444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The market for Autonomous Mobile Robots (AMRs) in logistics and warehousing is experiencing significant growth and is poised for further expansion in the coming years. AMRs are robotic systems designed to operate autonomously in industrial environments, including warehouses and distribution centers. These robots have the ability to navigate through complex spaces, perform various tasks, and collaborate with human workers seamlessly. They are equipped with advanced sensors, mapping technologies, and artificial intelligence algorithms that enable them to efficiently handle material handling, inventory management, and other logistics operations.

Meaning

Autonomous Mobile Robots for logistics and warehousing refer to a specialized category of robots that can operate independently without human intervention. These robots are specifically designed to streamline and optimize logistics and warehousing operations. They can transport goods, pallets, and bins from one location to another, pick and place items accurately, and perform repetitive tasks with precision. AMRs are capable of navigating safely in dynamic and changing environments, adapting to obstacles, and optimizing their routes to ensure efficient operations.

Executive Summary

The market for Autonomous Mobile Robots in logistics and warehousing is witnessing substantial growth due to the increasing need for automation and optimization in the supply chain industry. AMRs offer numerous benefits such as increased productivity, improved accuracy, reduced labor costs, and enhanced workplace safety. These factors, along with advancements in robotic technologies, are driving the adoption of AMRs across various industries.

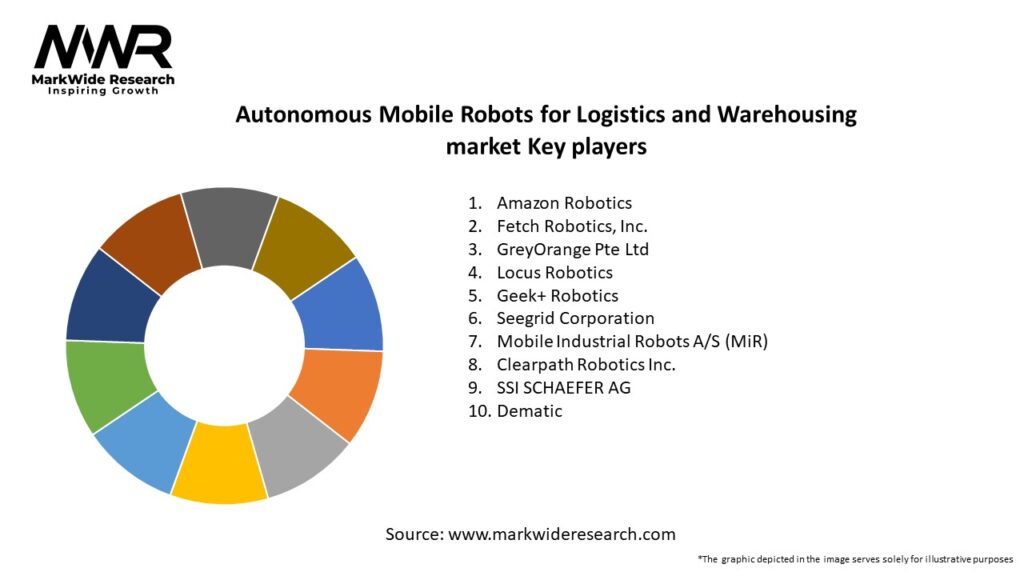

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The market for Autonomous Mobile Robots in logistics and warehousing is driven by a combination of factors, including the need for operational efficiency, technological advancements, industry-specific challenges, and changing market dynamics. These factors shape the demand, adoption, and growth of AMRs in the market.

The increasing need for automation and optimization in logistics and warehousing operations is a primary driver. Organizations strive to improve productivity, reduce errors, and enhance overall efficiency. AMRs offer a viable solution to address these challenges, leading to increased adoption across industries.

Technological advancements play a crucial role in the growth of the market. Improved sensors, advanced navigation systems, and artificial intelligence algorithms have empowered AMRs to operate autonomously, adapt to changing environments, and collaborate with humans effectively. These advancements have expanded the capabilities and applications of AMRs, making them more valuable to businesses.

Regional Analysis

The market for Autonomous Mobile Robots in logistics and warehousing is experiencing significant growth on a global scale. The adoption of AMRs varies across different regions, influenced by factors such as technological advancements, industrialization, labor costs, and regulatory environment.

North America is one of the leading regions in terms of AMR adoption. The region has a mature logistics and warehousing industry, coupled with a strong focus on automation and technological advancements. The presence of major e-commerce players and advanced robotics research and development centers contribute to the growth of the market in this region.

Europe is also witnessing substantial growth in the adoption of AMRs. The region has a well-established logistics network and a strong emphasis on sustainability and efficiency. AMRs offer a viable solution to optimize operations, reduce carbon emissions, and address the labor shortage in certain European countries.

