444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The B2B Mobility Sharing market is a rapidly growing sector that caters to the needs of businesses seeking efficient transportation solutions. This market revolves around the concept of sharing vehicles or mobility services among companies, providing a cost-effective and convenient alternative to traditional methods of transportation. B2B mobility sharing encompasses various modes of transport, including cars, bikes, scooters, and even electric vehicles.

Meaning

B2B mobility sharing refers to the practice of businesses sharing vehicles or mobility services to meet their transportation needs. It involves the use of technology platforms and applications that allow companies to access a fleet of vehicles on-demand, eliminating the need for individual ownership or long-term leases. This model enables businesses to optimize their transportation resources, reduce costs, and enhance operational efficiency.

Executive Summary

The B2B Mobility Sharing market is experiencing significant growth, driven by the increasing demand for flexible and cost-efficient transportation solutions among businesses. The adoption of digital platforms and the rise of the sharing economy have paved the way for the expansion of this market. Key players in the industry are leveraging advanced technologies, such as GPS tracking, mobile applications, and real-time analytics, to provide seamless and convenient mobility services to businesses.

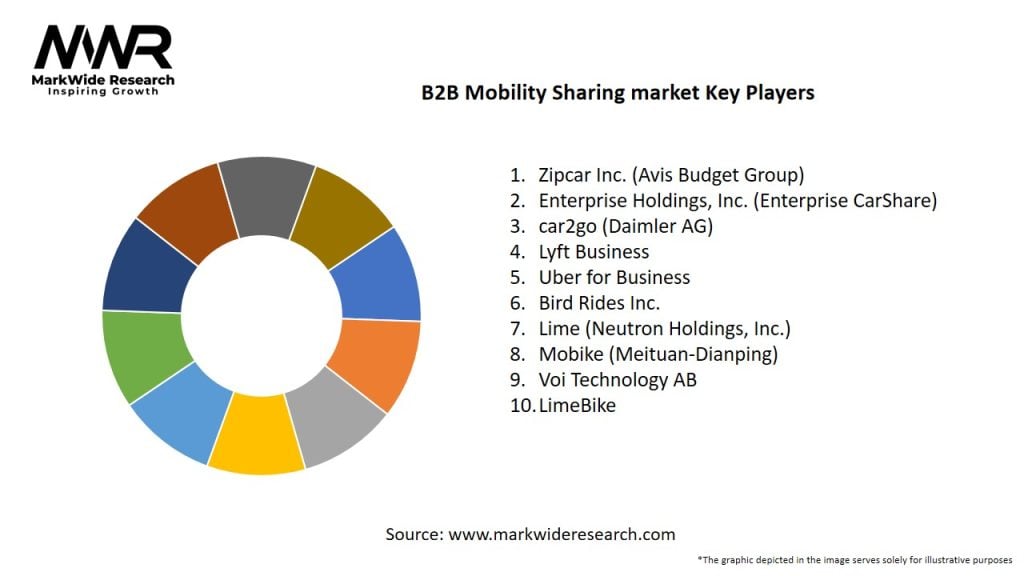

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Cost Savings: Organizations report up to 30% reduction in fleet costs—including depreciation, maintenance, and insurance—by shifting to shared models for low-utilization vehicles.

Utilization Optimization: B2B sharing platforms typically achieve vehicle utilization rates of 50–60%, compared to 15–25% in traditional corporate fleets.

Employee Adoption: Over 70% of employees offered shared mobility options rate them as favorable replacements for individual vehicle allowances.

Sustainability Impact: Companies leveraging shared electric vehicle (EV) fleets can reduce Scope 1 emissions by up to 40%.

Digital Integration: Seamless connection with single sign-on (SSO), expense management, and dashboard reporting is cited as the top priority by 85% of enterprise buyers.

Market Drivers

Cost-Control Mandates: Tightening corporate budgets and the need to optimize asset utilization push businesses toward variable-cost sharing models.

Sustainability Goals: Net-zero pledges and ESG reporting requirements drive adoption of shared electric and hybrid fleets over internal combustion engine (ICE) vehicles.

Employee Experience: Flexible mobility programs—enabling multimodal options for commuting, client visits, and deliveries—enhance workforce satisfaction and retention.

Digital Transformation: Advances in cloud-based fleet management, real-time telematics, and mobile apps simplify operations and data analytics.

