and the focus on green and sustainable solutions.

The market is witnessing a steady growth rate due to the rising demand for biopharmaceutical drugs, which are favored over traditional pharmaceuticals for their targeted and personalized approach. The advancements in separation technologies have greatly improved the efficiency and productivity of bioseparation processes, leading to higher purity and yield of biopharmaceutical products. Furthermore, increasing investments in research and development have paved the way for innovative bioseparation technologies that can overcome the complexities of separating and purifying biomolecules.

Regional Analysis

The biopharmaceutical bioseparation systems market can be analyzed based on regional segmentation, which provides insights into the market dynamics and opportunities across different geographic regions. The regional analysis helps in understanding the market trends, regulatory landscape, and competitive scenario specific to each region. Here is an overview of the regional analysis for the biopharmaceutical bioseparation systems market:

North America: North America holds a significant share in the biopharmaceutical bioseparation systems market due to the presence of a well-established biopharmaceutical industry and a favorable regulatory environment. The United States, in particular, dominates the market in this region, driven by the high demand for biopharmaceutical drugs, technological advancements, and strong R&D activities. The region also witnesses collaborations between biopharmaceutical companies and research institutions, fostering innovation and market growth.

Europe: Europe is another prominent region in the biopharmaceutical bioseparation systems market. Countries such as Germany, France, and the United Kingdom are major contributors to the market growth in this region. Europe has a robust healthcare infrastructure and a strong focus on research and development. The presence of well-established pharmaceutical and biopharmaceutical companies, coupled with favorable government initiatives, drives the market in Europe.

Asia Pacific: The Asia Pacific region is witnessing rapid growth in the biopharmaceutical bioseparation systems market. Countries like China, Japan, and India are the key contributors to market growth in this region. Factors such as a large patient population, increasing healthcare expenditure, and favorable government policies drive the demand for biopharmaceutical drugs and bioseparation systems. The region also benefits from low manufacturing costs, attracting investments from global players.

Latin America: Latin America is emerging as a significant market for biopharmaceutical bioseparation systems. Countries like Brazil, Mexico, and Argentina are witnessing rapid growth in the biopharmaceutical industry, driven by increasing healthcare expenditure and favorable government initiatives. The region offers opportunities for market players to expand their presence and cater to the growing demand for biopharmaceutical drugs and efficient bioseparation systems.

Middle East and Africa: The Middle East and Africa region show potential for market growth in the biopharmaceutical bioseparation systems market. Countries like Saudi Arabia, United Arab Emirates, and South Africa are witnessing increasing investments in the healthcare sector and the development of advanced healthcare infrastructure. The region offers opportunities for market players to establish partnerships and collaborations with local biopharmaceutical companies to meet the growing demand for biopharmaceutical drugs.

The regional analysis highlights the diverse market landscape and opportunities for market players in different regions. Understanding the regional dynamics and tailoring strategies to specific regions can help companies capitalize on the growth potential in each market.

Competitive Landscape

Leading Companies in the Biopharmaceutical Bioseparation Systems Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

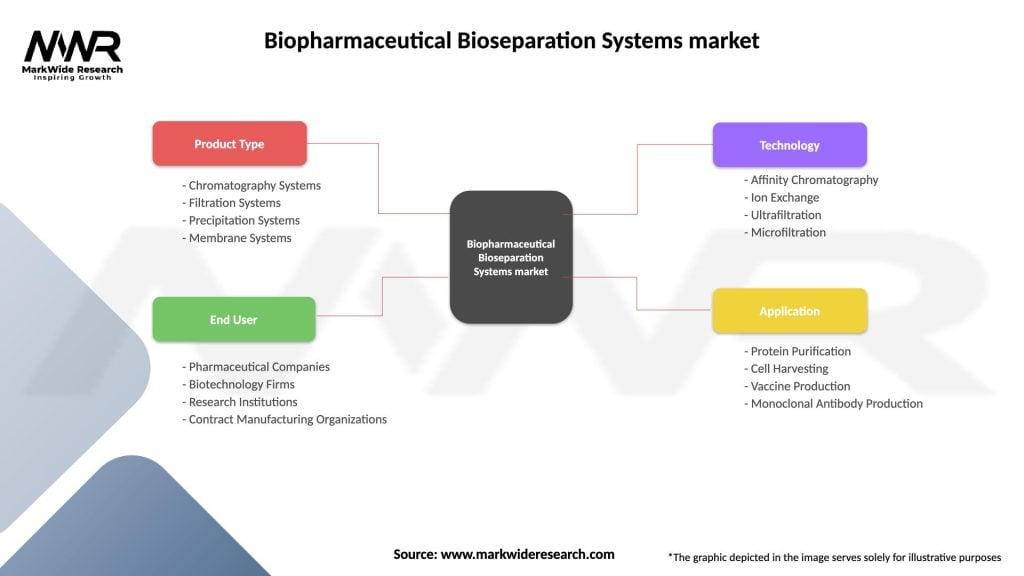

Segmentation

The biopharmaceutical bioseparation systems market can be segmented based on various factors, including product type, technology, end-user, and application. Segmentation helps in understanding the specific market segments and their growth potential. Here are the key segments in the biopharmaceutical bioseparation systems market:

