Market Overview

The digital banking platform market has witnessed significant growth in recent years, driven by the increasing adoption of digitalization in the banking sector. Digital banking platforms enable banks and financial institutions to offer a wide range of online banking services to their customers, including account management, fund transfers, bill payments, and loan applications, among others. These platforms provide convenience, accessibility, and personalized experiences to users, transforming the way banking services are delivered.

Meaning

A digital banking platform refers to the technology infrastructure and software solutions used by banks and financial institutions to deliver digital banking services to their customers. It encompasses a variety of components, such as mobile banking applications, online portals, payment gateways, and backend systems. These platforms enable users to access banking services anytime, anywhere, using their preferred devices, such as smartphones, tablets, or computers. Digital banking platforms aim to streamline banking operations, enhance customer engagement, and drive operational efficiency.

Executive Summary

The global digital banking platform market is experiencing robust growth, driven by the increasing demand for seamless digital banking experiences. The market is witnessing significant investments in technological advancements and innovations to offer enhanced security, personalization, and convenience to customers. Moreover, the emergence of new players and the expansion of existing banking institutions into the digital space are further fueling market growth.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

- Rising Adoption of Mobile Banking: The widespread use of smartphones and the growing popularity of mobile applications have contributed to the rapid adoption of mobile banking services. Customers are increasingly opting for mobile banking apps to perform various financial transactions, leading to the growth of the digital banking platform market.

- Focus on Enhanced Security: With the increasing volume of digital transactions, security has become a top priority for banks and customers. Digital banking platforms are investing in advanced security measures such as biometric authentication, encryption, and fraud detection to ensure the safety of customer data and transactions.

- Demand for Personalized Banking Experiences: Customers now expect personalized experiences and tailored recommendations from their banking service providers. Digital banking platforms are leveraging artificial intelligence and data analytics to offer personalized banking services, targeted marketing campaigns, and customized product offerings.

- Integration of Emerging Technologies: The integration of emerging technologies such as artificial intelligence (AI), machine learning (ML), blockchain, and Internet of Things (IoT) is revolutionizing the digital banking platform market. These technologies enable banks to automate processes, improve operational efficiency, and offer innovative services.

Market Drivers

- Increasing Digital Transformation Initiatives: Banks and financial institutions are embracing digital transformation to stay competitive in the market. The need to improve customer experiences, reduce costs, and streamline operations is driving the adoption of digital banking platforms.

- Growing Customer Expectations: Customers today expect seamless, user-friendly digital experiences across all industries, including banking. Digital banking platforms enable banks to meet these expectations by offering convenient, 24/7 access to banking services and personalized experiences.

- Cost Savings and Operational Efficiency: Digital banking platforms help banks reduce costs associated with physical branches and manual processes. Automation and digitization of banking operations lead to improved operational efficiency, faster transaction processing, and reduced overhead expenses.

- Increasing Smartphone Penetration: The widespread adoption of smartphones and the availability of high-speed internet access have fueled the growth of mobile banking. Digital banking platforms capitalize on this trend by offering mobile applications that allow users to access banking services on their smartphones.

Market Restraints

- Security Concerns: As digital banking transactions increase, so do concerns about data breaches, identity theft, and fraud. Banks and financial institutions need to invest heavily in robust security measures to protect customer data and maintain trust in digital banking platforms.

- Lack of Digital Literacy: Despite the increasing popularity of digital banking, a significant portion of the population still faces challenges in adopting and utilizing these platforms due to a lack of digital literacy. Bridging the digital divide and educating customers about the benefits and usage of digital banking platforms is essential.

- Regulatory Challenges: The digital banking industry is subject to various regulations and compliance requirements, which can vary across different countries and regions. Adhering to these regulations while offering innovative services can pose challenges for digital banking platform providers.

- Connectivity and Infrastructure Issues: In some regions, limited access to high-speed internet and inadequate technology infrastructure can hinder the widespread adoption of digital banking platforms. The availability and reliability of internet connectivity play a crucial role in the success of these platforms.

Market Opportunities

- Untapped Emerging Markets: Emerging economies offer significant growth opportunities for digital banking platform providers. As these countries undergo economic development and technological advancements, there is a growing demand for digital banking services, presenting a vast untapped market.

