444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

Market Overview

The Asia-Pacific region has witnessed significant growth in the paints and coatings additives market in recent years. Paints and coatings additives are substances that are added to paint formulations to enhance their properties, performance, and durability. These additives play a crucial role in improving various characteristics of paints and coatings, such as viscosity, leveling, adhesion, and resistance to chemicals, UV radiation, and weathering.

Meaning

Paints and coatings additives are specialty chemicals that are blended into paint formulations to modify their properties and performance. These additives can be categorized into various types, including dispersants, rheology modifiers, wetting agents, defoamers, biocides, and others. Each type of additive serves a specific purpose in enhancing the overall quality and functionality of paints and coatings.

Executive Summary

The Asia-Pacific paints and coatings additives market has experienced steady growth over the past few years. The market is primarily driven by increasing demand for high-quality paints and coatings in various industries, such as automotive, construction, and industrial. The region’s rapid urbanization and infrastructure development have further boosted the demand for paints and coatings additives.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The Asia-Pacific paints and coatings additives market is driven by various dynamic factors, including changing consumer preferences, regulatory developments, technological advancements, and economic growth. These factors influence the market’s growth trajectory, market share, and competitive landscape.

Regional Analysis

The Asia-Pacific region is geographically diverse, comprising countries such as China, India, Japan, South Korea, and Australia. Each country has its unique market dynamics and demand for paints and coatings additives. China and India are the dominant markets in the region, driven by their large population, rapid urbanization, and extensive construction activities. Japan and South Korea have well-established manufacturing sectors, contributing to the demand for industrial coatings and additives. Australia has a developed infrastructure and construction industry, driving the demand for high-quality paints and coatings.

Competitive Landscape

Leading Companies in the Asia-Pacific Paints and Coatings Additives Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

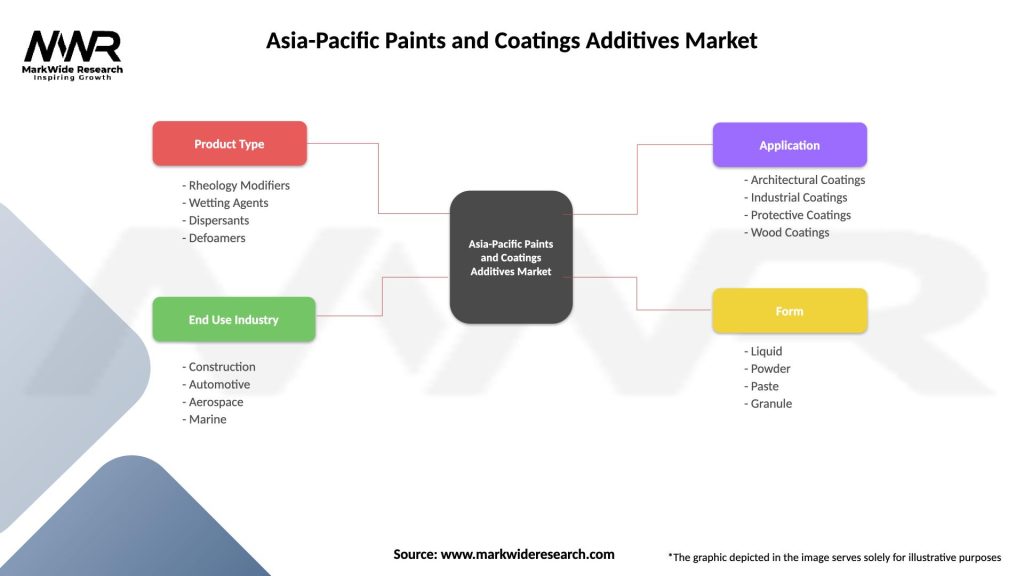

The Asia-Pacific paints and coatings additives market can be segmented based on type, application, and end-use industry.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic had a significant impact on the Asia-Pacific paints and coatings additives market. The strict lockdown measures and disruptions in supply chains resulted in a temporary slowdown in construction activities, automotive production, and other end-user industries. This led to a decline in the demand for paints and coatings additives during the initial phases of the pandemic.

