444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

The 5G fronthaul and backhaul equipment market represents a critical infrastructure segment driving the global telecommunications revolution. This rapidly expanding market encompasses essential networking components that enable seamless data transmission between radio access networks and core network infrastructure. Market dynamics indicate unprecedented growth driven by increasing demand for ultra-low latency communications, massive IoT deployments, and enhanced mobile broadband services.

Fronthaul equipment connects remote radio heads to baseband processing units, while backhaul equipment links cell towers to core networks. The convergence of these technologies is experiencing remarkable expansion, with industry adoption rates reaching 78% among major telecommunications providers globally. Network operators are investing heavily in advanced equipment to support 5G network densification and capacity enhancement requirements.

Regional deployment patterns show significant variation, with Asia-Pacific leading adoption at 42% market share, followed by North America at 28% and Europe at 22%. The remaining 8% is distributed across emerging markets in Latin America, Middle East, and Africa. Technology evolution continues accelerating as operators transition from legacy 4G infrastructure to comprehensive 5G network architectures.

The 5G fronthaul and backhaul equipment market refers to the comprehensive ecosystem of networking hardware, software solutions, and infrastructure components that facilitate high-speed data transmission within fifth-generation wireless networks. This market encompasses specialized equipment designed to handle the unique requirements of 5G networks, including ultra-reliable low-latency communications, enhanced mobile broadband, and massive machine-type communications.

Fronthaul networks specifically connect distributed antenna systems and remote radio heads to centralized baseband processing units, enabling efficient spectrum utilization and network flexibility. Backhaul networks provide the critical link between cell sites and core network infrastructure, ensuring seamless data flow across the entire telecommunications ecosystem. These interconnected systems form the backbone of modern 5G network architecture.

Equipment categories include fiber optic cables, microwave radios, millimeter wave systems, optical transport platforms, and advanced switching solutions. The market also encompasses supporting technologies such as network function virtualization, software-defined networking, and cloud-based management platforms that optimize network performance and operational efficiency.

Market transformation in the 5G fronthaul and backhaul equipment sector reflects the telecommunications industry’s fundamental shift toward next-generation network architectures. The market demonstrates robust expansion driven by accelerating 5G deployments, increasing data traffic demands, and evolving consumer connectivity expectations. Technology convergence between fronthaul and backhaul solutions is creating integrated platforms that optimize network performance while reducing operational complexity.

Key growth drivers include the proliferation of IoT devices, autonomous vehicle development, smart city initiatives, and industrial automation applications requiring ultra-reliable connectivity. Network operators are prioritizing equipment investments that support network slicing capabilities, enabling customized service delivery across diverse use cases. Innovation trends focus on energy-efficient solutions, AI-driven network optimization, and seamless integration with existing infrastructure.

Competitive dynamics reveal intense competition among established telecommunications equipment manufacturers and emerging technology providers. Market leaders are differentiating through comprehensive solution portfolios, advanced software capabilities, and strategic partnerships with network operators. Investment patterns show increasing focus on open RAN architectures and vendor-neutral solutions that enhance network flexibility and reduce deployment costs.

Strategic market insights reveal several critical trends shaping the 5G fronthaul and backhaul equipment landscape:

Primary market drivers propelling the 5G fronthaul and backhaul equipment market include unprecedented data traffic growth, evolving application requirements, and transformative technology trends. Mobile data consumption continues expanding exponentially, with video streaming, gaming, and emerging applications driving bandwidth demands that exceed current network capabilities.

Industrial digitalization represents a significant growth catalyst, as manufacturing, healthcare, transportation, and energy sectors adopt 5G-enabled solutions for process optimization and automation. Smart city initiatives worldwide are creating substantial demand for reliable, high-capacity network infrastructure supporting connected traffic systems, public safety applications, and environmental monitoring platforms.

Autonomous vehicle development requires ultra-reliable low-latency communications that depend on robust fronthaul and backhaul infrastructure. Vehicle-to-everything communication systems demand network performance levels that traditional infrastructure cannot support, necessitating comprehensive equipment upgrades. IoT proliferation across consumer and industrial segments is generating massive connectivity requirements that drive network capacity expansion.

Government initiatives supporting 5G deployment through spectrum allocation, infrastructure investment, and regulatory frameworks are accelerating market growth. National broadband strategies emphasize network modernization as essential for economic competitiveness and digital transformation objectives.

