444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The Automotive Start-Stop Battery market is a rapidly growing sector within the automotive industry, driven by the increasing demand for fuel-efficient vehicles and the need to reduce carbon emissions. Start-stop battery systems are designed to automatically shut off the engine when the vehicle comes to a stop, such as at traffic lights or in heavy traffic, and restart it quickly when the driver presses the accelerator. This technology helps improve fuel efficiency by reducing idle time and minimizing unnecessary engine usage.

Meaning

Automotive start-stop batteries are specialized batteries that provide the necessary power to restart the engine quickly and reliably in vehicles equipped with start-stop systems. These batteries are designed to handle the increased demands placed on them due to frequent engine starts and stops. They are typically advanced lead-acid batteries or enhanced flooded batteries (EFBs) that are optimized for high cycling and durability.

Executive Summary

The Automotive Start-Stop Battery market has witnessed significant growth in recent years, driven by stringent emission regulations and the growing consumer preference for fuel-efficient vehicles. The market is characterized by the presence of several established players as well as new entrants, fostering intense competition. The demand for start-stop batteries is expected to further increase as automotive manufacturers strive to meet stringent emission targets and improve overall vehicle efficiency.

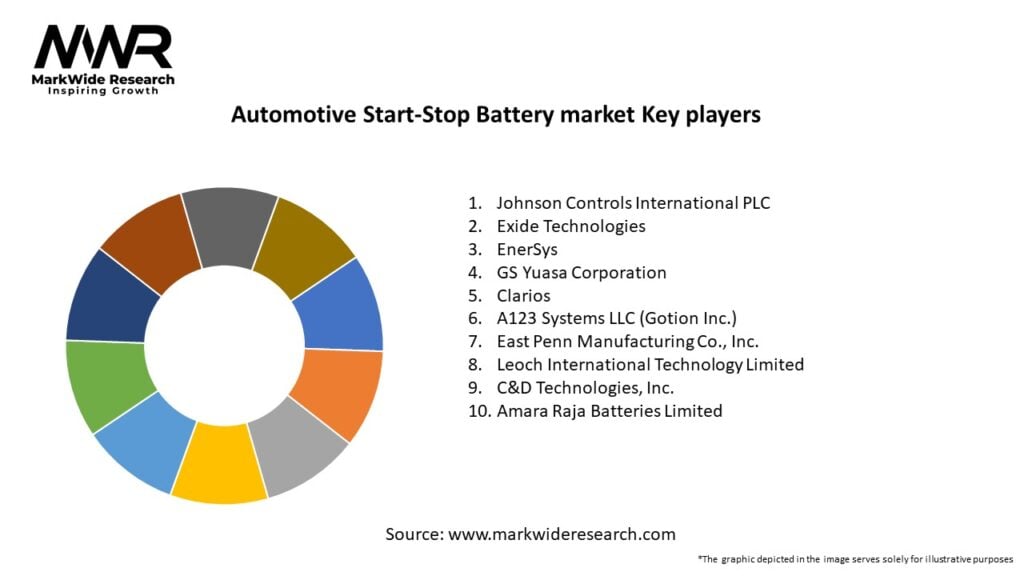

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The Automotive Start-Stop Battery market is characterized by intense competition, driven by the presence of several established players and the emergence of new entrants. Key players in the market are focused on product innovation, partnerships, and acquisitions to gain a competitive edge. The market is also influenced by evolving consumer preferences, government regulations, and technological advancements.

Regional Analysis

Competitive Landscape

Leading Companies in the Automotive Start-Stop Battery Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The Automotive Start-Stop Battery market can be segmented based on battery type, vehicle type, and region.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic had a significant impact on the global automotive industry, including the Automotive Start-Stop Battery market. The pandemic led to a temporary shutdown of manufacturing facilities and disrupted the global supply chain. However, the market showed signs of recovery as restrictions were eased and automotive production resumed. The pandemic also highlighted the importance of fuel efficiency and sustainability, driving the demand for start-stop systems and batteries in the post-pandemic era.

Key Industry Developments

Analyst Suggestions

Future Outlook

The Automotive Start-Stop Battery market is expected to witness significant growth in the coming years. The increasing demand for fuel-efficient vehicles, stringent emission regulations, and the rising adoption of start-stop technology in electric vehicles will drive market expansion. Advancements in battery technologies, such as the development of solid-state batteries and AI integration, will further fuel market growth and innovation.

Conclusion

The Automotive Start-Stop Battery market is experiencing rapid growth, driven by the increasing demand for fuel-efficient vehicles and the need to reduce carbon emissions. The market is highly competitive, with several key players vying for market share through technological advancements and strategic collaborations. The future of the market looks promising, with opportunities arising from rising electric vehicle adoption and continuous advancements in battery technologies. Manufacturers and stakeholders should focus on improving battery durability, investing in research and development, and expanding their product portfolios to capitalize on the growing market potential.

What is Automotive Start-Stop Battery?

Automotive Start-Stop Battery refers to a specialized battery designed to support the start-stop technology in vehicles, which allows the engine to turn off when the vehicle is stationary and restart when needed. This technology enhances fuel efficiency and reduces emissions by minimizing idle time.

What are the key players in the Automotive Start-Stop Battery market?

Key players in the Automotive Start-Stop Battery market include Johnson Controls, Exide Technologies, and Bosch, among others. These companies are involved in the development and production of advanced battery technologies to meet the growing demand for efficient automotive solutions.

What are the growth factors driving the Automotive Start-Stop Battery market?

The growth of the Automotive Start-Stop Battery market is driven by increasing fuel efficiency regulations, rising consumer demand for eco-friendly vehicles, and advancements in battery technology. Additionally, the growing popularity of hybrid and electric vehicles contributes to market expansion.

What challenges does the Automotive Start-Stop Battery market face?

The Automotive Start-Stop Battery market faces challenges such as high manufacturing costs, limited consumer awareness, and competition from alternative battery technologies. These factors can hinder market growth and adoption in certain regions.

What opportunities exist in the Automotive Start-Stop Battery market?

Opportunities in the Automotive Start-Stop Battery market include the increasing adoption of electric vehicles, advancements in battery recycling technologies, and the potential for integration with renewable energy sources. These trends can enhance the sustainability of automotive power systems.

What trends are shaping the Automotive Start-Stop Battery market?

Trends shaping the Automotive Start-Stop Battery market include the development of lightweight materials for battery construction, the integration of smart battery management systems, and the growing focus on sustainability in automotive design. These innovations aim to improve performance and reduce environmental impact.

Automotive Start-Stop Battery market

| Segmentation Details | Description |

|---|---|

| Product Type | Lead-Acid, Lithium-Ion, Nickel-Metal Hydride, Absorbent Glass Mat |

| End User | OEMs, Aftermarket Providers, Vehicle Assemblers, Tier-1 Suppliers |

| Technology | Micro-Hybrid, Full-Hybrid, Plug-In Hybrid, Start-Stop |

| Power Rating | 12V, 24V, 48V, Others |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Automotive Start-Stop Battery Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at