- Integration of Open Banking: Open banking initiatives are gaining traction globally, enabling customers to share their financial data securely with authorized third-party providers. Digital banking platforms that support open banking create new opportunities for collaboration, innovation, and personalized financial services.

- Expansion of Digital Payment Services: The rise of digital payments, including mobile wallets, peer-to-peer transfers, and contactless payments, presents opportunities for digital banking platforms to integrate and provide seamless payment solutions, enhancing customer convenience.

- Focus on Customer Experience: Improving customer experience remains a key opportunity for digital banking platforms. By leveraging technologies such as AI, ML, and natural language processing (NLP), banks can offer personalized recommendations, virtual assistants, and proactive customer support to enhance user satisfaction.

Market Dynamics

The digital banking platform market is characterized by intense competition and rapid technological advancements. Key dynamics shaping the market include:

- Competition among Incumbent Banks and Fintech Startups: Traditional banks face competition from agile fintech startups that offer innovative digital banking solutions. Incumbent banks are investing in digital banking platforms or collaborating with fintech companies to stay competitive.

- Strategic Partnerships and Acquisitions: Established players in the banking and technology sectors are forming strategic partnerships and acquiring digital banking platform providers to expand their capabilities and accelerate market growth.

- Emphasis on User-Centric Design: User-centric design principles are driving the development of digital banking platforms. Intuitive interfaces, seamless navigation, and personalized experiences are critical factors for customer adoption and retention.

- Continuous Technological Innovations: The digital banking platform market is witnessing continuous technological innovations, such as AI-powered chatbots, voice banking, robo-advisors, and biometric authentication. These innovations enhance user experiences and drive market growth.

Regional Analysis

The digital banking platform market is experiencing significant growth across various regions. The key regional markets include:

- North America: The North American market is at the forefront of digital banking platform adoption, driven by technological advancements, high smartphone penetration, and changing customer preferences. The presence of major banking institutions and fintech hubs contributes to market growth in this region.

- Europe: Europe is witnessing rapid digital banking transformation, with countries such as the United Kingdom, Germany, and the Nordic countries leading the way. Stringent regulations, open banking initiatives, and the presence of tech-savvy customers drive the adoption of digital banking platforms in Europe.

- Asia Pacific: The Asia Pacific region is experiencing substantial growth in the digital banking platform market. Factors such as a large unbanked population, rising smartphone penetration, government initiatives promoting digital payments, and the presence of tech giants contribute to the market’s expansion in this region.

- Latin America: Latin America is an emerging market for digital banking platforms, fueled by increasing internet penetration, smartphone adoption, and efforts to bring the unbanked population into the formal banking system. Governments in the region are also promoting financial inclusion, further driving market growth.

Competitive Landscape

Leading Companies in the Digital Banking Platform Market:

- Fiserv, Inc.

- Infosys Limited

- Oracle Corporation

- SAP SE

- Tata Consultancy Services Limited

- Temenos AG

- Backbase

- EdgeVerve Systems Limited (a subsidiary of Infosys Limited)

