444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

The banking industry has been revolutionized by the emergence of neobanks. These digital-only banks offer an array of services that are cost-effective and customer-centric. In recent years, the neobanking market has witnessed significant growth globally. The neobanking market is projected to grow at a CAGR of 46.5% from 2021 to 2028, with North America and Europe leading the way.

Neobanking is a type of digital banking that operates exclusively through online channels, such as mobile applications or web platforms. Unlike traditional banks, neobanks do not have physical branches. Instead, they offer financial services, including opening accounts, making payments, and managing finances, entirely through digital channels.

Executive Summary

The neobanking market is growing at an unprecedented rate, fueled by changing consumer preferences and advancements in technology. Neobanks offer a range of benefits, including lower fees, faster transaction processing, and improved customer service. The market is highly competitive, with new players entering the market regularly. North America and Europe are expected to continue leading the way in terms of market share. The global neobanking market is expected to grow at a CAGR of 46.5% from 2021 to 2028.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Consumers are increasingly turning to neobanks for their financial needs due to the convenience and cost-effectiveness of their services. Neobanks offer simple and easy-to-use mobile applications that allow customers to manage their finances from anywhere, at any time.

Advancements in technology have enabled neobanks to offer innovative and personalized financial products and services. Artificial intelligence, machine learning, and data analytics are some of the technologies that neobanks use to create a seamless customer experience.

One of the key benefits of neobanks is that they offer lower fees compared to traditional banks. Neobanks do not have the overhead costs associated with physical branches, which enables them to offer cost-effective services.

Neobanks offer faster transaction processing compared to traditional banks. This is due to their advanced technology infrastructure, which allows for real-time transactions.

Market Restraints

Security concerns are a major challenge facing the neobanking market. As neobanks operate exclusively through digital channels, they are vulnerable to cyber-attacks and fraud. This could erode consumer trust and limit market growth.

Regulatory challenges are another potential restraint for the neobanking market. Neobanks are subject to various regulations and compliance requirements, which could impede their ability to expand their offerings and enter new markets.

Market Opportunities

The neobanking market presents significant opportunities for growth, particularly in untapped markets. Emerging markets, such as Asia-Pacific and Latin America, have high potential for growth due to their large populations and increasing internet penetration rates.

Partnerships and collaborations offer neobanks an opportunity to expand their offerings and reach a wider audience. Neobanks can collaborate with fintech companies, traditional banks, and other industry players to offer innovative financial products and services.

The demand for digital banking services is increasing globally, presenting a significant opportunity for neobanks. Consumers are increasingly using mobile applications and web platforms to manage their finances, which creates a conducive environment for neobanks to thrive.

Market Dynamics

The neobanking market is highly dynamic and characterized by intense competition, technological advancements, and changing consumer preferences. The market is evolving rapidly, with new players entering the market regularly and existing players expanding their offerings to retain their market position.

The market is highly fragmented, with several players operating in different regions and offering a range of financial products and services. The market is also highly competitive, with players competing on factors such as cost-effectiveness, convenience, and customer service.

Regional Analysis

North America and Europe are expected to continue leading the way in terms of market share due to the high adoption rate of digital banking services. Asia-Pacific and Latin America are expected to witness significant growth due to the large population and increasing internet penetration rates.

Competitive Landscape

Leading Companies in the Neobanking Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

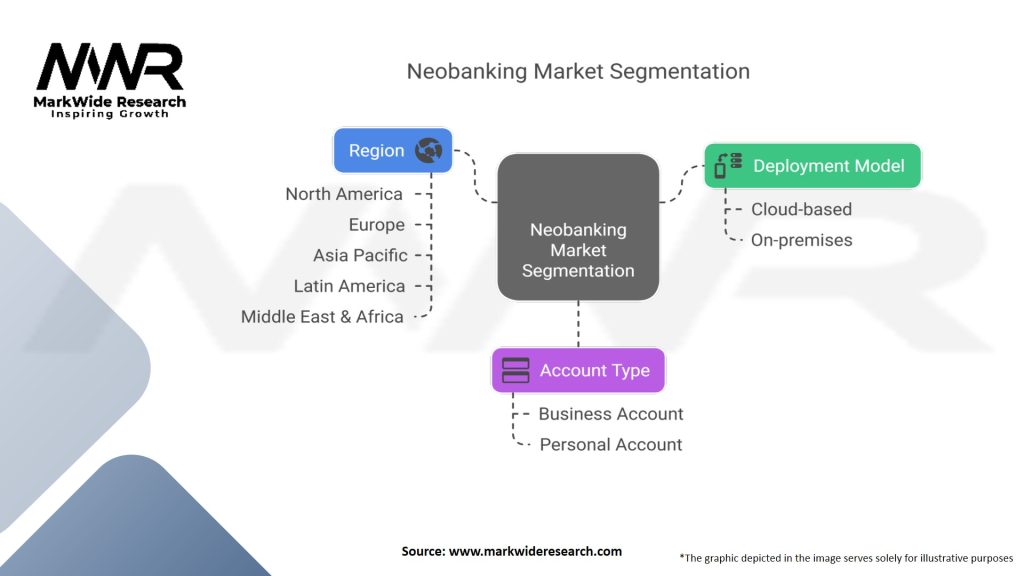

Segmentation

The neobanking market can be segmented based on the type of service offered and the region. Based on the type of service offered, the market can be segmented into:

Based on the region, the market can be segmented into:

Category-wise Insights

The payments segment is expected to continue leading the way in terms of market share. Neobanks offer cost-effective and convenient payment solutions, which appeal to a wide range of consumers.