Urban Congestion Policies: Low-emission zones and city regulations on corporate parking motivate companies to adopt shared mobility to avoid fines and permit costs.

Market Restraints

Regulatory Complexity: Varying local regulations for commercial vehicle-sharing, parking permits, and micro-mobility can slow rollout.

Integration Challenges: Aligning new sharing platforms with legacy fleet-management and accounting systems can require significant IT investment.

Change Management: Shifting employee mindsets from assigned vehicles to shared usage demands robust communication and incentives.

Data Security Concerns: Handling user identity, trip data, and billing information raises privacy and cybersecurity considerations.

Vehicle Availability: High-demand periods and insufficient fleet sizing can lead to access gaps, undermining user confidence.

Market Opportunities

Electric & Micromobility Expansion: Offering shared e-bikes and e-scooters alongside vehicles to support “last-mile” commuting and campus mobility.

Dynamic Pricing Models: Utilizing AI to adjust rates based on demand, duration, and distance to optimize utilization and profitability.

White-Label Solutions: Providing OEMs and large corporations with branded sharing platforms to maintain customer engagement and data ownership.

Integration with MaaS: Embedding B2B sharing offerings within Mobility-as-a-Service (MaaS) suites that combine public transport, ridesharing, and corporate mobility budgets.

Autonomous Vehicle Pilots: Partnering with AV providers to pilot self-driving shared shuttles for corporate campuses and logistics yards.

Market Dynamics

Consolidation & Partnerships: M&A among sharing-platform vendors, telematics providers, and rental-car companies is creating integrated B2B solutions.

Platform Interoperability: Demand for open APIs and standardized data exchange is driving collaboration across software ecosystems.

SLA-driven Contracts: Enterprises increasingly require service-level agreements (SLAs) covering vehicle uptime, maintenance turnaround, and user support responsiveness.

Corporate Policy Evolution: HR and procurement teams are redefining mobility policies to incorporate shared assets and flexible allowances.

Analytics & Benchmarking: Benchmarking tools that compare utilization, cost-per-kilometer, and emissions across business units inform mobility strategy.

Regional Analysis

North America: Mature market with leading providers (e.g., ShareNow for fleets, Zipcar for business) and strong corporate sustainability mandates.

Europe: High adoption driven by urban low-emission zones, commuter incentives, and integrated bike-sharing/public-transit ecosystems.

Asia-Pacific: Rapid growth in China, Japan, and Southeast Asia as enterprises digitalize and environmental regulations tighten in major cities.

Latin America: Emerging interest among multinational firms and government agencies; pilot projects for university and healthcare-campus mobility.

Middle East & Africa: Niche deployment in free zones and smart-city districts; opportunities for on-demand shuttle services in large campuses and industrial parks.

Competitive Landscape

Leading Companies in the B2B Mobility Sharing Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