Significant market restraints challenge the 5G fronthaul and backhaul equipment sector, including substantial capital investment requirements, technical complexity, and regulatory uncertainties. Infrastructure deployment costs represent major barriers for network operators, particularly in rural and underserved markets where return on investment timelines extend significantly.

Technical integration challenges arise from the complexity of migrating from legacy network architectures to advanced 5G systems while maintaining service continuity. Operators must navigate interoperability issues between equipment from different vendors, requiring careful planning and extensive testing protocols. Skilled workforce shortages in telecommunications engineering and network operations limit deployment capabilities and increase project timelines.

Regulatory uncertainties surrounding spectrum allocation, equipment certification, and security requirements create planning challenges for equipment manufacturers and network operators. Geopolitical tensions affecting global supply chains and technology transfer restrictions impact equipment availability and pricing structures.

Energy consumption concerns associated with dense 5G networks create operational cost pressures and environmental compliance challenges. Network operators must balance performance requirements with sustainability objectives, often requiring premium equipment solutions that increase initial investment costs.

Substantial market opportunities emerge from evolving technology trends, expanding application domains, and global infrastructure modernization initiatives. Private 5G networks represent a rapidly growing segment, with enterprises across manufacturing, logistics, healthcare, and mining sectors investing in dedicated network infrastructure to support specialized applications and ensure data security.

Edge computing convergence creates opportunities for integrated solutions that combine transport networking with distributed computing capabilities. This convergence enables new service models and revenue streams for equipment providers while addressing latency-sensitive applications in gaming, augmented reality, and industrial automation.

Rural connectivity initiatives supported by government funding and public-private partnerships are opening new market segments for cost-effective fronthaul and backhaul solutions. Satellite integration with terrestrial networks presents opportunities for hybrid solutions serving remote areas and mobile platforms.

Network-as-a-Service models are creating opportunities for equipment providers to develop subscription-based offerings that reduce upfront capital requirements for network operators. Artificial intelligence integration in network management and optimization tools represents a growing opportunity for value-added solutions that improve operational efficiency and service quality.

Complex market dynamics shape the 5G fronthaul and backhaul equipment landscape through interconnected technological, economic, and regulatory factors. Technology evolution cycles create continuous pressure for equipment upgrades and capability enhancements, with operators balancing performance improvements against investment costs and operational complexity.

Competitive pressures drive innovation in equipment efficiency, functionality, and cost-effectiveness. Established telecommunications equipment manufacturers compete with emerging technology companies and specialized solution providers, creating a dynamic ecosystem that benefits end users through improved products and competitive pricing.

Supply chain considerations significantly impact market dynamics, with global component shortages, logistics challenges, and geopolitical factors affecting equipment availability and pricing. MarkWide Research analysis indicates that supply chain resilience has become a critical factor in vendor selection processes, with operators prioritizing suppliers demonstrating reliable delivery capabilities.

Standards evolution continues influencing market dynamics as industry organizations develop specifications for advanced 5G features and interoperability requirements. The transition toward open architectures is reshaping vendor relationships and creating opportunities for new market entrants while challenging traditional business models.

Comprehensive research methodology employed in analyzing the 5G fronthaul and backhaul equipment market incorporates multiple data sources, analytical techniques, and validation processes to ensure accuracy and reliability. Primary research activities include structured interviews with industry executives, technical experts, and end-user organizations across major geographic markets.

Secondary research components encompass analysis of industry reports, financial statements, patent filings, and regulatory documents from telecommunications authorities worldwide. Market modeling techniques utilize statistical analysis, trend extrapolation, and scenario planning to project market developments and identify growth opportunities.

Data validation processes involve cross-referencing information from multiple sources, conducting expert reviews, and applying consistency checks to ensure research findings meet quality standards. Geographic coverage spans major markets including North America, Europe, Asia-Pacific, Latin America, Middle East, and Africa, with detailed analysis of regional variations and local market conditions.

Technology assessment methodologies evaluate equipment capabilities, performance characteristics, and competitive positioning through technical specifications analysis and field deployment case studies. Industry expert panels provide insights into technology trends, market dynamics, and future development directions.

Regional market analysis reveals significant variations in 5G fronthaul and backhaul equipment adoption patterns, driven by infrastructure maturity, regulatory environments, and economic conditions. Asia-Pacific markets demonstrate the highest growth rates, with China, South Korea, and Japan leading 5G deployment initiatives and driving substantial equipment demand.

