444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview

The healthcare logistics market in Australia and New Zealand is an integral part of the overall healthcare industry, ensuring the efficient and timely delivery of healthcare products and services to patients, healthcare providers, and various healthcare facilities. Healthcare logistics encompasses a wide range of activities, including transportation, warehousing, inventory management, and supply chain optimization. It plays a crucial role in maintaining the integrity of healthcare products, such as pharmaceuticals, medical devices, and diagnostics, throughout the supply chain.

Meaning

Healthcare logistics refers to the planning, coordination, and management of the flow of healthcare products and services from the point of origin to the point of consumption. It involves the movement of goods, information, and funds across various stakeholders in the healthcare supply chain, including manufacturers, distributors, hospitals, clinics, pharmacies, and patients. The ultimate goal of healthcare logistics is to ensure that the right product is delivered to the right place at the right time, while maintaining quality, safety, and cost-effectiveness.

Executive Summary

The healthcare logistics market in Australia and New Zealand is experiencing significant growth due to various factors, such as the increasing demand for healthcare products and services, advancements in medical technology, and the need for efficient supply chain management. The market is highly competitive, with several key players operating in the region. However, there are also challenges and opportunities that need to be considered for sustained growth and success in the market.

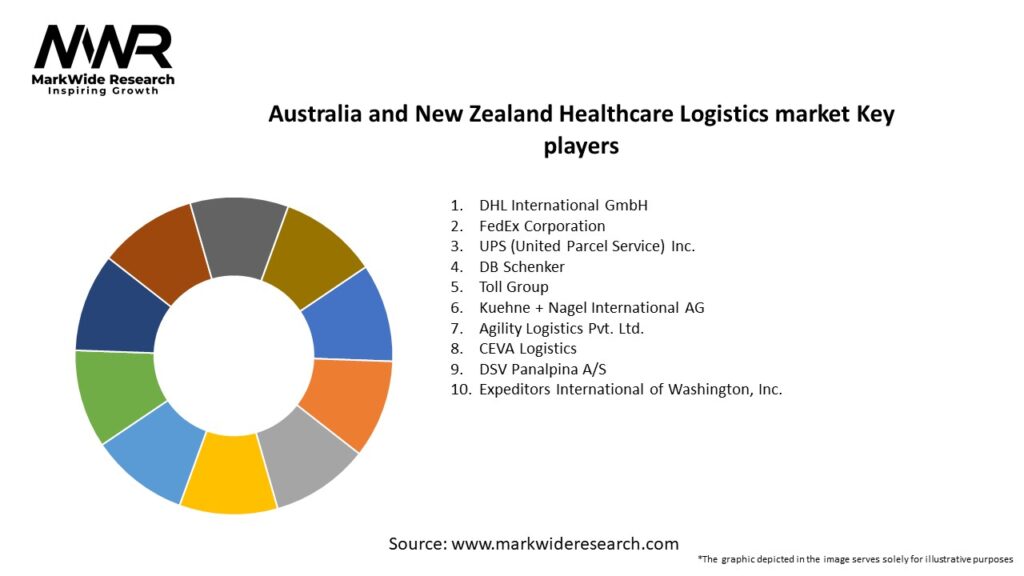

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The healthcare logistics market in Australia and New Zealand is dynamic and influenced by various factors, including changing healthcare needs, technological advancements, regulatory requirements, and market competition. It is characterized by a constant need for innovation, operational efficiency, and adaptability to evolving market conditions. Logistics providers must stay abreast of market dynamics and proactively respond to emerging trends and challenges to maintain their competitiveness.

Regional Analysis

Australia and New Zealand, as geographically close regions, share many similarities in terms of healthcare logistics. Both countries have robust healthcare systems and face similar challenges, including a vast and sparsely populated landmass, remote communities, and unique regulatory frameworks. However, there are also differences in healthcare infrastructure, population demographics, and market dynamics that need to be considered when operating in each country.

In Australia, the healthcare logistics market is relatively mature and well-developed, with a strong focus on quality and regulatory compliance. The market is dominated by a few large logistics providers, alongside several smaller players. The country’s vast land area and dispersed population pose logistical challenges, particularly in remote areas. However, advancements in transportation networks, including air and road connectivity, have improved access to healthcare products in these regions.

In New Zealand, the healthcare logistics market is smaller in scale compared to Australia but presents growth opportunities. The country’s unique geography, with its two main islands and numerous smaller islands, requires efficient transportation and logistics solutions. The market is characterized by a mix of domestic and international logistics providers, with an emphasis on sustainability and environmental considerations.

