444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview

The US insurance advertising market is a dynamic and competitive industry that encompasses various forms of advertising and marketing strategies aimed at promoting insurance products and services to consumers. Insurance companies rely on effective advertising campaigns to raise awareness, build brand recognition, and drive customer acquisition and retention. The market includes a wide range of advertising channels, such as television commercials, print advertisements, digital marketing, social media campaigns, and direct mail.

Meaning

Insurance advertising refers to the strategic communication efforts employed by insurance companies to convey their value proposition, showcase their products and services, and connect with their target audience. It involves creating compelling messages, designing engaging visuals, and selecting appropriate media platforms to reach and engage potential customers. Effective insurance advertising aims to build trust, educate consumers about insurance coverage options, and influence their purchasing decisions.

Executive Summary

The US insurance advertising market is highly competitive and dynamic, driven by various factors such as technological advancements, changing consumer behavior, regulatory landscape, and market trends. Insurance companies invest significant resources in advertising to differentiate themselves in the market, establish brand identity, and attract and retain customers. The advent of digital marketing and data analytics has revolutionized the advertising landscape, allowing insurers to target specific customer segments with personalized messages and offers. However, the market also faces challenges, including regulatory compliance, increased competition, and evolving consumer expectations. To succeed in the market, insurance companies must adapt their advertising strategies, leverage emerging technologies, and focus on customer-centric approaches.

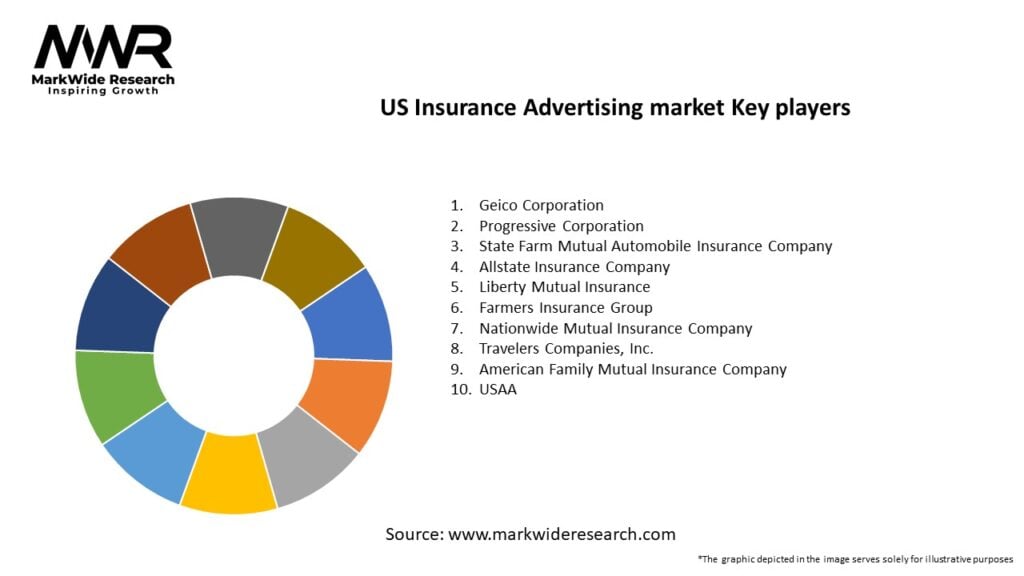

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The US insurance advertising market is shaped by various dynamics, including technological advancements, regulatory landscape, consumer behavior, and market trends. The market is characterized by intense competition, with insurance companies investing significant resources in advertising to gain a competitive edge. The shift to digital channels, personalization and targeting, and the emphasis on branding and trust are driving the evolution of insurance advertising strategies. Advertisers must navigate regulatory challenges, adapt to changing consumer behavior, and leverage emerging technologies to succeed in the market.

Regional Analysis

The US insurance advertising market is diverse and varies across regions within the country. Different states may have unique regulatory frameworks, cultural nuances, and consumer preferences that influence insurance advertising strategies. Regional analysis helps insurance advertisers understand and tailor their campaigns to specific geographic markets, taking into account regional trends, competition, and consumer behavior.

Competitive Landscape

Leading Companies in the US Insurance Advertising Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