- Finastra

- Appway AG

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

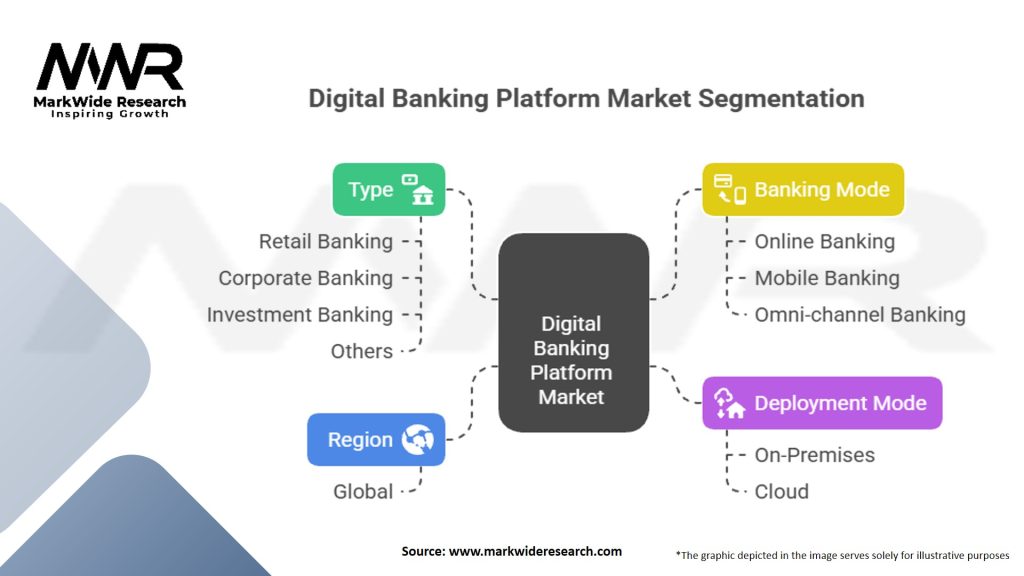

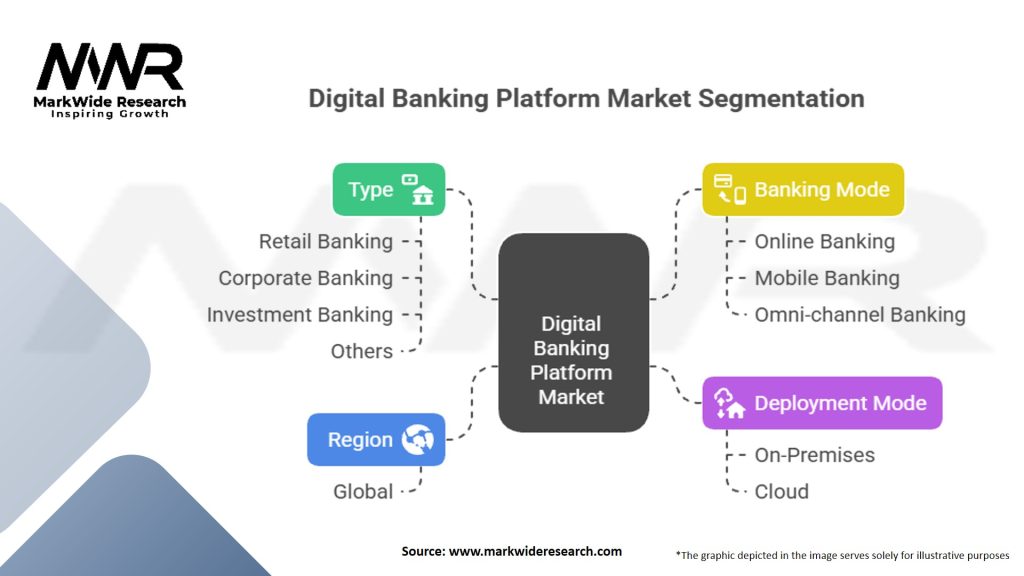

Segmentation

The digital banking platform market can be segmented based on:

- Banking Type: Retail Banking, Corporate Banking, and Investment Banking.

- Deployment Model: On-Premises and Cloud-Based.

- Solution: Core Banking Solutions, Mobile Banking Solutions, Online Banking Solutions, and Others.

- End-User: Banks, Financial Institutions, and Credit Unions.

Segmenting the market helps in understanding specific customer needs, tailoring solutions, and targeting the right customer segments.

Category-wise Insights

- Core Banking Solutions: Core banking solutions form the backbone of digital banking platforms, enabling banks to manage customer accounts, process transactions, and provide essential banking functionalities. These solutions offer real-time access to customer data, seamless integration with other banking modules, and centralized control over banking operations.

- Mobile Banking Solutions: Mobile banking solutions empower customers to access banking services through mobile applications. These solutions provide features such as balance inquiries, fund transfers, bill payments, and account management. Mobile banking apps are becoming increasingly sophisticated, incorporating biometric authentication, chatbots, and personalized recommendations.