Both Australia and New Zealand have well-established regulatory frameworks governing the import, export, storage, and transportation of healthcare products. Compliance with these regulations is crucial for logistics providers to ensure patient safety, product integrity, and regulatory compliance.

Competitive Landscape

Leading Companies in the Australia and New Zealand Healthcare Logistics Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

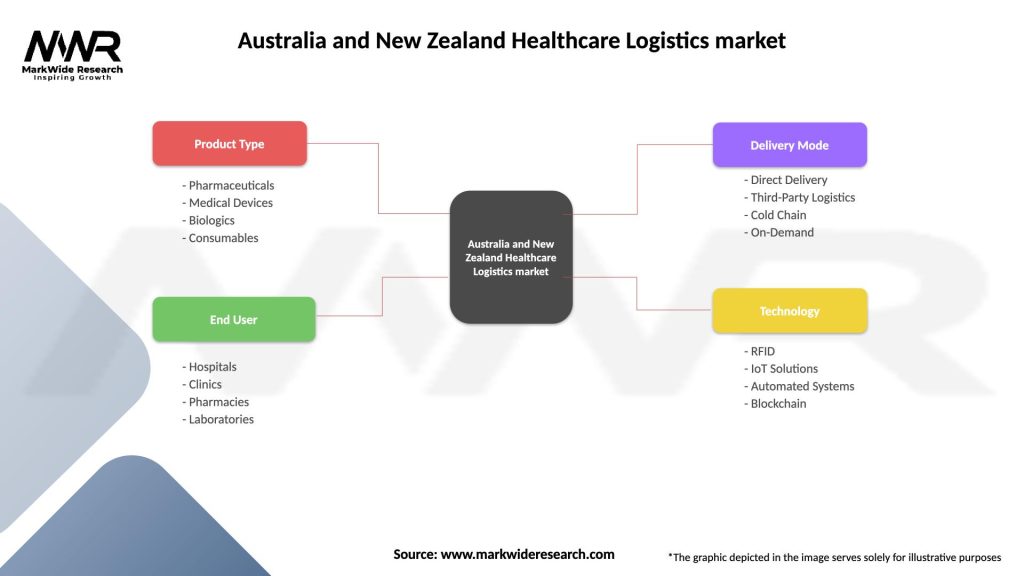

The healthcare logistics market in Australia and New Zealand can be segmented based on various factors, including service type, product type, end-user, and geography.

Based on service type, the market can be segmented into transportation services, warehousing and storage services, inventory management, and value-added services. Transportation services include air freight, road transport, sea freight, and specialized temperature-controlled logistics. Warehousing and storage services involve the management of inventory, including storage, order picking, and stock rotation. Inventory management encompasses activities such as demand forecasting, procurement, and order fulfillment. Value-added services may include kitting and assembly, reverse logistics, and repackaging.

From a product type perspective, the market can be segmented into pharmaceuticals, medical devices, diagnostics, and others. Pharmaceutical logistics involve the transportation and storage of prescription drugs, over-the-counter medications, and vaccines. Medical device logistics cover the handling and distribution of various medical devices, including implants, surgical instruments, and monitoring equipment. Diagnostics logistics involve the transportation of laboratory samples, reagents, and testing kits.

End-users of healthcare logistics services include hospitals, clinics, pharmacies, diagnostic laboratories, pharmaceutical manufacturers, and medical device companies. Each end-user has unique logistics requirements and preferences based on factors such as order volume, urgency, and product characteristics.

Geographically, the market can be segmented into Australia and New Zealand. While both countries share similarities in terms of healthcare logistics, there are also distinct differences in market dynamics, regulatory frameworks, and infrastructure that need to be considered.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic has significantly impacted the healthcare logistics market in Australia and New Zealand. The pandemic has created unprecedented challenges, such as the urgent need for medical supplies, vaccines, and testing kits, and the disruption of global supply chains. However, it has also highlighted the importance of efficient healthcare logistics in responding to healthcare emergencies and ensuring the continuity of essential healthcare services.

The pandemic has led to increased demand for healthcare logistics services, particularly in the transportation and distribution of vaccines and personal protective equipment (PPE). Healthcare logistics providers have played a crucial role in ensuring the safe and timely delivery of these critical supplies to healthcare facilities and vaccination centers.

The pandemic has also accelerated the adoption of digital technologies in healthcare logistics. Real-time tracking, contactless delivery, and remote monitoring have become essential for maintaining supply chain visibility and reducing the risk of virus transmission.