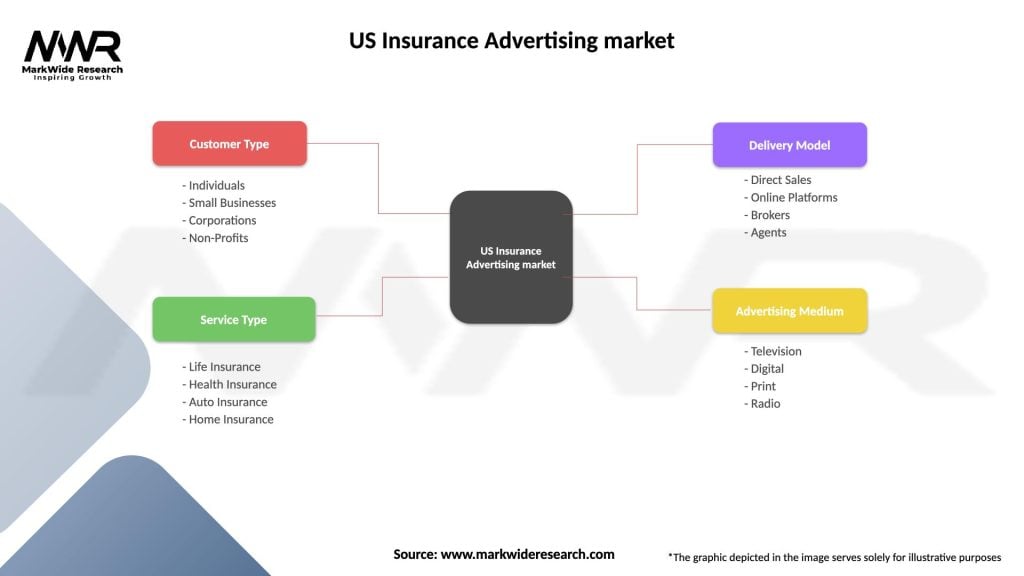

Segmentation

The US insurance advertising market can be segmented based on various factors, including insurance product type, target audience, geographic location, and advertising channels. Segmentation allows insurance advertisers to tailor their campaigns to specific customer segments, ensuring that messages resonate with the intended audience and maximize advertising effectiveness.

Category-wise Insights

Insurance advertisers can gain valuable insights by analyzing different insurance categories and their unique characteristics. By understanding category-specific trends, customer preferences, and competitive dynamics, insurance advertisers can develop targeted advertising strategies for each insurance category, maximizing their impact and return on investment.

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic has had a significant impact on the insurance advertising market. As consumer behaviors and priorities shifted during the pandemic, insurance advertisers needed to adapt their strategies to address new customer needs and concerns. The pandemic accelerated the digital transformation of the industry, with increased reliance on online channels for advertising and customer engagement. Virtual events, webinars, and online educational resources gained prominence as in-person interactions became limited. Advertisers also had to navigate the sensitive nature of advertising during a crisis, ensuring that their messaging was empathetic, relevant, and supportive.

Key Industry Developments

Analyst Suggestions

Future Outlook

The future of the US insurance advertising market is expected to be driven by advancements in technology, evolving consumer behaviors, and regulatory developments. Digital advertising will continue to play a significant role, with a focus on data-driven targeting, personalized experiences, and omnichannel campaigns. Insurance advertisers will need to adapt to changing consumer preferences, leverage emerging technologies, and prioritize customer engagement to remain competitive in the evolving landscape.

Conclusion

The US insurance advertising market is a dynamic and competitive space, driven by technological advancements, changing consumer behaviors, and regulatory requirements. Insurance advertisers play a crucial role in raising awareness, attracting customers, and building brand recognition. The market offers opportunities for innovation, personalization, and targeted advertising. However, advertisers must navigate challenges such as regulatory compliance, increasing competition, and evolving consumer expectations. By embracing digital transformation, adopting a customer-centric approach, and staying abreast of market trends, insurance advertisers can position themselves for success in the US insurance advertising market.

What is US Insurance Advertising?

US Insurance Advertising refers to the promotional activities and strategies used by insurance companies to market their products and services to consumers. This includes various channels such as television, online platforms, print media, and social media to reach potential customers effectively.

What are the key players in the US Insurance Advertising market?

Key players in the US Insurance Advertising market include major insurance companies such as State Farm, Geico, Allstate, and Progressive. These companies utilize diverse advertising strategies to enhance brand visibility and attract new customers, among others.

What are the main drivers of growth in the US Insurance Advertising market?

The growth of the US Insurance Advertising market is driven by increasing competition among insurers, the rise of digital marketing channels, and changing consumer preferences towards personalized insurance solutions. Additionally, advancements in data analytics are enabling more targeted advertising strategies.

What challenges does the US Insurance Advertising market face?

The US Insurance Advertising market faces challenges such as regulatory constraints, the need for compliance with advertising standards, and the difficulty in measuring the effectiveness of advertising campaigns. Additionally, consumer skepticism towards insurance advertisements can hinder engagement.

What opportunities exist in the US Insurance Advertising market?

Opportunities in the US Insurance Advertising market include the growing use of social media for targeted advertising, the potential for innovative digital marketing strategies, and the increasing demand for insurance products tailored to specific demographics. These trends can help companies reach new customer segments.

What trends are shaping the US Insurance Advertising market?

Trends shaping the US Insurance Advertising market include the integration of artificial intelligence in ad targeting, the rise of influencer marketing, and a focus on sustainability in advertising messages. These trends reflect the evolving landscape of consumer engagement and brand positioning.

US Insurance Advertising market

| Segmentation Details | Description |

|---|---|

| Customer Type | Individuals, Small Businesses, Corporations, Non-Profits |

| Service Type | Life Insurance, Health Insurance, Auto Insurance, Home Insurance |

| Delivery Model | Direct Sales, Online Platforms, Brokers, Agents |

| Advertising Medium | Television, Digital, Print, Radio |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the US Insurance Advertising Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at