Segmentation allows market players to target specific customer segments, understand their unique needs, and develop tailored marketing strategies and product offerings. It also helps in analyzing the market dynamics and growth potential of each segment.

Category-wise Insights

The biopharmaceutical bioseparation systems market can be further analyzed based on different categories to gain insights into specific aspects of the market. Here are some category-wise insights:

1. Biopharmaceuticals vs. Traditional Pharmaceuticals: The demand for biopharmaceutical drugs is increasing due to their targeted and personalized approach. Bioseparation systems play a crucial role in ensuring the purity and efficacy of these drugs, driving the demand for bioseparation systems. Traditional pharmaceuticals also require bioseparation systems, but the growth is relatively slower compared to biopharmaceuticals.

2. Single-Use vs. Reusable Systems: The adoption of single-use bioseparation systems is gaining traction due to their advantages in terms of cost-effectiveness, process flexibility, and reduced cross-contamination risks. Single-use systems are particularly beneficial for small-scale manufacturers and contract research organizations. However, reusable systems still have a significant market share, especially in large-scale manufacturing facilities.

3. Upstream vs. Downstream Processing: Bioseparation systems are used in both upstream and downstream processing stages of biopharmaceutical production. Upstream processing involves cell culture, fermentation, and harvesting, where bioseparation systems are used to separate cells and biomass from the culture medium. Downstream processing focuses on the purification and isolation of the target biomolecules using bioseparation systems such as chromatography, filtration, and centrifugation.

4. Chromatography Dominance: Chromatography systems, including affinity chromatography, ion exchange chromatography, and size exclusion chromatography, are widely used in the biopharmaceutical industry for the separation and purification of biomolecules. Chromatography dominates the bioseparation systems market due to its versatility, efficiency, and ability to achieve high levels of purity. The demand for chromatography systems is driven by the increasing production of monoclonal antibodies, vaccines, and other biopharmaceutical products.

Key Benefits for Industry Participants and Stakeholders

The biopharmaceutical bioseparation systems market offers several key benefits for industry participants and stakeholders. These benefits contribute to the growth and success of the market. Here are some key benefits:

The benefits mentioned above highlight the value proposition of bioseparation systems for industry participants, including biopharmaceutical manufacturers, suppliers, service providers, and patients. These benefits drive the adoption and growth of bioseparation systems in the biopharmaceutical industry.

SWOT Analysis

A SWOT analysis provides a comprehensive evaluation of the strengths, weaknesses, opportunities, and threats in the biopharmaceutical bioseparation systems market. Understanding these factors helps industry participants and stakeholders formulate effective strategies and make informed decisions. Here is a SWOT analysis for the market:

Strengths:

Weaknesses:

Opportunities:

Threats:

The SWOT analysis provides valuable insights into the internal and external factors influencing the biopharmaceutical bioseparation systems market. Leveraging strengths, addressing weaknesses, capitalizing on opportunities, and mitigating threats are essential for market players to succeed and thrive in this dynamic industry.

Market Key Trends

The biopharmaceutical bioseparation systems market is characterized by several key trends that shape its growth and development. These trends reflect the evolving needs and dynamics of the biopharmaceutical industry. Here are some key trends in the market:

These key trends in the biopharmaceutical bioseparation systems market reflect the industry’s evolving landscape and the ongoing efforts to enhance process efficiency, sustainability, and product quality. Manufacturers and suppliers that adapt to these trends and offer innovative solutions will be well-positioned to capitalize on the market opportunities.

Covid-19 Impact

The COVID-19 pandemic has had a significant impact on the biopharmaceutical bioseparation systems market. The pandemic created both challenges and opportunities for the market players. Here are some key aspects of the COVID-19 impact:

While the pandemic posed challenges to the biopharmaceutical bioseparation systems market, it also created opportunities for innovation, collaboration, and accelerated development. The market responded by adapting to the changing demands and requirements, and manufacturers played a crucial role in ensuring the supply of biopharmaceutical products to combat the pandemic.

