Market Overview

The Claims Processing Software market is witnessing significant growth and is expected to continue expanding in the coming years. Claims processing software refers to a digital solution that automates and streamlines the entire claims management process for insurance companies, healthcare providers, and other industries that handle large volumes of claims.

Meaning

Claims processing software simplifies the complex and time-consuming task of processing claims by leveraging advanced technologies such as artificial intelligence (AI), machine learning (ML), and robotic process automation (RPA). This software helps in efficient data capture, validation, adjudication, and payment processing, reducing manual errors and improving overall operational efficiency.

Executive Summary

The global Claims Processing Software market has experienced remarkable growth due to the increasing adoption of digital transformation and the need for streamlining claim management processes. The market has witnessed the emergence of several key players offering innovative software solutions to cater to the specific needs of various industries.

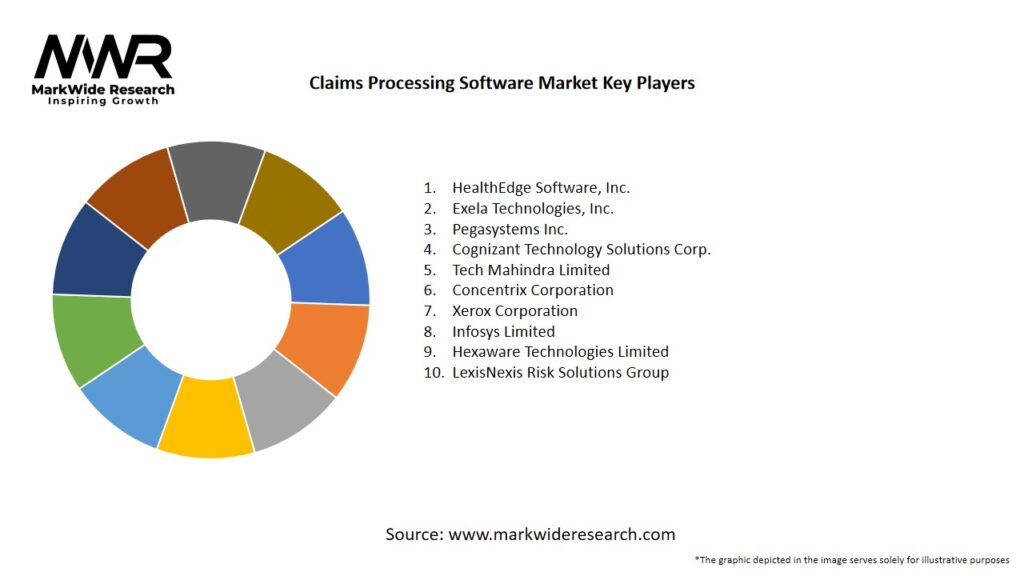

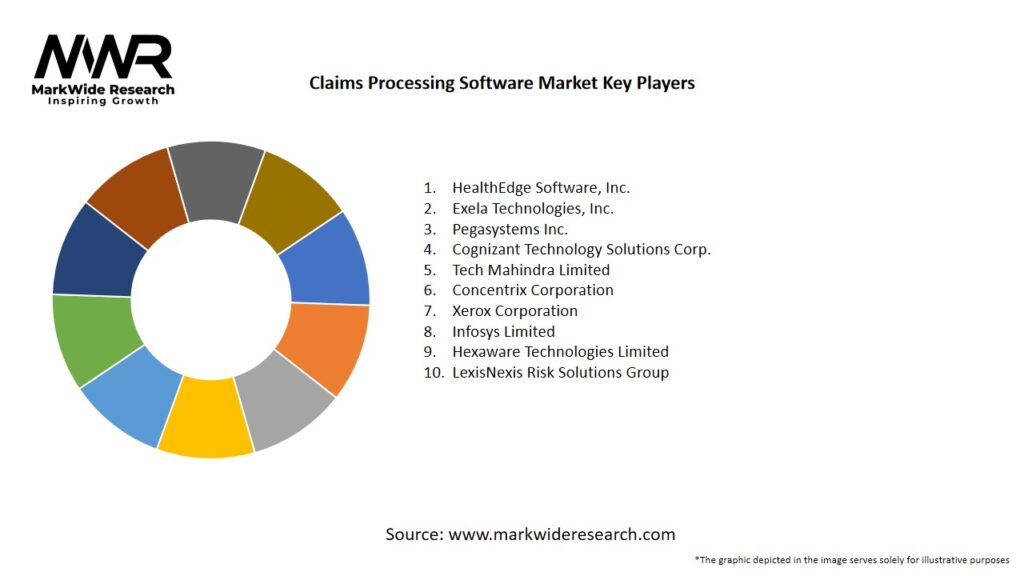

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

- The market is driven by the rising demand for automated and efficient claims processing solutions across industries.