- Online Banking Solutions: Online banking solutions encompass web-based platforms that allow customers to access banking services through internet browsers. These solutions offer a wide range of functionalities, including account monitoring, transaction history, online applications, and customer support. Online banking platforms focus on delivering user-friendly interfaces, robust security, and seamless integration with backend systems.

- Other Solutions: Apart from core banking, mobile banking, and online banking solutions, digital banking platforms offer additional features such as payment gateways, fraud detection systems, loan origination modules, and customer relationship management (CRM) tools. These solutions cater to specific banking requirements and enhance the overall functionality of the digital banking platform.

Key Benefits for Industry Participants and Stakeholders

The adoption of digital banking platforms offers several key benefits to industry participants and stakeholders, including:

- Enhanced Customer Experience: Digital banking platforms provide customers with convenient access to a wide range of banking services, personalized recommendations, and seamless user experiences. This leads to higher customer satisfaction and loyalty.

- Improved Operational Efficiency: By automating manual processes, digitizing transactions, and integrating backend systems, digital banking platforms help banks and financial institutions improve operational efficiency, reduce costs, and streamline workflows.

- Expanded Market Reach: Digital banking platforms enable banks to reach a broader customer base, including those in remote areas with limited physical banking infrastructure. This expands market opportunities and enhances financial inclusion.

- Data-driven Insights: Digital banking platforms generate vast amounts of customer data, which can be analyzed to gain valuable insights into customer behavior, preferences, and trends. This data-driven approach helps in targeted marketing, product development, and risk management.

- Competitive Advantage: Adopting digital banking platforms allows banks and financial institutions to stay competitive in a rapidly evolving market. It enables them to offer innovative services, adapt to changing customer needs, and differentiate themselves from traditional banking models.

SWOT Analysis

A SWOT (Strengths, Weaknesses, Opportunities, Threats) analysis of the digital banking platform market provides an overview of the internal and external factors influencing the market’s growth:

Strengths:

- Increasing demand for digital banking services.

- Technological advancements and innovations in the banking sector.

- Focus on enhancing customer experiences and personalization.

- Growing investments in digital banking infrastructure.

- Strong market presence of key players.

Weaknesses:

- Security concerns and data breaches.

- Limited digital literacy among certain customer segments.

- Regulatory complexities and compliance challenges.

- Connectivity and infrastructure issues in certain regions.

- Resistance to change from traditional banking models.

Opportunities:

- Untapped emerging markets and unbanked population.

- Integration of open banking and collaboration with third-party providers.

- Expansion of digital payment services.

- Focus on customer experience and personalization.

- Continuous technological innovations and integration of emerging technologies.

Threats:

- Intense competition from incumbent banks and fintech startups.

- Cybersecurity threats and fraud risks.

- Regulatory changes and compliance requirements.

- Economic uncertainties and market volatility.

- Resistance to digital banking adoption in certain customer segments.

Market Key Trends

- Open Banking and API Integration: The adoption of open banking APIs allows banks to share customer data securely with authorized third-party providers, enabling the development of innovative financial services and enhancing customer experiences.

- Artificial Intelligence and Machine Learning: AI and ML technologies are being leveraged in digital banking platforms to provide personalized recommendations, automate customer support, and enhance fraud detection capabilities.

- Biometric Authentication: Biometric authentication methods such as fingerprint scanning, facial recognition, and voice recognition are becoming increasingly prevalent in digital banking platforms, offering enhanced security and convenience to customers.

- Voice Banking and Virtual Assistants: The integration of voice recognition technology enables customers to perform banking transactions and access account information using voice commands. Virtual assistants powered by AI provide personalized assistance and answer customer queries.

- Blockchain Technology: Blockchain is being explored in digital banking platforms for secure and transparent transaction processing, reducing the need for intermediaries, and enhancing trust in financial transactions.

Covid-19 Impact

The COVID-19 pandemic has significantly accelerated the adoption of digital banking platforms. Lockdowns and social distancing measures imposed during the pandemic restricted physical branch visits, leading to a surge in online and mobile banking usage. Banks and financial institutions rapidly scaled up their digital capabilities to ensure uninterrupted banking services. The pandemic acted as a catalyst for digital transformation in the banking sector, with customers becoming more comfortable with digital channels and services. This shift is likely to have a long-lasting impact on the digital banking platform market, with increased focus on digitization, remote banking, and contactless payments.