Key Industry Developments

The biopharmaceutical bioseparation systems market has witnessed several key industry developments in recent years. These developments include technological advancements, strategic collaborations, product launches, and acquisitions. Here are some notable industry developments:

These key industry developments demonstrate the dynamic nature of the biopharmaceutical bioseparation systems market, with companies striving to innovate, collaborate, and expand their market presence. The developments focus on improving process efficiency, enhancing product quality, and meeting the evolving needs of the biopharmaceutical industry.

Analyst Suggestions

Based on the analysis of the biopharmaceutical bioseparation systems market, here are some suggestions for industry participants, stakeholders, and market players:

By following these suggestions, industry participants and market players can position themselves strategically, capitalize on market opportunities, and drive growth in the biopharmaceutical bioseparation systems market.

Future Outlook

The future outlook for the biopharmaceutical bioseparation systems market is promising, driven by factors such as the increasing demand for biopharmaceutical drugs, technological advancements, and the focus on personalized medicine. Here are some key aspects of the future outlook:

Overall, the future outlook for the biopharmaceutical bioseparation systems market is optimistic, with substantial growth opportunities driven by the expanding biopharmaceutical industry, technological advancements, and the focus on personalized medicine and sustainability. Market players that adapt to these trends and invest in innovation will be well-positioned to thrive in the evolving landscape of the biopharmaceutical bioseparation systems market.

Conclusion

The biopharmaceutical bioseparation systems market plays a crucial role in the production of high-quality biopharmaceutical drugs by facilitating the separation and purification of complex biological molecules. The market is driven by the increasing demand for biopharmaceutical drugs, advancements in separation technologies, and growing investments in research and development. However, challenges such as high costs, complexity in separating and purifying biomolecules, and stringent regulatory requirements exist.

In conclusion, the biopharmaceutical bioseparation systems market plays a critical role in ensuring the purity and quality of biopharmaceutical drugs. Despite challenges, the market is poised for growth driven by increasing demand, advancements in technologies, and the focus on sustainability and personalized medicine. With strategic approaches and investments in innovation, market players can position themselves for success in this dynamic and evolving market.

What is Biopharmaceutical Bioseparation Systems?

Biopharmaceutical bioseparation systems refer to the technologies and processes used to separate and purify biological products, such as proteins, antibodies, and vaccines, from complex mixtures. These systems are essential in the biopharmaceutical industry for ensuring product quality and efficacy.

What are the key players in the Biopharmaceutical Bioseparation Systems market?

Key players in the biopharmaceutical bioseparation systems market include companies like Merck KGaA, GE Healthcare, and Thermo Fisher Scientific. These companies are known for their innovative technologies and solutions that enhance the efficiency of bioseparation processes, among others.

What are the main drivers of the Biopharmaceutical Bioseparation Systems market?

The main drivers of the biopharmaceutical bioseparation systems market include the increasing demand for biopharmaceuticals, advancements in separation technologies, and the growing focus on personalized medicine. These factors contribute to the expansion and innovation within the industry.

What challenges does the Biopharmaceutical Bioseparation Systems market face?

The biopharmaceutical bioseparation systems market faces challenges such as high operational costs, the complexity of separation processes, and regulatory compliance issues. These challenges can hinder the efficiency and scalability of bioseparation technologies.

What opportunities exist in the Biopharmaceutical Bioseparation Systems market?

Opportunities in the biopharmaceutical bioseparation systems market include the development of novel separation techniques, the rise of biosimilars, and the increasing investment in biopharmaceutical research. These trends are expected to drive growth and innovation in the sector.

What trends are shaping the Biopharmaceutical Bioseparation Systems market?

Trends shaping the biopharmaceutical bioseparation systems market include the integration of automation and digital technologies, the shift towards continuous processing, and the emphasis on sustainability in bioprocessing. These trends are influencing how bioseparation systems are designed and implemented.

Biopharmaceutical Bioseparation Systems market

| Segmentation Details | Description |

|---|---|

| Product Type | Chromatography Systems, Filtration Systems, Precipitation Systems, Membrane Systems |

| End User | Pharmaceutical Companies, Biotechnology Firms, Research Institutions, Contract Manufacturing Organizations |

| Technology | Affinity Chromatography, Ion Exchange, Ultrafiltration, Microfiltration |

| Application | Protein Purification, Cell Harvesting, Vaccine Production, Monoclonal Antibody Production |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Biopharmaceutical Bioseparation Systems Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at