However, the pandemic has also exposed vulnerabilities in the healthcare supply chain. Border closures, travel restrictions, and disruptions in transportation networks have highlighted the need for resilient and flexible logistics systems. Healthcare logistics providers have had to adapt to rapidly changing market conditions, implement contingency plans, and collaborate closely with stakeholders to overcome these challenges.

Key Industry Developments

Analyst Suggestions

Future Outlook

The future of the healthcare logistics market in Australia and New Zealand looks promising, driven by factors such as population growth, technological advancements, and the increasing focus on patient care and safety. The market is expected to witness continued growth, with opportunities arising from e-commerce, temperature-controlled logistics, and supply chain optimization.

Technological innovations, such as real-time tracking, data analytics, and automation, will play a crucial role in shaping the future of healthcare logistics. These advancements will improve supply chain visibility, enable proactive decision-making, and enhance operational efficiency.

The ongoing COVID-19 pandemic has highlighted the need for resilient and adaptable healthcare logistics systems. The lessons learned from this crisis will inform future strategies, with a focus on building robust supply chains, strengthening emergency response capabilities, and ensuring the availability of essential healthcare products.

Regulatory compliance will remain a key consideration for healthcare logistics providers. Adherence to quality standards, temperature control requirements, and security measures will continue to be vital for maintaining patient safety, product integrity, and regulatory compliance.

In summary, the healthcare logistics market in Australia and New Zealand presents significant opportunities for growth and innovation. By embracing technological advancements, focusing on regulatory compliance, and collaborating with stakeholders, logistics providers can position themselves for success in this dynamic and essential sector.

Conclusion

The healthcare logistics market in Australia and New Zealand plays a critical role in ensuring the timely and efficient delivery of healthcare products and services to patients, healthcare providers, and healthcare facilities. With the increasing demand for healthcare products and services, advancements in medical technology, and the emphasis on supply chain efficiency, the market is experiencing significant growth.

The market offers various opportunities for logistics providers, including e-commerce and direct-to-patient delivery, temperature-controlled logistics, and supply chain visibility solutions. However, challenges such as high regulatory compliance costs, lack of standardization, and infrastructure constraints need to be addressed for sustained growth.

What is Healthcare Logistics?

Healthcare logistics refers to the management of the flow of medical supplies, equipment, and pharmaceuticals within the healthcare system. It encompasses various activities including transportation, warehousing, and inventory management to ensure that healthcare providers have the necessary resources to deliver patient care effectively.

What are the key players in the Australia and New Zealand Healthcare Logistics market?

Key players in the Australia and New Zealand Healthcare Logistics market include companies like DHL Supply Chain, Linfox, and Cardinal Health. These companies provide essential logistics services tailored to the healthcare sector, including distribution and supply chain management, among others.

What are the main drivers of growth in the Australia and New Zealand Healthcare Logistics market?

The growth of the Australia and New Zealand Healthcare Logistics market is driven by factors such as the increasing demand for efficient supply chain solutions, the rise in healthcare expenditures, and the growing need for temperature-sensitive logistics for pharmaceuticals. Additionally, advancements in technology are enhancing logistics operations.

What challenges does the Australia and New Zealand Healthcare Logistics market face?

The Australia and New Zealand Healthcare Logistics market faces challenges such as regulatory compliance, the complexity of managing cold chain logistics, and the need for real-time tracking of medical supplies. These factors can complicate logistics operations and impact service delivery.

What opportunities exist in the Australia and New Zealand Healthcare Logistics market?

Opportunities in the Australia and New Zealand Healthcare Logistics market include the expansion of telehealth services, which require efficient logistics for medical supplies, and the increasing adoption of automation and digital solutions in supply chain management. These trends can enhance operational efficiency and improve patient outcomes.

What trends are shaping the Australia and New Zealand Healthcare Logistics market?

Trends shaping the Australia and New Zealand Healthcare Logistics market include the integration of advanced technologies such as IoT and AI for better inventory management, the focus on sustainability in logistics practices, and the growing importance of last-mile delivery solutions. These trends are transforming how healthcare logistics operates.

Australia and New Zealand Healthcare Logistics market

| Segmentation Details | Description |

|---|---|

| Product Type | Pharmaceuticals, Medical Devices, Biologics, Consumables |

| End User | Hospitals, Clinics, Pharmacies, Laboratories |

| Delivery Mode | Direct Delivery, Third-Party Logistics, Cold Chain, On-Demand |

| Technology | RFID, IoT Solutions, Automated Systems, Blockchain |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Australia and New Zealand Healthcare Logistics Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at