North American markets show strong momentum in private 5G networks and enterprise applications, with the United States and Canada investing heavily in network modernization programs. Carrier investments focus on network densification in urban areas and coverage expansion in rural regions, creating balanced demand across fronthaul and backhaul segments.

European markets emphasize energy efficiency and sustainability in network deployments, driving demand for advanced equipment solutions that reduce power consumption and environmental impact. Regulatory frameworks supporting open RAN adoption are influencing vendor selection and equipment procurement strategies across the region.

Emerging markets in Latin America, Middle East, and Africa present significant growth opportunities as telecommunications infrastructure modernization accelerates. Government initiatives supporting digital transformation and connectivity expansion are creating favorable conditions for equipment market growth, though economic constraints may influence deployment timelines and technology choices.

Competitive landscape analysis reveals a dynamic market structure with established telecommunications equipment manufacturers competing alongside emerging technology providers and specialized solution developers. Market leadership positions are determined by technology innovation, global reach, customer relationships, and comprehensive solution portfolios.

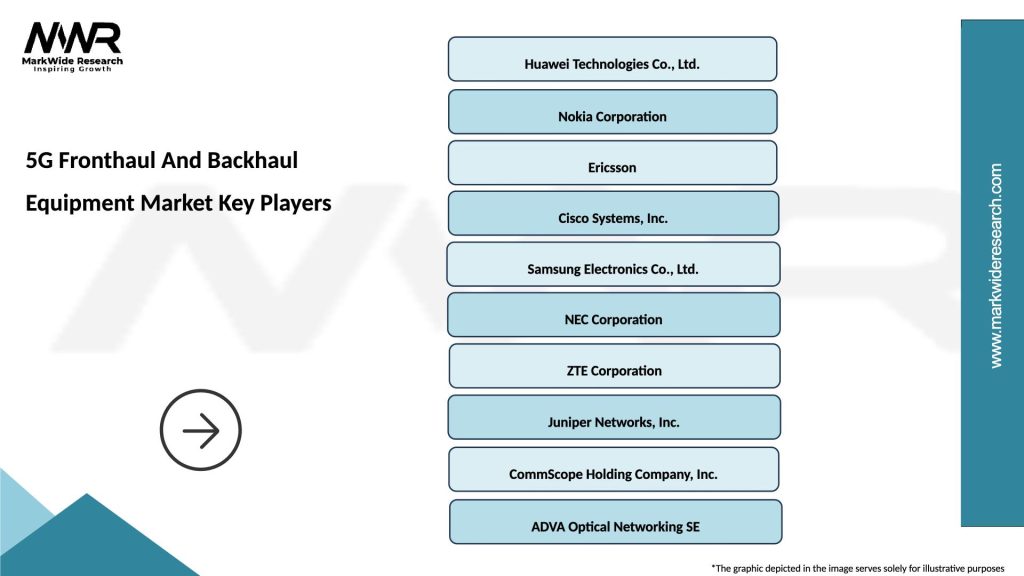

Leading market participants include:

Competitive strategies emphasize technology differentiation, strategic partnerships, and comprehensive service offerings that address evolving customer requirements and market dynamics.

Market segmentation analysis provides detailed insights into the diverse components and applications within the 5G fronthaul and backhaul equipment market. Technology-based segmentation distinguishes between various transport technologies, equipment types, and deployment architectures that serve different network requirements and use cases.

By Technology:

By Application:

Fronthaul equipment category demonstrates rapid growth driven by network densification requirements and the proliferation of small cell deployments. Optical fronthaul solutions dominate high-capacity applications, while wireless fronthaul options provide deployment flexibility in challenging environments. Centralized RAN architectures are driving demand for high-performance fronthaul equipment that supports baseband processing centralization.

Backhaul equipment category shows strong demand across fiber, microwave, and satellite solutions, with operators selecting technologies based on geographic requirements, capacity needs, and economic considerations. Fiber backhaul remains preferred for high-capacity applications, while microwave solutions offer rapid deployment advantages and cost-effectiveness in specific scenarios.

Integrated transport platforms are gaining traction as operators seek simplified network architectures that reduce operational complexity and improve efficiency. These solutions combine fronthaul and backhaul capabilities in unified platforms that support diverse connectivity requirements while minimizing equipment footprint and power consumption.