- Advancements in AI, ML, and RPA technologies have enhanced the capabilities of claims processing software.

- Cloud-based deployment models are gaining traction due to their scalability and cost-effectiveness.

- The insurance sector holds a significant share in the market due to the increasing volume of insurance claims.

- The healthcare industry is also a major adopter of claims processing software, driven by the need for streamlined medical billing and insurance claim settlement processes.

Market Drivers

Several factors are driving the growth of the Claims Processing Software market:

- Increasing complexity and volume of claims: The growing number of claims across industries has led to a demand for automated solutions to handle the complexity and volume efficiently.

- Cost reduction and operational efficiency: Claims processing software eliminates manual processes, reduces errors, and improves overall operational efficiency, resulting in cost savings for organizations.

- Enhanced customer experience: Automation of claims processing enables faster turnaround times, improving customer satisfaction and loyalty.

- Integration of advanced technologies: The integration of AI, ML, and RPA technologies enables intelligent data processing, fraud detection, and predictive analytics, further improving the claims management process.

Market Restraints

Despite the positive growth prospects, the Claims Processing Software market faces some challenges:

- Concerns regarding data security and privacy: As claims processing software involves handling sensitive personal and financial information, ensuring data security and privacy is a top priority for organizations.

- Integration complexities: Integrating claims processing software with existing legacy systems and workflows can be complex and time-consuming, posing challenges for organizations during implementation.

- Lack of skilled professionals: The shortage of skilled professionals proficient in claims processing software and related technologies can impede the adoption and implementation process.

Market Opportunities

The Claims Processing Software market presents lucrative opportunities for industry players:

- Integration with emerging technologies: The integration of claims processing software with emerging technologies such as blockchain and natural language processing (NLP) can further enhance its capabilities and open up new opportunities.

- Expansion in untapped markets: Emerging economies offer untapped opportunities for claims processing software providers, as these regions experience rapid growth in industries such as healthcare, insurance, and finance.

- Customization and tailored solutions: Offering customizable and tailored solutions to cater to the unique requirements of different industries can attract a broader customer base.

Market Dynamics

The Claims Processing Software market is characterized by dynamic factors that shape its growth and evolution:

- Technological advancements: Continuous advancements in AI, ML, and RPA technologies drive innovation and improve the functionalities of claims processing software.

- Increasing demand for automation: The need for automation and digital transformation across industries has created a favorable environment for the adoption of claims processing software.

- Regulatory landscape: Changing regulations and compliance requirements in various industries, such as healthcare and insurance, influence the adoption of claims processing software to ensure adherence to industry standards.

- Strategic partnerships and collaborations: Key players in the market are forming strategic partnerships and collaborations to leverage their expertise and expand their customer base.

Regional Analysis

The Claims Processing Software market is analyzed across various regions:

- North America: The region dominates the market due to the presence of major software vendors and the high adoption rate of claims processing software in industries such as insurance and healthcare.

- Europe: The European market is witnessing steady growth, driven by the increasing focus on digital transformation and the need for efficient claims management processes.

- Asia Pacific: The region presents significant growth opportunities, propelled by the expanding insurance and healthcare sectors, and the rising adoption of claims processing software to streamline operations.

- Latin America: The market in Latin America is expected to witness steady growth, driven by the increasing digitization efforts in industries such as finance and healthcare.

- Middle East and Africa: The market in this region is fueled by the growing awareness of the benefits of claims processing software and the need to improve operational efficiency.

Competitive Landscape

Leading Companies in the Claims Processing Software Market:

- HealthEdge Software, Inc.

- Exela Technologies, Inc.

- Pegasystems Inc.

- Cognizant Technology Solutions Corp.