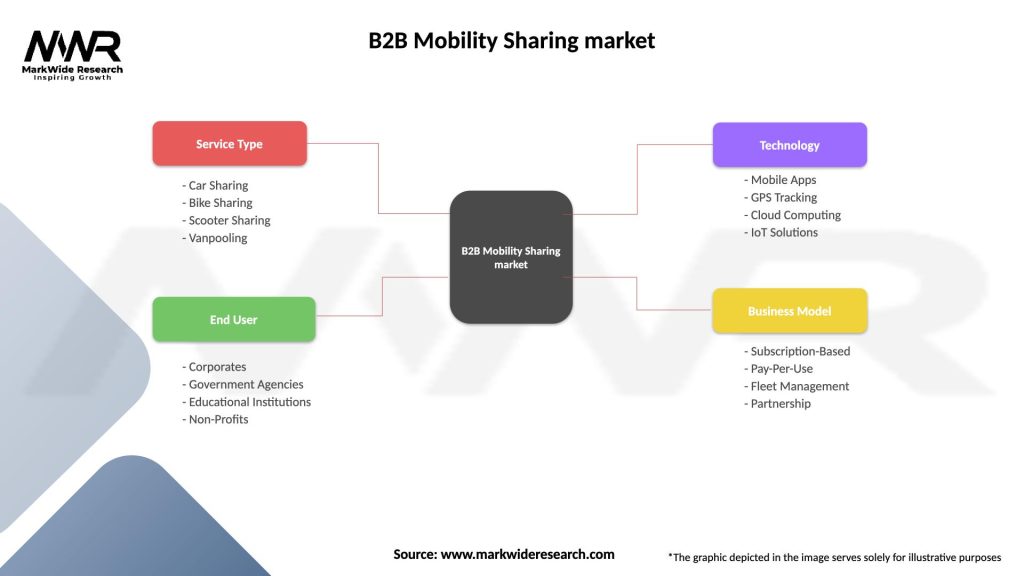

Segmentation

By Vehicle Type: Passenger Cars, Vans & Light Commercial Vehicles, E-Bikes/E-Scooters, Shuttles/Coaches

By Deployment Model: Dedicated Corporate Fleet Sharing, On-Demand Operator-Managed Sharing, White-Label Enterprise Platforms

By Component: Vehicle Hardware & Telematics, Sharing & Booking Software, Maintenance & Service Contracts, Analytics & Reporting

By End-User Vertical: Corporate Commuter Programs, Field-Service & Utilities, Logistics & Last-Mile Delivery, Hospitality & Campus Mobility

Category-wise Insights

Corporate Commuter Programs: Provide flexible daily commute options through pooled vehicles or e-bike fleets; reduce parking needs.

Field-Service Sharing: Enables technicians to reserve vans or trucks on demand, cutting idle time and optimizing routing.

Logistics Sharing: Shared-use cargo vans and box trucks for parcel deliveries and inventory replenishment, avoiding underused owned fleets.

Hospitality & Campus: On-demand shuttles and golf-cart–style vehicles improve guest and student mobility within large sites.

Key Benefits for Industry Participants and Stakeholders

Reduced Capital Expenditure: Eliminates need for vehicle ownership and depreciation, converting fixed costs into variable expenses.

Simplified Operations: Outsourced fleet maintenance, insurance, and billing streamline administrative burdens on procurement and finance teams.

Increased Fleet Utilization: Centralized booking and analytics ensure vehicles are in use rather than idle, maximizing ROI per asset.

Enhanced Sustainability Reporting: Shared mobility lowers fleet emissions per trip and aligns with corporate environmental targets.

Improved Employee Satisfaction: On-demand, flexible transportation enhances workplace productivity and reduces commute stress.

SWOT Analysis

Strengths:

Clear ROI through cost savings and utilization improvements.

Scalable solutions across multiple geographies and fleet types.

Proprietary software differentiates providers on user experience and analytics.

Weaknesses:

Dependence on reliable digital infrastructure and device connectivity.

Potential resistance from stakeholders accustomed to private vehicle allowances.

Complexity of managing multi-modal fleets and variable pricing models.

Opportunities:

Integration with emerging Mobility-as-a-Service (MaaS) ecosystems.

Expansion into autonomous shared-vehicle fleets as technology matures.

Partnerships with public transit agencies for seamless first/last-mile solutions.

Threats:

Regulatory changes on corporate mobility allowances and taxation.

Entrants from large OEMs bundling OEM telematics with proprietary sharing platforms.

Shifts in travel patterns (e.g., remote work trends) potentially reducing overall mobility demand.

Market Key Trends

Subscription + Sharing Hybrids: Bundling unlimited shared-vehicle access with digital services for flat monthly fees.

Predictive Maintenance Integration: Telematics-driven alerts optimize vehicle uptime and reduce unplanned downtime.

Blockchain for Access Control: Secure, decentralized identity and booking records to manage multi-tenant fleets.

Dynamic Fleet Allocation: AI platforms reallocate vehicles across sites based on real-time usage patterns and forecasts.

Sustainable Fleet Mix: Increasing proportion of shared electric vehicles and micromobility solutions to meet ESG goals.

Covid-19 Impact

The pandemic catalyzed the shift away from shared mass transit, prompting organizations to adopt private but shared fleets to ensure employee safety. Contactless booking, sanitization protocols, and flexible reservation policies became standard. While overall mobility demand dipped, B2B sharing proved more resilient than B2C carsharing, as corporate needs for field services and logistics persisted. Post-pandemic recovery has seen accelerated adoption of digital platforms and shared electric fleets, driven by renewed focus on cost efficiency and environmental sustainability.