Software-defined transport represents an emerging category enabling dynamic network configuration and optimization through centralized management platforms. This approach supports network slicing capabilities and service customization requirements that are essential for 5G network operations.

Network operators benefit from advanced 5G fronthaul and backhaul equipment through enhanced network capacity, improved service quality, and operational efficiency gains. Revenue opportunities expand through support for new service categories including ultra-reliable low-latency communications, enhanced mobile broadband, and massive IoT applications that generate premium pricing potential.

Equipment manufacturers gain access to substantial market opportunities driven by global 5G deployment initiatives and network modernization programs. Technology innovation enables differentiation through advanced features, improved performance, and integrated solutions that address evolving customer requirements.

Enterprise customers benefit from private 5G network capabilities that support digital transformation initiatives, operational efficiency improvements, and competitive advantages through advanced connectivity solutions. Industrial applications enable automation, remote monitoring, and predictive maintenance capabilities that reduce costs and improve productivity.

Government stakeholders achieve economic development objectives through improved telecommunications infrastructure that supports innovation, attracts investment, and enhances citizen services. Public safety benefits include enhanced emergency communications capabilities and smart city applications that improve quality of life.

Strengths:

Weaknesses:

Opportunities:

Threats:

Open RAN adoption represents a transformative trend reshaping the 5G fronthaul and backhaul equipment market through vendor-neutral architectures that promote interoperability and reduce deployment costs. Industry momentum toward open standards is accelerating, with major operators committing to open RAN deployments and driving ecosystem development.

Edge computing integration is creating convergence opportunities between transport networking and distributed computing infrastructure. This trend enables new service models and applications requiring ultra-low latency performance while optimizing network resource utilization and operational efficiency.

Artificial intelligence integration in network management and optimization is becoming increasingly important for handling the complexity of 5G networks. AI-driven solutions enable predictive maintenance, automated optimization, and intelligent resource allocation that improve network performance and reduce operational costs.

Sustainability focus is driving demand for energy-efficient equipment solutions that reduce power consumption and environmental impact. Green networking initiatives are influencing equipment design and deployment strategies as operators balance performance requirements with sustainability objectives.

Network slicing capabilities are becoming essential for supporting diverse 5G use cases with customized performance characteristics. Equipment must support dynamic resource allocation and service differentiation to enable new business models and revenue opportunities.

Recent industry developments highlight the dynamic nature of the 5G fronthaul and backhaul equipment market, with significant announcements regarding technology innovations, strategic partnerships, and deployment milestones. Open RAN ecosystem expansion continues with major operators announcing large-scale deployment plans and vendor partnerships that promote interoperability and competition.

Technology breakthroughs in optical transport systems are enabling higher capacity and improved efficiency for fronthaul and backhaul applications. Coherent optical technology advances are extending reach capabilities while reducing power consumption and equipment footprint requirements.

Strategic acquisitions and partnerships are reshaping the competitive landscape as companies seek to expand capabilities and market reach. Vertical integration trends see equipment manufacturers acquiring software companies and service providers to offer comprehensive solutions.

Government initiatives supporting 5G deployment through funding programs, spectrum allocation, and regulatory frameworks are accelerating market development. National security considerations are influencing vendor selection and supply chain strategies in major markets worldwide.

Standards evolution continues with industry organizations developing specifications for advanced 5G features including network slicing, edge computing integration, and enhanced security capabilities that drive equipment requirements and market opportunities.

Strategic recommendations for market participants emphasize the importance of technology innovation, partnership development, and market positioning strategies that address evolving customer requirements and competitive dynamics. Equipment manufacturers should prioritize open architecture development and software-defined solutions that provide flexibility and future-proofing capabilities.

Network operators are advised to develop comprehensive 5G deployment strategies that balance performance requirements, cost considerations, and operational complexity. Vendor diversification strategies can reduce supply chain risks while promoting competition and innovation in equipment procurement processes.

Investment priorities should focus on technologies and solutions that support multiple use cases and provide scalability for future requirements. MWR analysis suggests that operators prioritizing integrated platforms and software-defined capabilities will achieve better long-term return on investment and operational efficiency.

Partnership strategies become increasingly important as the market evolves toward ecosystem-based solutions requiring collaboration between equipment manufacturers, software providers, and service companies. Ecosystem development efforts should focus on interoperability, standards compliance, and customer value creation.

Market entry strategies for new participants should emphasize differentiation through specialized capabilities, innovative business models, or focus on underserved market segments where established players may have limited presence.