- Tech Mahindra Limited

- Concentrix Corporation

- Xerox Corporation

- Infosys Limited

- Hexaware Technologies Limited

- LexisNexis Risk Solutions Group

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

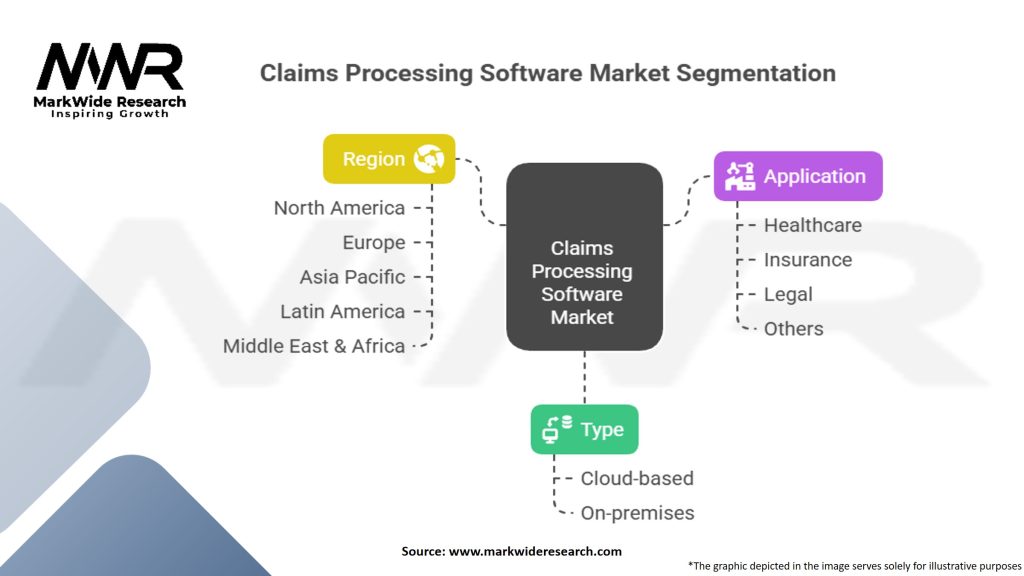

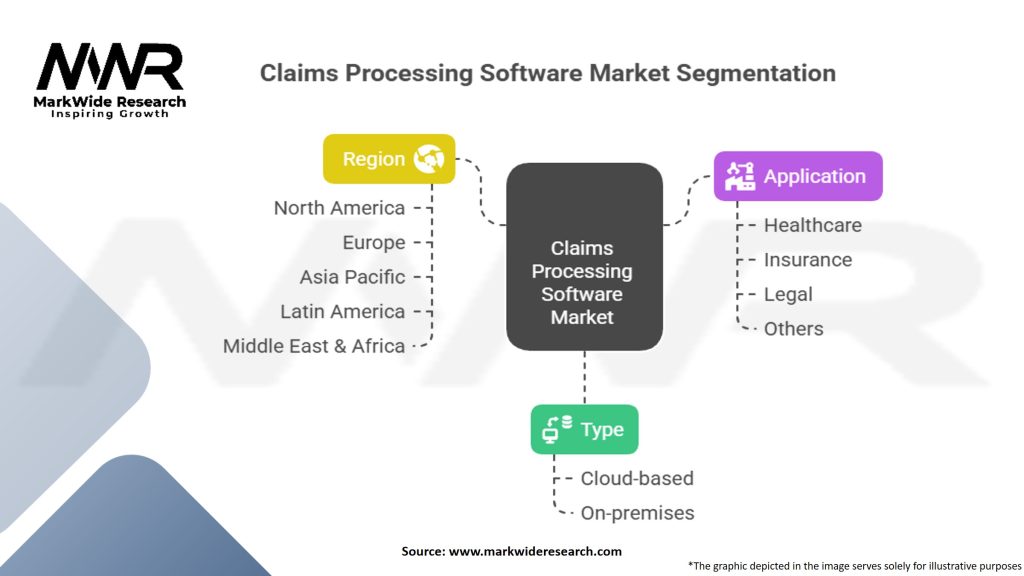

Segmentation

The Claims Processing Software market can be segmented based on:

- Deployment Model: a. On-premises b. Cloud-based c. Hybrid

- Organization Size: a. Small and Medium-sized Enterprises (SMEs) b. Large Enterprises

- Industry Vertical: a. Insurance b. Healthcare c. Finance d. Retail e. Others

Category-wise Insights

- Insurance Sector: a. Claims processing software helps insurance companies automate the entire claims management process, resulting in faster claim settlements and improved customer satisfaction. b. Integration of AI and ML technologies enables accurate fraud detection and risk assessment, minimizing fraudulent claims and reducing financial losses.

- Healthcare Sector: a. Claims processing software streamlines medical billing and insurance claim processing, reducing errors and improving revenue cycle management. b. Integration with electronic health record (EHR) systems ensures seamless data exchange and enhances the efficiency of claims processing in healthcare organizations.

- Finance Sector: a. Claims processing software in the finance sector automates the processing of financial claims, such as reimbursement claims, loan claims, and tax claims, improving operational efficiency and reducing manual errors. b. Integration with accounting and financial management systems enables seamless claim validation, approval, and payment processing.

