444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

Market Overview

The Asia-Pacific feed amino acids market has been experiencing significant growth in recent years. Feed amino acids play a crucial role in animal nutrition as they are essential for the growth, development, and overall well-being of animals. These amino acids are primarily used as feed additives to enhance the nutritional value of animal feed, ensuring optimum animal health and productivity. The Asia-Pacific region, with its vast population and increasing demand for animal-based products, presents a lucrative market for feed amino acids.

Meaning

Feed amino acids are organic compounds that serve as building blocks for protein synthesis in animals. They are classified into essential and non-essential amino acids. Essential amino acids cannot be produced by the animal’s body and must be obtained through their diet. Non-essential amino acids, on the other hand, can be synthesized by the animal’s body. Feed amino acids are used to supplement animal feed to meet the specific nutritional requirements of different animal species.

Executive Summary

The Asia-Pacific feed amino acids market has been witnessing robust growth due to various factors such as the rising demand for animal protein, increasing awareness about animal health, and the need for improved feed efficiency. This market offers promising opportunities for manufacturers and suppliers of feed amino acids to expand their presence and tap into the region’s growing market potential.

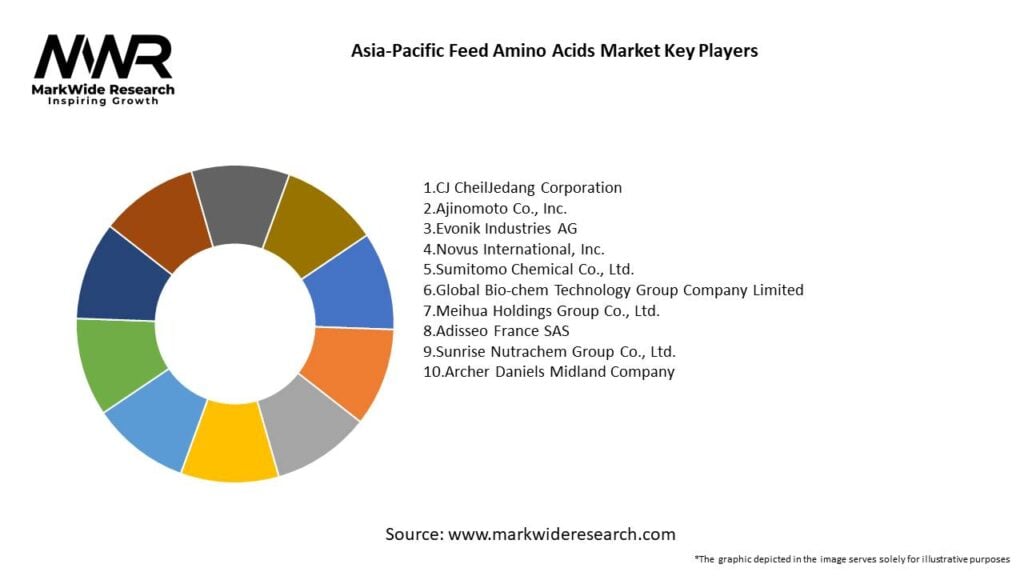

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The Asia-Pacific feed amino acids market is characterized by intense competition among key players. Manufacturers are focused on research and development activities to introduce innovative products and expand their product portfolios. Collaborations, partnerships, and mergers and acquisitions are common strategies adopted by companies to strengthen their market presence and gain a competitive edge.

Regional Analysis

The Asia-Pacific feed amino acids market is segmented into several key regions, including China, India, Japan, South Korea, Australia, and the rest of the Asia-Pacific. China holds the largest market share, driven by its vast livestock population and robust agricultural industry. India and Japan are also significant contributors to the regional market growth, supported by increasing investments in the animal husbandry sector and growing awareness about animal nutrition.

Competitive Landscape

Leading Companies in the Asia-Pacific Feed Amino Acids Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The Asia-Pacific feed amino acids market is segmented based on type, livestock, and form.

By Type:

By Livestock:

By Form:

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic has had a mixed impact on the Asia-Pacific feed amino acids market. While the initial phases of the pandemic led to disruptions in the supply chain and logistics, the market gradually rebounded as the situation improved. The demand for animal protein remained resilient, and farmers continued to prioritize animal nutrition and health to ensure uninterrupted production. However, market players had to adapt to changing consumer preferences and safety concerns, leading to shifts in product offerings and marketing strategies.

Key Industry Developments

Analyst Suggestions

Future Outlook

The Asia-Pacific feed amino acids market is expected to witness steady growth in the coming years. The rising demand for high-quality animal protein, coupled with the need for improved animal nutrition, will continue to drive the market. Advancements in technology and increasing investments in research and development are likely to result in the introduction of innovative feed amino acid products with enhanced functionalities. Additionally, the focus on sustainability, product safety, and precision nutrition will shape the future landscape of the market.

Conclusion

The Asia-Pacific feed amino acids market is poised for substantial growth, driven by the increasing demand for animal protein, growing awareness about animal health, and the need for improved feed efficiency. With a focus on innovation, sustainability, and product differentiation, market players can capitalize on the abundant opportunities in this dynamic market. By providing essential nutrition and contributing to animal health and productivity, feed amino acids play a crucial role in supporting the sustainable growth of the livestock industry in the Asia-Pacific region.

What is Feed Amino Acids?

Feed amino acids are organic compounds that serve as the building blocks of proteins, essential for animal nutrition. They play a crucial role in promoting growth, improving feed efficiency, and enhancing overall health in livestock and aquaculture.

What are the key players in the Asia-Pacific Feed Amino Acids Market?

Key players in the Asia-Pacific Feed Amino Acids Market include companies like Ajinomoto Co., Inc., Evonik Industries AG, and Archer Daniels Midland Company, among others. These companies are involved in the production and distribution of various amino acids for animal feed applications.

What are the growth factors driving the Asia-Pacific Feed Amino Acids Market?

The growth of the Asia-Pacific Feed Amino Acids Market is driven by increasing demand for high-quality animal protein, rising livestock production, and advancements in animal nutrition. Additionally, the growing aquaculture industry is also contributing to market expansion.

What challenges does the Asia-Pacific Feed Amino Acids Market face?

The Asia-Pacific Feed Amino Acids Market faces challenges such as fluctuating raw material prices, regulatory hurdles, and competition from alternative protein sources. These factors can impact production costs and market dynamics.

What opportunities exist in the Asia-Pacific Feed Amino Acids Market?

Opportunities in the Asia-Pacific Feed Amino Acids Market include the development of innovative amino acid formulations and the increasing focus on sustainable animal farming practices. Additionally, the rising demand for organic and natural feed additives presents new avenues for growth.

What trends are shaping the Asia-Pacific Feed Amino Acids Market?

Trends in the Asia-Pacific Feed Amino Acids Market include the growing adoption of precision nutrition, advancements in fermentation technology, and an increasing emphasis on health and wellness in livestock. These trends are influencing product development and consumer preferences.

Asia-Pacific Feed Amino Acids Market

| Segmentation Details | Description |

|---|---|

| Product Type | L-Lysine, L-Threonine, L-Tryptophan, L-Methionine |

| End Use Industry | Poultry, Swine, Aquaculture, Ruminants |

| Form | Powder, Liquid, Granular, Tablet |

| Distribution Channel | Direct Sales, Distributors, Online Retail, Wholesalers |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Asia-Pacific Feed Amino Acids Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at