Future market outlook indicates continued robust growth for the 5G fronthaul and backhaul equipment market, driven by expanding 5G deployments, evolving application requirements, and technology innovation. Market expansion is expected to accelerate as 5G networks mature and new use cases emerge across consumer, enterprise, and industrial segments.

Technology evolution will focus on increased integration, improved efficiency, and enhanced capabilities supporting advanced 5G features. Next-generation solutions will incorporate artificial intelligence, machine learning, and automation capabilities that optimize network performance and reduce operational complexity.

Geographic expansion opportunities will emerge as 5G deployments extend to additional markets and regions worldwide. Emerging markets present significant growth potential as telecommunications infrastructure modernization accelerates and government initiatives support connectivity expansion.

Application diversification will drive demand for specialized equipment solutions supporting vertical industry requirements and use cases. Private 5G networks are projected to experience particularly strong growth as enterprises recognize the strategic value of dedicated connectivity infrastructure.

MarkWide Research projects that the market will continue evolving toward open architectures, software-defined solutions, and integrated platforms that provide flexibility and cost-effectiveness for network operators. Innovation cycles will accelerate as competition intensifies and customer requirements become more sophisticated, creating opportunities for companies that successfully anticipate and address market needs.

The 5G fronthaul and backhaul equipment market represents a critical enabler of the global telecommunications transformation, providing essential infrastructure components that support next-generation network capabilities and applications. Market dynamics reflect the complex interplay of technological innovation, economic factors, and regulatory influences that shape industry development and competitive positioning.

Growth prospects remain strong across all market segments, driven by accelerating 5G deployments, expanding application domains, and evolving customer requirements. The transition toward open architectures and software-defined solutions is creating new opportunities while challenging traditional business models and competitive relationships.

Success factors for market participants include technology leadership, strategic partnerships, operational excellence, and customer focus that addresses the diverse requirements of network operators, enterprise customers, and vertical industry applications. Future competitiveness will depend on the ability to innovate, adapt to changing market conditions, and deliver comprehensive solutions that create value for customers and stakeholders throughout the telecommunications ecosystem.

What is 5G Fronthaul And Backhaul Equipment?

5G Fronthaul And Backhaul Equipment refers to the technology and infrastructure used to connect the core network to the radio access network in 5G telecommunications. This equipment is essential for managing data traffic and ensuring efficient communication between base stations and the network core.

What are the key players in the 5G Fronthaul And Backhaul Equipment Market?

Key players in the 5G Fronthaul And Backhaul Equipment Market include companies like Cisco Systems, Nokia, and Ericsson, which are known for their advanced networking solutions. These companies are actively involved in developing innovative technologies to enhance network performance and capacity, among others.

What are the main drivers of the 5G Fronthaul And Backhaul Equipment Market?

The main drivers of the 5G Fronthaul And Backhaul Equipment Market include the increasing demand for high-speed internet, the proliferation of IoT devices, and the need for enhanced mobile broadband services. These factors are pushing telecom operators to invest in advanced fronthaul and backhaul solutions.

What challenges does the 5G Fronthaul And Backhaul Equipment Market face?

The 5G Fronthaul And Backhaul Equipment Market faces challenges such as high deployment costs, the complexity of integrating new technologies with existing infrastructure, and regulatory hurdles. These issues can hinder the rapid rollout of 5G networks.

What opportunities exist in the 5G Fronthaul And Backhaul Equipment Market?

Opportunities in the 5G Fronthaul And Backhaul Equipment Market include the expansion of smart cities, the growth of autonomous vehicles, and the increasing adoption of cloud services. These trends are expected to drive demand for robust and scalable network solutions.

What trends are shaping the 5G Fronthaul And Backhaul Equipment Market?

Trends shaping the 5G Fronthaul And Backhaul Equipment Market include the shift towards virtualization and software-defined networking, the rise of edge computing, and the integration of AI for network management. These innovations are enhancing the efficiency and flexibility of network operations.

5G Fronthaul And Backhaul Equipment Market

| Segmentation Details | Description |

|---|---|

| Product Type | Radio Units, Optical Transport, Routers, Switches |

| Technology | Millimeter Wave, Fiber Optics, Microwave, Satellite |

| End User | Telecom Operators, Enterprises, Government, ISPs |

| Deployment | Urban, Suburban, Rural, Remote |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the 5G Fronthaul And Backhaul Equipment Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at