Key Benefits for Industry Participants and Stakeholders

- Improved operational efficiency: Claims processing software automates manual tasks, reducing processing time and increasing efficiency.

- Cost savings: Automation reduces the need for manual labor and minimizes errors, resulting in cost savings for organizations.

- Enhanced accuracy: Advanced technologies such as AI and ML improve accuracy in claims processing, minimizing errors and fraud.

- Faster claim settlements: Automation enables faster claim adjudication and payment processing, leading to quicker claim settlements and improved customer satisfaction.

- Better compliance and regulatory adherence: Claims processing software helps organizations adhere to industry regulations and compliance standards, reducing the risk of penalties.

SWOT Analysis

Strengths:

- Advanced technology integration

- Streamlined claims management process

- Improved operational efficiency

Weaknesses:

- Integration complexities with legacy systems

- Dependence on skilled professionals

Opportunities:

- Integration with emerging technologies

- Expansion in untapped markets

Threats:

- Data security and privacy concerns

- Intense competition in the market

Market Key Trends

- Increasing adoption of cloud-based solutions: The shift towards cloud-based deployment models offers scalability, flexibility, and cost-effectiveness to organizations.

- Focus on predictive analytics: Claims processing software is incorporating predictive analytics capabilities to identify patterns, trends, and potential risks in claims data, enabling proactive decision-making.

- Mobile applications and self-service portals: The development of mobile applications and self-service portals allows customers to file and track claims conveniently, improving customer experience and reducing the workload on customer support teams.

Covid-19 Impact

The Covid-19 pandemic has had a significant impact on the Claims Processing Software market:

- Accelerated digitization: The pandemic highlighted the need for digital solutions, leading to increased adoption of claims processing software to enable remote work and ensure business continuity.

- Surge in insurance claims: The healthcare and travel insurance sectors experienced a surge in claims, increasing the demand for efficient claims processing software to handle the influx of claims.

- Focus on cost optimization: Organizations turned to claims processing software to streamline operations, reduce costs, and maintain profitability in the challenging economic environment.

Key Industry Developments

- Introduction of AI-powered claims processing solutions: Key players are integrating AI capabilities into their claims processing software to automate data extraction, analysis, and decision-making processes.

- Collaborations with insurtech startups: Established software vendors are partnering with insurtech startups to leverage their innovative technologies and enhance their claims processing solutions.

- Expansion into emerging markets: Key players are expanding their presence in emerging markets to capitalize on the growing demand for claims processing software in industries such as healthcare and insurance.

Analyst Suggestions

- Focus on data security: Companies should prioritize robust data security measures to protect sensitive customer information and build trust with clients.

- Embrace emerging technologies: Investing in emerging technologies such as blockchain and NLP can enhance the functionalities of claims processing software and provide a competitive advantage.

- Offer customizable solutions: Tailoring solutions to meet the specific needs of different industries and organizations can attract a broader customer base.

Future Outlook

The future of the Claims Processing Software market looks promising, with the following trends and opportunities:

- Continued adoption of automation: Organizations across industries will increasingly embrace claims processing software to automate manual processes, reduce errors, and improve operational efficiency.

- Integration with emerging technologies: The integration of claims processing software with emerging technologies will further enhance its capabilities, enabling advanced analytics, fraud detection, and real-time processing.

- Expansion in healthcare and finance sectors: The healthcare and finance sectors will be key drivers of market growth, as the demand for streamlined claims management processes and regulatory compliance increases.

- Focus on user experience: User-friendly interfaces, mobile applications, and self-service portals will play a crucial role in improving customer experience and driving adoption.

Conclusion

The Claims Processing Software market is witnessing significant growth, driven by the increasing demand for automated and efficient claims management solutions across industries. Advancements in AI, ML, and RPA technologies, along with the need for cost reduction and improved operational efficiency, are propelling market growth. While the market faces challenges related to data security and integration complexities, it also presents opportunities for integration with emerging technologies and expansion in untapped markets. As organizations continue to prioritize digital transformation and automation, the future of the Claims Processing Software market looks promising, with continued innovation and strategic partnerships shaping its growth.

Claims Processing Software Market

| Segmentation Details |

Details |

| Type |

Cloud-based, On-premises |

| Application |

Healthcare, Insurance, Legal, Others |

| Region |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Claims Processing Software Market:

- HealthEdge Software, Inc.

- Exela Technologies, Inc.

- Pegasystems Inc.

- Cognizant Technology Solutions Corp.

- Tech Mahindra Limited

- Concentrix Corporation

- Xerox Corporation

- Infosys Limited

- Hexaware Technologies Limited

- LexisNexis Risk Solutions Group

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA