444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

Market Overview

The UK wealth and liquid asset market encompasses a wide range of financial products and services that cater to individuals and institutions seeking to grow and preserve their wealth. This market includes various investment vehicles, such as stocks, bonds, real estate, cash, and alternative investments. It plays a crucial role in the overall economy and financial well-being of individuals and organizations in the United Kingdom.

Meaning

The UK wealth and liquid asset market refers to the sector that deals with the management, growth, and protection of financial assets. It involves financial institutions, wealth managers, investment advisors, and individuals seeking opportunities to generate returns and secure their financial future.

Executive Summary

The UK wealth and liquid asset market have witnessed steady growth over the years, driven by factors such as economic prosperity, financial innovation, and favorable investment climate. However, the market also faces challenges, including market volatility, regulatory changes, and geopolitical uncertainties. Opportunities exist in areas such as sustainable investments, digitalization, and personalized wealth management services.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The UK wealth and liquid asset market operate in a dynamic environment influenced by economic factors, market trends, regulatory changes, and investor behavior. Understanding market dynamics helps industry participants make informed decisions, adapt to changes, and identify new growth avenues.

Regional Analysis

The UK wealth and liquid asset market exhibit regional variations based on factors such as economic activity, population density, and investment preferences. London, as the financial hub of the UK, holds a significant share of the market, attracting both domestic and international investors. Regional analysis helps identify regional-specific trends, preferences, and investment opportunities.

Competitive Landscape

Leading Companies in the UK Wealth and Liquid Asset Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

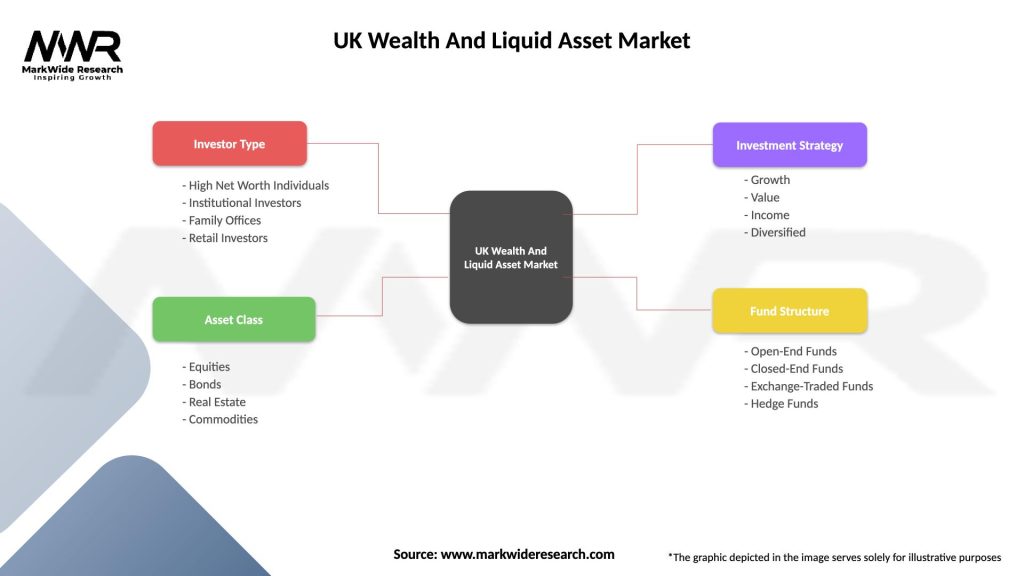

Segmentation

The UK wealth and liquid asset market can be segmented based on various criteria, including investment product types, investor profiles, and wealth thresholds. Segmenting the market enables targeted marketing, product development, and client segmentation strategies.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic had a significant impact on the UK wealth and liquid asset market. Volatile financial markets, economic uncertainties, and changes in investor behavior affected investment portfolios and strategies. However, the market demonstrated resilience, with opportunities emerging in sectors such as healthcare, technology, and sustainable investments.

Key Industry Developments

Analyst Suggestions

Future Outlook

The future of the UK wealth and liquid asset market is promising, driven by factors such as economic growth, technological advancements, and the growing demand for sustainable investments. However, challenges such as market volatility, regulatory changes, and geopolitical uncertainties require industry participants to stay agile and adapt to changing market conditions.

Conclusion

The UK wealth and liquid asset market offer opportunities for individuals and institutions to grow and preserve their wealth. The market dynamics, including economic factors, regulatory changes, and investor preferences, shape the industry’s growth and competitiveness. Embracing sustainable investments, digitalization, and personalized wealth management will be key to success. The future outlook remains positive, but industry participants must navigate challenges and capitalize on emerging trends to thrive in this dynamic market.

What is Wealth And Liquid Asset?

Wealth and liquid assets refer to the financial resources that individuals or entities can easily convert into cash or use for investments. This includes cash, stocks, bonds, and other easily tradable assets that contribute to an individual’s or organization’s overall financial health.

What are the key players in the UK Wealth And Liquid Asset Market?

Key players in the UK Wealth And Liquid Asset Market include major financial institutions such as Barclays, HSBC, and Lloyds Banking Group. These companies provide a range of services related to wealth management and liquid asset investment, among others.

What are the growth factors driving the UK Wealth And Liquid Asset Market?

The UK Wealth And Liquid Asset Market is driven by factors such as increasing disposable incomes, a growing number of high-net-worth individuals, and the rising demand for investment opportunities. Additionally, advancements in financial technology are making asset management more accessible.

What challenges does the UK Wealth And Liquid Asset Market face?

Challenges in the UK Wealth And Liquid Asset Market include regulatory changes, market volatility, and economic uncertainties that can affect investor confidence. Additionally, competition from fintech companies is reshaping traditional wealth management practices.

What opportunities exist in the UK Wealth And Liquid Asset Market?

Opportunities in the UK Wealth And Liquid Asset Market include the expansion of digital wealth management platforms and the increasing interest in sustainable investment options. There is also potential for growth in personalized financial advisory services.

What trends are shaping the UK Wealth And Liquid Asset Market?

Trends in the UK Wealth And Liquid Asset Market include a shift towards sustainable investing, the integration of artificial intelligence in asset management, and a growing focus on financial literacy among consumers. These trends are influencing how wealth is managed and invested.

UK Wealth And Liquid Asset Market

| Segmentation Details | Description |

|---|---|

| Investor Type | High Net Worth Individuals, Institutional Investors, Family Offices, Retail Investors |

| Asset Class | Equities, Bonds, Real Estate, Commodities |

| Investment Strategy | Growth, Value, Income, Diversified |

| Fund Structure | Open-End Funds, Closed-End Funds, Exchange-Traded Funds, Hedge Funds |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the UK Wealth and Liquid Asset Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at