444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

Market Overview

The Asia-Pacific Islamic finance market is a rapidly growing sector within the broader global Islamic finance industry. Islamic finance refers to financial activities that are conducted in accordance with Islamic principles and values, which prohibit the charging or payment of interest (riba) and the involvement of speculative or uncertain transactions (gharar). Instead, Islamic finance promotes profit-sharing arrangements and asset-backed transactions.

Meaning

Islamic finance operates on the principles of fairness, transparency, and ethical conduct. It offers an alternative to conventional finance, appealing to individuals and businesses who seek financial solutions that align with their religious beliefs and values. The Asia-Pacific region has a significant Muslim population, making it a crucial market for Islamic finance products and services.

Executive Summary

The Asia-Pacific Islamic finance market has witnessed substantial growth in recent years. The market offers a wide range of products, including Islamic banking, Islamic insurance (Takaful), Islamic bonds (Sukuk), and Islamic funds. These products cater to various financial needs, from retail banking services to infrastructure financing.

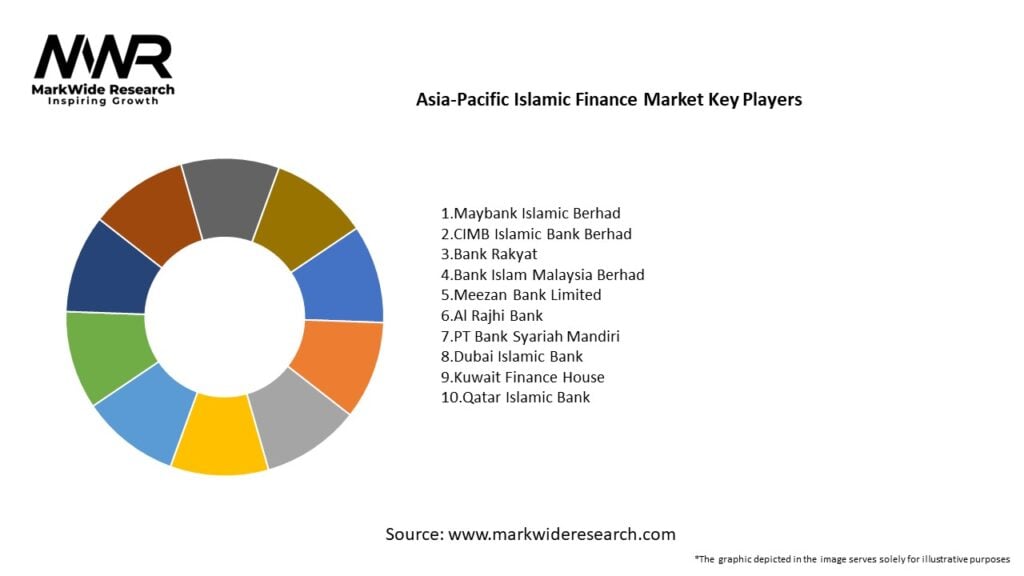

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Several factors are driving the growth of the Asia-Pacific Islamic Finance market:

Market Restraints

Despite its growth prospects, the Asia-Pacific Islamic Finance market faces several challenges:

Market Opportunities

The Asia-Pacific Islamic Finance market presents significant opportunities for growth and development:

Market Dynamics

The Asia-Pacific Islamic Finance market is shaped by several dynamic trends:

Regional Analysis

The Asia-Pacific Islamic Finance market shows varying adoption rates and sector maturity across different regions:

Competitive Landscape

Leading Companies in the Asia-Pacific Islamic Finance Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The Asia-Pacific Islamic Finance market can be segmented based on the following factors:

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

The Asia-Pacific Islamic Finance market offers several key benefits:

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic has had both short-term and long-term impacts on the Asia-Pacific Islamic finance market. In the immediate aftermath of the pandemic, there was a temporary disruption in business operations, as lockdowns and movement restrictions were imposed. However, the crisis also highlighted the resilience of Islamic finance, which emphasizes risk-sharing and asset-backed transactions. As the region recovers, Islamic finance is expected to play a role in supporting economic recovery and financing sustainable projects.

Key Industry Developments

The Asia-Pacific Islamic finance market has witnessed several noteworthy developments in recent years. For instance, Malaysia launched the Value-based Intermediation (VBI) initiative to promote the integration of environmental and social considerations into Islamic finance. The United Arab Emirates introduced regulations to facilitate crowdfunding platforms for Islamic finance. These developments reflect ongoing efforts to enhance the market’s inclusivity and sustainability.

Analyst Suggestions

Industry analysts suggest several strategies to further enhance the Asia-Pacific Islamic finance market. Firstly, harmonizing regulations and standardizing Islamic finance practices across countries would facilitate cross-border transactions and foster market growth. Secondly, raising awareness and improving financial literacy about Islamic finance among potential customers would drive market expansion. Additionally, leveraging technology and partnerships can enhance the accessibility and efficiency of Islamic finance services.

Future Outlook

The future outlook for the Asia-Pacific Islamic finance market is positive. The market is expected to continue its upward trajectory, driven by the region’s growing Muslim population, supportive government policies, and increasing awareness of Islamic finance. The integration of fintech solutions, sustainable finance principles, and digital innovation is likely to shape the market’s future landscape. Islamic finance is poised to contribute significantly to the region’s financial sector and economic development.

Conclusion

The Asia-Pacific Islamic finance market presents a promising landscape for industry participants and stakeholders. With a growing Muslim population, supportive government policies, and increasing awareness, the market offers substantial growth opportunities. However, challenges such as regulatory fragmentation and limited customer awareness need to be addressed. By focusing on product innovation, expanding digital services, and exploring infrastructure financing, the market can overcome these challenges and thrive. The integration of environmental and social considerations, as well as the adoption of fintech solutions, will further enhance the market’s sustainability and accessibility. With ongoing efforts to harmonize regulations and raise awareness about Islamic finance, the future outlook for the Asia-Pacific Islamic finance market is bright. The market is expected to continue its upward trajectory, contributing to financial inclusion, economic growth, and sustainable development in the region.

Asia-Pacific Islamic Finance Market

| Segmentation Details | Description |

|---|---|

| Investment Strategy | Equity Financing, Debt Financing, Sukuk Issuance, Venture Capital |

| Asset Class | Real Estate, Commodities, Equities, Cash Equivalents |

| Investor Type | Institutional Investors, Retail Investors, High-Net-Worth Individuals, Sovereign Wealth Funds |

| Transaction Size | Small Cap, Mid Cap, Large Cap, Mega Cap |

Leading Companies in the Asia-Pacific Islamic Finance Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at