The savings segment is also expected to witness significant growth due to the high adoption rate of digital banking services. Neobanks offer competitive interest rates and innovative savings products, which attract consumers.

The loans segment is expected to witness significant growth due to the increasing demand for cost-effective and convenient loan products. Neobanks offer innovative loan products, including personal loans and business loans, which appeal to a wide range of consumers.

The insurance segment is also expected to witness significant growth due to the increasing demand for innovative and cost-effective insurance products. Neobanks offer innovative insurance products, including travel insurance and life insurance, which appeal to a wide range of consumers.

Key Benefits for Industry Participants and Stakeholders

Neobanks offer cost-effective financial products and services, which appeal to a wide range of consumers. This enables industry participants to attract and retain customers.

Neobanks offer convenient financial products and services, which appeal to consumers who value ease of use and accessibility. This enables industry participants to create a seamless customer experience.

Neobanks offer innovative financial products and services, which enable industry participants to differentiate themselves from traditional banks and create a competitive advantage.

SWOT Analysis

Market Key Trends

Neobanks are expanding their offerings beyond traditional banking services to include investment, insurance, and other financial products. This enables neobanks to offer a comprehensive suite of financial services and create a competitive advantage.

Neobanks are using advanced technologies such as artificial intelligence and machine learning to create personalized financial products and services. This enables neobanks to offer customized solutions that meet the unique needs of individual consumers.

Neobanks are increasingly focusing on sustainability and incorporating environmental, social, and governance (ESG) considerations into their business models. This enables neobanks to appeal to consumers who value sustainability and social responsibility.

Covid-19 Impact

The Covid-19 pandemic has accelerated the adoption of digital banking services, including neobanking. The pandemic has highlighted the importance of digital channels and contactless payments, which has created a conducive environment for neobanks to thrive.

Key Industry Developments

Neobanks are partnering with fintech companies, traditional banks, and other industry players to expand their offerings and reach a wider audience. For example, Chime has partnered with Bancorp to offer deposit accounts and debit cards.

Neobanks are raising significant amounts of capital from investors, enabling them to expand their offerings and enter new markets. For example, Revolut raised $800 million in its latest funding round.

Analyst Suggestions

Neobanks need to address security concerns to retain consumer trust and maintain market growth. This requires investing in advanced security infrastructure and adopting best practices for cybersecurity.

Neobanks need to focus on creating a seamless customer experience to differentiate themselves from traditional banks and create a competitive advantage. This requires investing in advanced technologies and adopting a customer-centric approach.

Future Outlook

The neobanking market is expected to continue growing at a rapid pace, driven by changing consumer preferences, advancements in technology, and increasing demand for digital banking services. Neobanks will continue expanding their offerings beyond traditional banking services to include investment, insurance, and other financial products. The market will continue to be highly competitive, with new players entering the market regularly and existing players expanding their offerings to retain their market position.

Conclusion

The neobanking market is a dynamic and rapidly growing industry that is revolutionizing the banking sector. Neobanks offer cost-effective, convenient, and innovative financial products and services that appeal to a wide range of consumers. The market presents significant opportunities for growth, particularly in untapped markets and through partnerships and collaborations. However, neobanks must address security concerns, adopt a customer-centric approach, and comply with regulatory requirements to maintain market growth and retain consumer trust.

In conclusion, the neobanking market is an innovative and growing segment of the banking industry. Neobanks have disrupted the traditional banking model and have made banking more accessible and cost-effective for customers. As technology continues to advance, the potential for neobanks to expand their offerings and improve their services is vast.

The industry will continue to be competitive, and it is crucial for neobanks to stay ahead of the curve by adopting a customer-centric approach, investing in advanced technologies, and maintaining compliance with regulatory requirements. As the neobanking market continues to evolve, it presents exciting opportunities for both consumers and industry participants.

What is neobanking?

Neobanking refers to digital-only banks that operate without physical branches, offering services such as online banking, payment processing, and financial management through mobile apps. These banks leverage technology to provide a seamless banking experience to consumers and businesses.

What are the key players in the neobanking market?

Key players in the neobanking market include companies like Chime, N26, and Revolut, which provide innovative banking solutions tailored to tech-savvy consumers. These companies focus on user-friendly interfaces and low-cost services, among others.

What are the main drivers of growth in the neobanking market?

The neobanking market is driven by factors such as the increasing adoption of smartphones, the demand for convenient banking solutions, and the rise of digital payment methods. Additionally, younger consumers are more inclined to use digital banking services.

What challenges does the neobanking market face?

Challenges in the neobanking market include regulatory compliance, cybersecurity threats, and competition from traditional banks that are enhancing their digital offerings. These factors can impact the growth and sustainability of neobanks.

What opportunities exist for neobanks in the future?

Opportunities for neobanks include expanding into underserved markets, offering personalized financial products, and integrating advanced technologies like AI for better customer service. The growing trend of financial inclusion also presents significant potential.

What trends are shaping the neobanking market?

Trends in the neobanking market include the rise of embedded finance, where banking services are integrated into non-financial platforms, and the increasing focus on sustainability in banking practices. Additionally, partnerships with fintech companies are becoming more common.

Neobanking Market

| Segmentation Details | Details |

|---|---|

| Deployment Model | Cloud-based, On-premises |

| Account Type | Business Account, Personal Account |

| Region | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Neobanking Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at