444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

Market Overview

The Asia-Pacific lactic acid market is experiencing significant growth and is expected to continue its upward trajectory in the coming years. Lactic acid is a vital organic compound that is widely used in various industries, including food and beverages, pharmaceuticals, personal care, and bioplastics. It is produced through the fermentation of carbohydrates, mainly sugars, by the action of lactic acid bacteria.

Meaning

Lactic acid is a colorless liquid or white solid with a slightly sour taste. It is commonly found in dairy products and is responsible for the tangy flavor in yogurt. Apart from its culinary applications, lactic acid is a versatile ingredient that offers numerous benefits in different industries. Its unique properties make it an essential component in the production of various products, ranging from food additives to biodegradable plastics.

Executive Summary

The Asia-Pacific lactic acid market has witnessed substantial growth in recent years, driven by the increasing demand for eco-friendly and sustainable products across multiple sectors. The market is driven by factors such as the rising awareness of the harmful effects of conventional chemicals, growing consumer preference for natural and organic ingredients, and stringent government regulations promoting environmentally friendly practices.

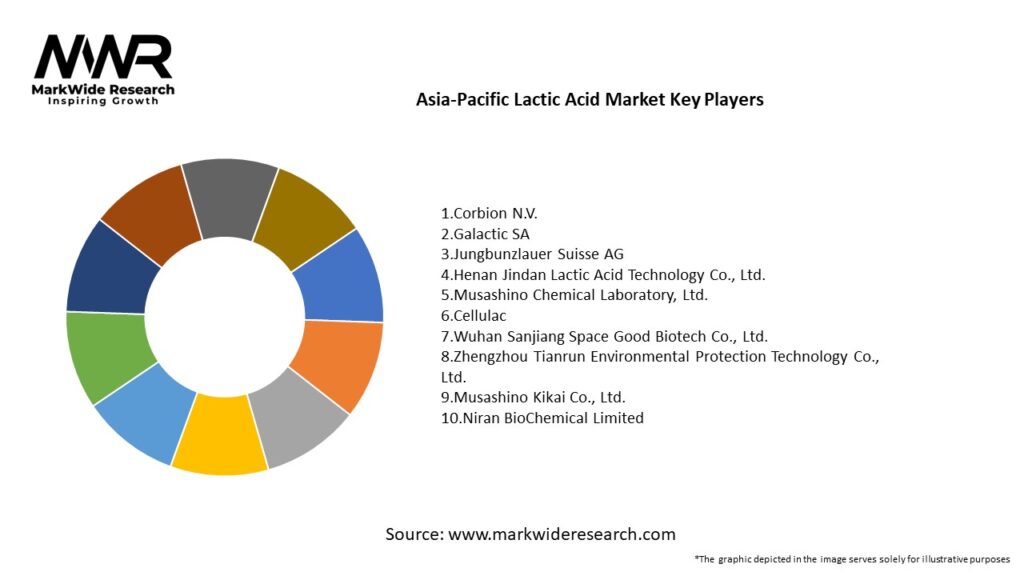

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The Asia-Pacific lactic acid market is driven by a combination of factors, including consumer preferences, government regulations, technological advancements, and industry collaborations. These dynamics contribute to the growth, expansion, and innovation in the market.

Regional Analysis

The Asia-Pacific lactic acid market is geographically segmented into several key regions, including China, India, Japan, South Korea, Australia, and others. China dominates the regional market due to its large population, robust industrial sector, and government initiatives promoting sustainable practices. India and Japan also hold significant market shares due to their growing economies and increasing consumer awareness.

Competitive Landscape

Leading Companies in the Asia-Pacific Lactic Acid Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The market can be segmented based on the type of lactic acid, application, and end-use industry. By type, lactic acid can be classified into two main categories: D-lactic acid and L-lactic acid. Applications of lactic acid include food and beverages, personal care products, pharmaceuticals, bioplastics, and others. The end-use industries that extensively utilize lactic acid are food and beverages, cosmetics, pharmaceuticals, and packaging.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic has had both positive and negative impacts on the Asia-Pacific lactic acid market. On one hand, the increased focus on health and hygiene has driven the demand for personal care products, including those containing lactic acid. The importance of clean label ingredients and natural formulations has also been emphasized during the pandemic, further boosting the demand for lactic acid.

On the other hand, disruptions in the supply chain and manufacturing operations have affected the market. Restrictions on movement and lockdown measures have caused challenges in sourcing raw materials and hindered production capacities. However, as the situation gradually stabilizes, the market is expected to recover and regain its growth momentum.

Key Industry Developments

Analyst Suggestions

Future Outlook

The future outlook for the Asia-Pacific lactic acid market is promising. The market is expected to witness sustained growth due to factors such as increasing consumer awareness, government support for sustainable practices, and technological advancements. The demand for natural and eco-friendly products is anticipated to drive the adoption of lactic acid across industries. Ongoing research and development efforts are likely to further expand its applications and improve production efficiencies.

Conclusion

The Asia-Pacific lactic acid market is poised for significant growth in the coming years. The market is driven by factors such as increasing consumer preference for natural and organic products, government regulations promoting sustainability, and advancements in biotechnology and fermentation techniques. Although challenges exist, such as high production costs and limited raw material availability, opportunities in functional foods, personal care, and pharmaceutical industries offer avenues for market expansion. By capitalizing on these trends and leveraging the strengths of lactic acid, industry participants can thrive in this dynamic and evolving market.

Asia-Pacific Lactic Acid Market

| Segmentation Details | Description |

|---|---|

| Product Type | Food Grade, Industrial Grade, Cosmetic Grade, Pharmaceutical Grade |

| End User | Food & Beverage, Personal Care, Pharmaceuticals, Bioplastics |

| Application | Preservative, Acidulant, Solvent, pH Regulator |

| Packaging Type | Drums, Bags, Bulk Containers, Bottles |

Leading Companies in the Asia-Pacific Lactic Acid Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at