444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

Market Overview

The Asia-Pacific automotive tire pressure management system (TPMS) market has witnessed significant growth in recent years. TPMS is a technology designed to monitor and manage the air pressure inside tires, ensuring optimal tire performance, safety, and fuel efficiency. It has gained immense popularity among automotive manufacturers and consumers due to its ability to prevent accidents caused by underinflated or overinflated tires.

Meaning

Tire pressure management systems, also known as TPMS, are electronic systems that monitor the air pressure inside tires and provide real-time information to the driver. The primary purpose of TPMS is to ensure that tires are properly inflated, as incorrect tire pressure can lead to various issues, such as reduced fuel efficiency, increased tire wear, and decreased vehicle stability. TPMS typically consists of sensors installed in each tire, a central control unit, and a dashboard display for the driver to monitor the tire pressure.

Executive Summary

The Asia-Pacific automotive tire pressure management system market has experienced substantial growth in recent years. The increasing emphasis on vehicle safety, government regulations mandating the use of TPMS, and rising consumer awareness about the benefits of tire pressure monitoring systems have been the key factors driving market growth. Additionally, advancements in sensor technology and integration of TPMS with advanced driver assistance systems (ADAS) have further boosted market demand.

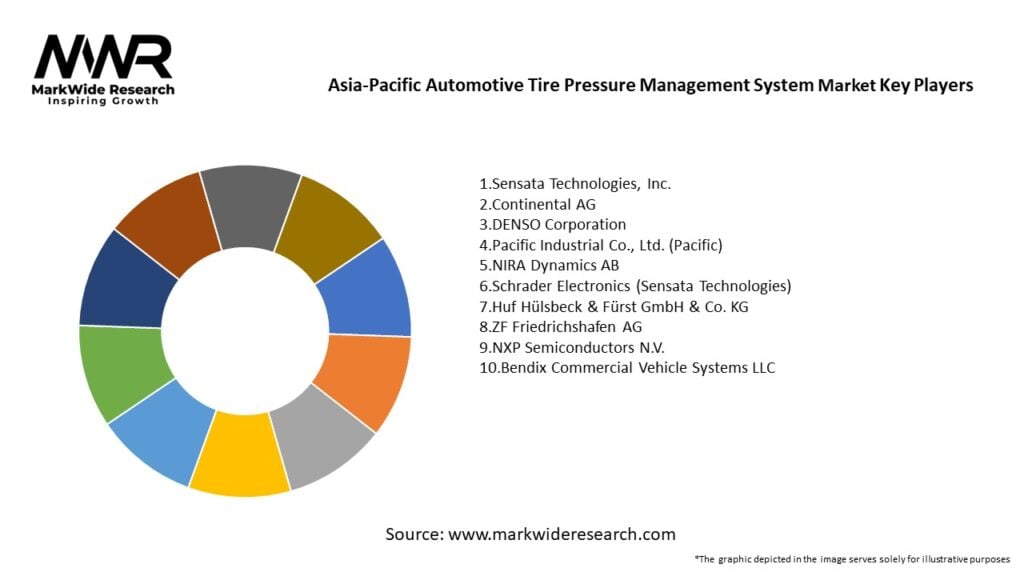

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The Asia-Pacific automotive tire pressure management system market is driven by various dynamic factors. The increasing focus on vehicle safety, government regulations mandating TPMS installation, rising consumer awareness, and advancements in sensor technology are the primary drivers. However, the market faces challenges such as high initial costs, lack of standardization, and limited aftermarket penetration. Despite these challenges, there are several opportunities for market growth, including increasing vehicle production and demand for electric vehicles, as well as advancements in sensor technology.

Regional Analysis

The Asia-Pacific automotive tire pressure management system market can be segmented into several key regions, including China, Japan, South Korea, India, and Australia. China is the largest market in the region, driven by its large automotive industry and government regulations mandating the use of TPMS. Japan and South Korea also have well-established automotive sectors and witness significant demand for TPMS due to safety concerns. India and Australia are emerging markets, with growing adoption of TPMS driven by increasing vehicle production and government initiatives promoting vehicle safety.

Competitive Landscape

Leading Companies in Asia-Pacific Automotive Tire Pressure Management System Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