Asia Pacific is an emerging market for AMRs in logistics and warehousing. The region has witnessed significant industrial growth and is home to numerous manufacturing hubs and e-commerce giants. The need to cater to the rising consumer demands, improve supply chain efficiency, and overcome labor challenges has propelled the adoption of AMRs in this region.

Latin America and the Middle East arealso showing potential for AMR adoption in logistics and warehousing. These regions are experiencing economic growth, urbanization, and an increasing focus on technological advancements. The need to improve logistics and warehousing operations to meet the demands of a growing population and expanding industries presents opportunities for AMR implementation.

Competitive Landscape

Leading Companies in the Autonomous Mobile Robots for Logistics and Warehousing Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The market for Autonomous Mobile Robots in logistics and warehousing can be segmented based on various factors, including:

Segmentation allows for a deeper understanding of the market, enabling companies to identify specific target segments, tailor their offerings, and address industry-specific challenges.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

The adoption of Autonomous Mobile Robots in logistics and warehousing offersseveral key benefits for industry participants and stakeholders:

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic has significantly impacted the logistics and warehousing industry and accelerated the adoption of automation, including AMRs. The pandemic led to disruptions in supply chains, increased e-commerce activities, and a heightened emphasis on workplace safety. AMRs emerged as a viable solution to address these challenges.

AMRs have played a crucial role in meeting the increased demand for e-commerce fulfillment during lockdowns and restrictions. These robots enabled contactless operations, reduced human-to-human interactions, and ensured continuity in supply chain operations. AMRs facilitated social distancing protocols, minimized the risk of virus transmission, and helped companies maintain operational efficiency during challenging times.

Furthermore, the pandemic highlighted the importance of resilience and agility in supply chains. AMRs provided a scalable and flexible solution to adapt to changing demands, optimize operations, and overcome labor shortages caused by the pandemic. The ability of AMRs to operate autonomously and efficiently proved beneficial in maintaining essential goods and services and mitigating the impact of disruptions.

As a result of the pandemic, the awareness and acceptance of AMRs as a valuable technology in logistics and warehousing have increased. Companies are now more inclined to invest in automation to enhance operational resilience, reduce reliance on manual labor, and future-proof their operations against similar disruptions.

Key Industry Developments

Analyst Suggestions

Future Outlook

The future outlook for the Autonomous Mobile Robots market in logistics and warehousing is promising. The demand for automation, optimization, and efficiency in supply chain operations is expected to drive the continued growth of AMRs. Advancements in robotics, artificial intelligence, and sensor technologies will further enhance the capabilities of AMRs, making them more intelligent, adaptable, and efficient.

The expansion of e-commerce, globalization of supply chains, and increasing consumer expectations will continue to fuel the adoption of AMRs in the logistics and warehousing sector. Companies will seek innovative solutions to streamline operations, reduce costs, and meet the growing demands of customers.

Collaborative robotics will play a significant role in the future, with AMRs working alongside human workers as collaborative partners. This approach will maximize the strengths of both humans and robots, improving productivity, efficiency, and safety in the workplace.

The customization of AMRs for specific industry requirements will open up new market segments and applications. Industries such as healthcare, pharmaceuticals, and food and beverage will increasingly leverage AMRs to address their unique challenges and optimize their logistics and warehousing operations.

While there may be challenges in terms of initial investments, integration complexities, and potential job displacement concerns, the overall benefits of AMRs in terms of increased productivity, accuracy, and workplace safety will outweigh these challenges.

Conclusion

The market for Autonomous Mobile Robots in logistics and warehousing is witnessing significant growth, driven by the need for operational efficiency, advancements in technology, and increasing e-commerce activities. AMRs offer numerous benefits, including increased productivity, improved accuracy, cost savings, and enhanced workplace safety.

While there are challenges such as initial investment costs and integration complexities, the opportunities for AMRs in terms of customization, collaborative robotics, and integration with emerging technologies are immense. The COVID-19 pandemic has further accelerated the adoption of AMRs, highlighting their value in maintaining supply chain operations during disruptions.

Autonomous Mobile Robots for Logistics and Warehousing market

| Segmentation Details | Description |

|---|---|

| Product Type | Automated Guided Vehicles, Autonomous Forklifts, Mobile Manipulators, Delivery Robots |

| End User | Manufacturing, Retail, E-commerce, Healthcare |

| Technology | LiDAR, Computer Vision, Machine Learning, Sensor Fusion |

| Application | Inventory Management, Order Fulfillment, Material Handling, Last-Mile Delivery |

Leading Companies in the Autonomous Mobile Robots for Logistics and Warehousing Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at