Key Industry Developments

Fleet Complete–Microsoft Partnership (2023): Integrated Microsoft Azure IoT analytics for real-time fleet optimization and sharing insights.

Enterprise Mobility’s EV Expansion (2022): Deployed 1,000 electric vehicles in its corporate car-sharing fleet across North America to support client decarbonization goals.

Moovex Autonomous Shuttle Pilot (2024): Launched a closed-campus trial of self-driving electric shuttles for a European logistics hub.

Dott ‘Campus Mobility as a Service’ (2021): Introduced turnkey e-scooter and e-bike fleets for university campuses with integrated student-ID authentication.

Analyst Suggestions

Standardize APIs: Work with industry consortia to define open booking and data-exchange interfaces for seamless multi-provider interoperability.

Enhance User Onboarding: Develop streamlined identity-verification and training modules to reduce friction and accelerate employee adoption.

Expand Service Ecosystems: Bundle mobility sharing with ride-hailing, micromobility, and public transit passes to offer comprehensive packages.

Implement Dynamic Pricing: Use real-time data to adjust rates dynamically—reward off-peak use and manage demand surges effectively.

Focus on Change Management: Provide corporate clients with communication toolkits and usage dashboards to drive policy adoption and behavioral change.

Future Outlook

The future outlook for the B2B Mobility Sharing market is highly optimistic. The market is expected to witness substantial growth, driven by factors such as the increasing demand for cost-effective transportation solutions, the rise of the sharing economy, and advancements in technology. The integration of electric and autonomous vehicles, coupled with the development of smart city infrastructure, will further fuel market expansion. However, market players need to be proactive in addressing regulatory challenges, ensuring data security, and continuously innovating to stay competitive in this evolving landscape.

Conclusion

The B2B Mobility Sharing market offers businesses a flexible and cost-efficient transportation solution that aligns with the changing needs of the modern workforce. With advancements in technology and the growing emphasis on sustainability, shared mobility services are becoming increasingly popular among companies seeking to optimize their transportation resources. While the market presents significant opportunities, industry participants must navigate regulatory complexities, address data security concerns, and adapt to evolving customer preferences. By embracing innovation and collaboration, companies can thrive in this dynamic market and contribute to the future of efficient and sustainable business mobility.

What is B2B Mobility Sharing?

B2B Mobility Sharing refers to the practice of businesses sharing transportation resources, such as vehicles or mobility services, to optimize costs and improve efficiency. This model is increasingly adopted in urban logistics, employee transportation, and fleet management.

What are the key players in the B2B Mobility Sharing market?

Key players in the B2B Mobility Sharing market include companies like Zipcar, Getaround, and Turo, which provide platforms for vehicle sharing among businesses. Additionally, larger automotive manufacturers are entering this space to offer integrated mobility solutions, among others.

What are the main drivers of growth in the B2B Mobility Sharing market?

The main drivers of growth in the B2B Mobility Sharing market include the rising need for cost-effective transportation solutions, increased urbanization leading to congestion, and a growing emphasis on sustainability and reducing carbon footprints.

What challenges does the B2B Mobility Sharing market face?

Challenges in the B2B Mobility Sharing market include regulatory hurdles, the need for robust technology infrastructure, and competition from traditional transportation services. Additionally, ensuring user trust and safety remains a significant concern.

What opportunities exist in the B2B Mobility Sharing market?

Opportunities in the B2B Mobility Sharing market include the potential for partnerships with tech companies to enhance service offerings, the expansion of electric vehicle sharing, and the integration of mobility-as-a-service (MaaS) platforms to streamline operations.

What trends are shaping the B2B Mobility Sharing market?

Trends shaping the B2B Mobility Sharing market include the increasing adoption of electric and autonomous vehicles, the rise of digital platforms for seamless booking and management, and a shift towards more flexible and on-demand mobility solutions.

B2B Mobility Sharing market

| Segmentation Details | Description |

|---|---|

| Service Type | Car Sharing, Bike Sharing, Scooter Sharing, Vanpooling |

| End User | Corporates, Government Agencies, Educational Institutions, Non-Profits |

| Technology | Mobile Apps, GPS Tracking, Cloud Computing, IoT Solutions |

| Business Model | Subscription-Based, Pay-Per-Use, Fleet Management, Partnership |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the B2B Mobility Sharing Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at