However, as economies gradually reopened and construction and manufacturing activities resumed, the demand for paints and coatings additives started to recover. The need for enhanced hygiene measures and antimicrobial coatings also presented new opportunities for additives that provide antimicrobial properties.

The pandemic has highlighted the importance of resilient and durable coatings, leading to increased investments in research and development for additives that improve performance and protection against pathogens. Overall, the Asia-Pacific paints and coatings additives market has shown resilience and is expected to recover and grow in the post-pandemic period.

Key Industry Developments

Analyst Suggestions

Future Outlook

The Asia-Pacific paints and coatings additives market is poised for substantial growth in the coming years. Factors such as rapid urbanization, infrastructure development, and increasing disposable income will continue to drive the demand for high-quality paints and coatings. The focus on sustainability, advancements in technology, and the need for performance-driven coatings will shape the market’s future.

Manufacturers that can innovate and offer specialized additives to meet these evolving requirements will have a competitive advantage. Collaboration and partnerships, along with strategic investments in research and development, will be crucial for industry participants to stay ahead in this dynamic and competitive market.

Conclusion

The Asia-Pacific paints and coatings additives market is witnessing significant growth, driven by factors such as urbanization, infrastructure development, and increasing demand for high-quality coatings. The market offers opportunities for manufacturers to develop sustainable and technologically advanced additives that enhance the performance, durability, and environmental properties of paints and coatings.

By focusingon customer needs, regional dynamics, and collaboration, industry participants can position themselves for success in this competitive market. The future outlook remains positive, with continued growth expected in the Asia-Pacific region. With a strategic approach and a commitment to innovation, manufacturers can capitalize on the market’s potential and meet the evolving demands of the paints and coatings industry in the region.

What is Paints and Coatings Additives?

Paints and Coatings Additives are substances added to paint formulations to enhance performance characteristics such as durability, stability, and appearance. These additives can include surfactants, thickeners, and anti-foaming agents, among others.

What are the key players in the Asia-Pacific Paints and Coatings Additives Market?

Key players in the Asia-Pacific Paints and Coatings Additives Market include BASF SE, Evonik Industries AG, and Arkema S.A., among others. These companies are known for their innovative solutions and extensive product portfolios in the coatings sector.

What are the growth factors driving the Asia-Pacific Paints and Coatings Additives Market?

The growth of the Asia-Pacific Paints and Coatings Additives Market is driven by increasing construction activities, rising demand for decorative paints, and the need for environmentally friendly coatings. Additionally, the automotive and furniture industries are significant contributors to market expansion.

What challenges does the Asia-Pacific Paints and Coatings Additives Market face?

The Asia-Pacific Paints and Coatings Additives Market faces challenges such as fluctuating raw material prices and stringent environmental regulations. These factors can impact production costs and limit the availability of certain additives.

What opportunities exist in the Asia-Pacific Paints and Coatings Additives Market?

Opportunities in the Asia-Pacific Paints and Coatings Additives Market include the growing trend towards sustainable and eco-friendly products, as well as advancements in technology that enhance additive performance. The rise of smart coatings also presents new avenues for innovation.

What trends are shaping the Asia-Pacific Paints and Coatings Additives Market?

Trends shaping the Asia-Pacific Paints and Coatings Additives Market include the increasing use of water-based coatings, the development of multifunctional additives, and a focus on reducing VOC emissions. These trends reflect a shift towards more sustainable and efficient coating solutions.

Asia-Pacific Paints and Coatings Additives Market

| Segmentation Details | Description |

|---|---|

| Product Type | Rheology Modifiers, Wetting Agents, Dispersants, Defoamers |

| End Use Industry | Construction, Automotive, Aerospace, Marine |

| Application | Architectural Coatings, Industrial Coatings, Protective Coatings, Wood Coatings |

| Form | Liquid, Powder, Paste, Granule |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Asia-Pacific Paints and Coatings Additives Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at