444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The Arrayed Waveguide Grating (AWG) Devices market is a rapidly growing segment within the telecommunications industry. AWG devices play a crucial role in optical communication systems by enabling the multiplexing and demultiplexing of multiple wavelengths of light. These devices are used in a wide range of applications, including fiber-optic networks, data centers, and telecommunications infrastructure.

Meaning

Arrayed Waveguide Grating (AWG) Devices are optical components that use an array of waveguides to separate and combine different wavelengths of light. They are commonly used in wavelength division multiplexing (WDM) systems, where multiple channels of information can be transmitted simultaneously over a single optical fiber. AWG devices provide high channel counts, low insertion loss, and excellent wavelength accuracy, making them an essential component in modern optical communication networks.

Executive Summary

The Arrayed Waveguide Grating (AWG) Devices market has witnessed significant growth in recent years, driven by the increasing demand for high-speed data transmission and the adoption of optical communication technologies. The market is characterized by intense competition among key players, who are continuously investing in research and development to enhance the performance and efficiency of AWG devices.

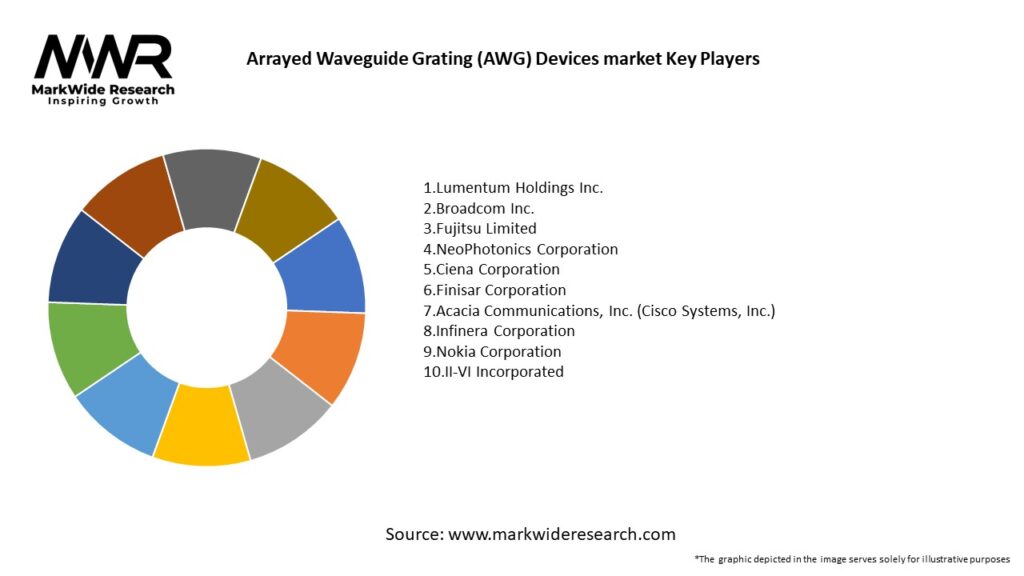

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The Arrayed Waveguide Grating (AWG) Devices market is characterized by intense competition and rapid technological advancements. Key market dynamics include:

Regional Analysis

The Arrayed Waveguide Grating (AWG) Devices market is segmented into several regions, including North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa. The regional analysis provides insights into the market size, growth rate, and key market trends specific to each region.

Competitive Landscape

Leading Companies in the Arrayed Waveguide Grating (AWG) Devices Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The Arrayed Waveguide Grating (AWG) Devices market can be segmented based on the following factors:

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

A SWOT analysis provides an overview of the Arrayed Waveguide Grating (AWG) Devices market by analyzing its strengths, weaknesses, opportunities, and threats.

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic has had both positive and negative impacts on the Arrayed Waveguide Grating (AWG) Devices market. On the positive side, the increased demand for high-speed internet connectivity and data transmission during lockdowns and remote working arrangements has driven the need for enhanced optical communication networks. AWG devices have played a critical role in meeting this demand by enabling efficient data transmission.

However, the pandemic has also presented challenges for the market. Supply chain disruptions, manufacturing delays, and reduced investments in infrastructure projects have affected the production and deployment of AWG devices. The market has experienced fluctuations in demand, with some industries experiencing slowdowns in network expansion plans.

Key Industry Developments

Analyst Suggestions

Future Outlook

The Arrayed Waveguide Grating (AWG) Devices market is expected to continue its growth trajectory in the coming years. The increasing demand for high-speed data transmission, advancements in optical communication technologies, and the deployment of 5G networks will drive market expansion.

Furthermore, the integration of AWG devices with emerging technologies like silicon photonics and the growing emphasis on energy efficiency will shape the future of the market. Strategic partnerships, collaborations, and investments in research and development will play a crucial role in driving innovation and market competitiveness.

Conclusion

In conclusion, the Arrayed Waveguide Grating (AWG) Devices market presents significant opportunities for industry participants and stakeholders. By addressing key market drivers, leveraging emerging trends, and overcoming challenges, companies can position themselves for success in this dynamic and evolving market.

What is Arrayed Waveguide Grating (AWG) Devices?

Arrayed Waveguide Grating (AWG) Devices are optical components used for wavelength division multiplexing, enabling the separation and routing of multiple wavelengths of light. They are essential in telecommunications and data center applications for efficient signal processing.

What are the key companies in the Arrayed Waveguide Grating (AWG) Devices market?

Key companies in the Arrayed Waveguide Grating (AWG) Devices market include Cisco Systems, Finisar Corporation, and Lumentum Operations, among others.

What are the growth factors driving the Arrayed Waveguide Grating (AWG) Devices market?

The growth of the Arrayed Waveguide Grating (AWG) Devices market is driven by the increasing demand for high-speed data transmission, the expansion of fiber optic networks, and the rise in cloud computing services.

What challenges does the Arrayed Waveguide Grating (AWG) Devices market face?

Challenges in the Arrayed Waveguide Grating (AWG) Devices market include the high cost of manufacturing, the complexity of integration with existing systems, and competition from alternative technologies such as optical switches.

What opportunities exist in the Arrayed Waveguide Grating (AWG) Devices market?

Opportunities in the Arrayed Waveguide Grating (AWG) Devices market include advancements in photonic integration, the growing adoption of 5G technology, and the increasing need for efficient data center solutions.

What trends are shaping the Arrayed Waveguide Grating (AWG) Devices market?

Trends in the Arrayed Waveguide Grating (AWG) Devices market include the development of miniaturized devices, the integration of AWG with other photonic components, and the focus on enhancing energy efficiency in optical networks.

Arrayed Waveguide Grating (AWG) Devices market

| Segmentation Details | Description |

|---|---|

| Product Type | Passive AWG, Active AWG, Integrated AWG, Hybrid AWG |

| End User | Telecommunications, Data Centers, Research Institutions, Defense |

| Technology | Silicon Photonics, InP Technology, Glass Waveguides, Polymer Waveguides |

| Application | Optical Networks, Signal Processing, Sensing, Test Equipment |

Leading Companies in the Arrayed Waveguide Grating (AWG) Devices Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at