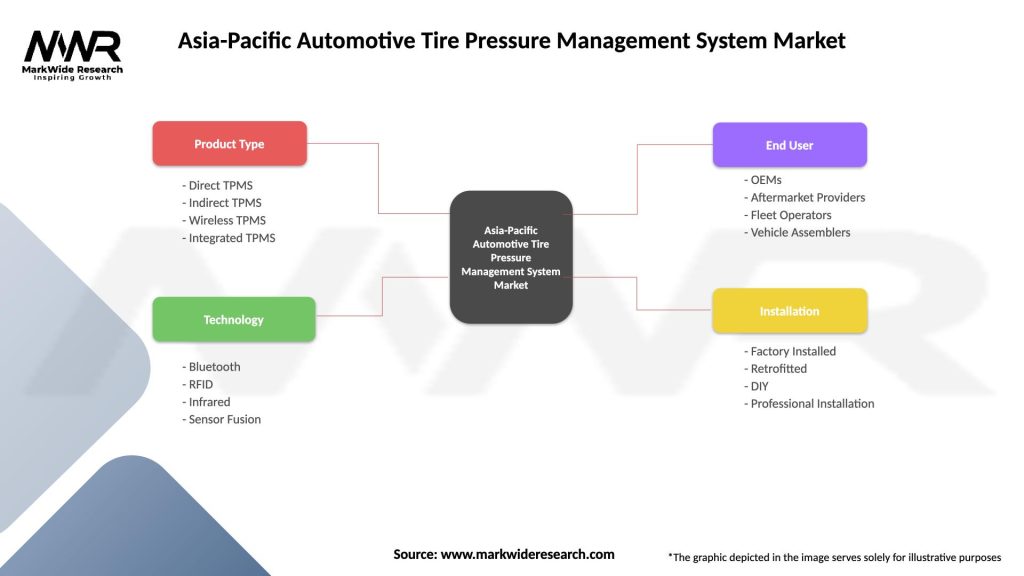

Segmentation

The Asia-Pacific automotive tire pressure management system market can be segmented based on vehicle type, technology, and distribution channel.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The Asia-Pacific automotive tire pressure management system market, like many other industries, experienced the impact of the COVID-19 pandemic. The pandemic led to disruptions in the automotive supply chain, production shutdowns, and reduced vehicle sales, affecting the TPMS market. However, the market showed resilience as the demand for vehicle safety remained a priority. The recovery in the automotive sector and the implementation of government stimulus measures supported market growth. The pandemic also highlighted the importance of TPMS in ensuring vehicle safety and reducing accidents caused by tire failures, further driving market demand.

Key Industry Developments

Analyst Suggestions

Future Outlook

The future outlook for the Asia-Pacific automotive tire pressure management system market is promising. The market is expected to witness steady growth due to increasing vehicle production, government regulations mandating TPMS installation, and rising consumer awareness about vehicle safety. Technological advancements, such as the integration of TPMS with ADAS, smart sensors, and wireless technologies, will further drive market growth. The market is also expected to benefit from the growing demand for electric vehicles and the focus on fuel efficiency and environmental sustainability. Overall, the future of the TPMS market in the Asia-Pacific region looks positive, with opportunities for innovation, market expansion, and industry collaborations.

Conclusion

The Asia-Pacific automotive tire pressure management system market has experienced significant growth driven by factors such as increasing vehicle safety concerns, government regulations, rising consumer awareness, and advancements in sensor technology. TPMS has become a crucial feature in vehicles, ensuring optimal tire performance, safety, and fuel efficiency. Despite challenges such as high initial costs and lack of standardization, there are several opportunities for market growth, including the increasing vehicle production, rising demand for electric vehicles, and advancements in sensor technology. The market is highly competitive, with key players focusing on product innovation and strategic partnerships. With the recovery of the automotive sector post-COVID-19, the future outlook for the TPMS market in the Asia-Pacific region remains positive, with potential for further growth and advancements in the coming years.

What is Automotive Tire Pressure Management System?

Automotive Tire Pressure Management System refers to technologies designed to monitor and manage tire pressure in vehicles, ensuring optimal performance, safety, and fuel efficiency. These systems can alert drivers to low tire pressure and help maintain proper inflation levels.

What are the key players in the Asia-Pacific Automotive Tire Pressure Management System Market?

Key players in the Asia-Pacific Automotive Tire Pressure Management System Market include Schrader Electronics, Continental AG, and Sensata Technologies, among others. These companies are known for their innovative solutions and contributions to tire pressure management technologies.

What are the growth factors driving the Asia-Pacific Automotive Tire Pressure Management System Market?

The growth of the Asia-Pacific Automotive Tire Pressure Management System Market is driven by increasing vehicle production, rising awareness of vehicle safety, and the growing demand for fuel-efficient vehicles. Additionally, advancements in sensor technology and regulatory mandates for tire pressure monitoring are contributing to market expansion.

What challenges does the Asia-Pacific Automotive Tire Pressure Management System Market face?

Challenges in the Asia-Pacific Automotive Tire Pressure Management System Market include the high cost of advanced systems and the lack of standardization across different vehicle models. Furthermore, consumer awareness and acceptance of these technologies can vary significantly across the region.

What opportunities exist in the Asia-Pacific Automotive Tire Pressure Management System Market?

Opportunities in the Asia-Pacific Automotive Tire Pressure Management System Market include the increasing adoption of electric vehicles, which often require advanced tire management systems, and the potential for integration with smart vehicle technologies. Additionally, growing environmental concerns are pushing for innovations in tire pressure management.

What trends are shaping the Asia-Pacific Automotive Tire Pressure Management System Market?

Trends in the Asia-Pacific Automotive Tire Pressure Management System Market include the development of wireless tire pressure monitoring systems and the integration of these systems with vehicle telematics. There is also a growing focus on sustainability, with manufacturers exploring eco-friendly materials and practices in tire management.

Asia-Pacific Automotive Tire Pressure Management System Market

| Segmentation Details | Description |

|---|---|

| Product Type | Direct TPMS, Indirect TPMS, Wireless TPMS, Integrated TPMS |

| Technology | Bluetooth, RFID, Infrared, Sensor Fusion |

| End User | OEMs, Aftermarket Providers, Fleet Operators, Vehicle Assemblers |

| Installation | Factory Installed, Retrofitted, DIY, Professional Installation |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in Asia-Pacific Automotive Tire Pressure Management System Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at