Key Industry Developments

- Launch of Digital-Only Banks: Several digital-only banks have emerged, offering banking services exclusively through digital channels. These banks leverage digital banking platforms to provide a seamless and personalized banking experience to their customers.

- Partnerships between Banks and Fintech Startups: Banks are partnering with fintech startups to leverage their innovative technologies and digital banking solutions. These partnerships enable banks to accelerate their digital transformation journey and offer advanced digital banking services to their customers.

- Emphasis on Cybersecurity: With the increasing prevalence of cyber threats, banks and digital banking platform providers are investing heavily in cybersecurity measures. Robust encryption, multi-factor authentication, and AI-powered fraud detection systems are being implemented to ensure the security of digital banking transactions.

- Integration of Data Analytics: Data analytics is playing a vital role in digital banking platforms. Banks are leveraging customer data to gain insights into customer behavior, preferences, and risk profiles. Advanced analytics tools and AI algorithms enable banks to offer personalized banking experiences and targeted product offerings.

- Expansion of Digital Payment Ecosystem: Digital banking platforms are integrating with various digital payment providers and networks to offer seamless and secure digital payment solutions. This includes integration with mobile wallets, payment gateways, and peer-to-peer payment systems.

Analyst Suggestions

- Focus on User Experience: User experience is critical in digital banking platforms. Banks should invest in intuitive interfaces, personalized recommendations, and proactive customer support to enhance user satisfaction and loyalty.

- Enhance Security Measures: With the increasing cybersecurity threats, banks need to prioritize security in their digital banking platforms. Implementing advanced authentication methods, encryption techniques, and real-time fraud detection systems is crucial to build trust and protect customer data.

- Embrace Open Banking: Open banking initiatives present opportunities for collaboration and innovation. Banks should embrace open banking and actively explore partnerships with third-party providers to offer a broader range of services and enhance customer experiences.

- Leverage Emerging Technologies: Integration of emerging technologies such as AI, ML, blockchain, and IoT can revolutionize digital banking platforms. Banks should explore the use of these technologies to automate processes, improve operational efficiency, and deliver innovative services.

- Educate Customers about Digital Banking: To bridge the digital literacy gap, banks should focus on educating customers about the benefits and usage of digital banking platforms. This can be done through targeted marketing campaigns, user-friendly tutorials, and proactive customer support.

Future Outlook

The future of the digital banking platform market looks promising, with continued growth expected in the coming years. Factors such as increasing smartphone penetration, rising customer expectations, and the need for enhanced security and convenience will drive the adoption of digital banking platforms. Technological advancements and the integration of emerging technologies will further revolutionize the digital banking experience. The market is likely to witness increased competition, strategic partnerships, and collaborations between banks and fintech companies. As digital transformation becomes the norm in the banking industry, digital banking platforms will play a crucial role in shaping the future of banking services.

Conclusion

The digital banking platform market is witnessing significant growth and transformation, driven by increasing customer demand for seamless, personalized, and convenient banking experiences. Digital banking platforms enable banks and financial institutions to offer a wide range of online banking services, leveraging technologies such as mobile apps, online portals, and backend systems.

The market is characterized by intense competition, continuous technological innovations, and a focus on enhancing security and user experiences. The future outlook for the digital banking platform market is positive, with opportunities arising from emerging markets, open banking initiatives, and the integration of advanced technologies.

Digital Banking Platform Market

| Segmentation |

Details |

| Type |

Retail Banking, Corporate Banking, Investment Banking, Others |

| Deployment Mode |

On-Premises, Cloud |

| Banking Mode |

Online Banking, Mobile Banking, Omni-channel Banking |

| Region |

Global |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Digital Banking Platform Market:

- Fiserv, Inc.

- Infosys Limited

- Oracle Corporation

- SAP SE

- Tata Consultancy Services Limited

- Temenos AG

- Backbase

- EdgeVerve Systems Limited (a subsidiary of Infosys Limited)

- Finastra

- Appway AG

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA