444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview:

The 2G Cellulose Ethanol market is experiencing rapid growth globally, fueled by the increasing demand for sustainable biofuels and the need to reduce greenhouse gas emissions from the transportation sector. 2G cellulose ethanol, also known as second-generation ethanol, is derived from non-food feedstocks such as agricultural residues, forest residues, municipal solid waste, and energy crops. Unlike first-generation ethanol produced from food crops such as corn and sugarcane, 2G cellulose ethanol offers several environmental and socioeconomic benefits, including lower carbon emissions, reduced land competition with food production, and enhanced rural development opportunities. With stringent environmental regulations, growing concerns over energy security, and the imperative to mitigate climate change, there is a growing emphasis on advancing 2G cellulose ethanol technologies to achieve sustainable and decarbonized transportation systems.

Meaning:

2G cellulose ethanol refers to ethanol produced from lignocellulosic biomass feedstocks, including agricultural residues (such as corn stover, wheat straw, and rice husks), forest residues (such as wood chips and sawdust), municipal solid waste (such as paper, cardboard, and yard waste), and energy crops (such as switchgrass and miscanthus). Unlike first-generation ethanol, which relies on food crops such as corn and sugarcane, 2G cellulose ethanol utilizes non-food biomass resources, offering advantages such as reduced competition with food production, improved lifecycle greenhouse gas emissions, and enhanced sustainability. The production process involves pretreatment, enzymatic hydrolysis, fermentation, and distillation to convert cellulose and hemicellulose into fermentable sugars, which are then fermented into ethanol by microorganisms such as yeast or bacteria. 2G cellulose ethanol technologies hold promise for advancing the biofuels industry and achieving renewable energy goals while addressing environmental and social concerns associated with conventional biofuel production.

Executive Summary:

The 2G Cellulose Ethanol market is witnessing robust growth, driven by the increasing emphasis on renewable energy sources, decarbonization of the transportation sector, and the transition to low-carbon and sustainable fuel alternatives. With growing concerns over climate change, energy security, and resource depletion, there is a pressing need to accelerate the commercialization and deployment of 2G cellulose ethanol technologies to replace fossil fuels and mitigate greenhouse gas emissions. Governments, industry stakeholders, and investors are ramping up efforts to support research, development, and deployment initiatives aimed at scaling up 2G cellulose ethanol production capacity, reducing production costs, and enhancing the efficiency and sustainability of biofuel supply chains.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights:

Market Drivers:

Market Restraints:

Market Opportunities:

Market Dynamics:

The 2G Cellulose Ethanol market is characterized by dynamic factors driving growth, including policy support, technological innovation, market demand, and industry collaboration. Key trends such as advances in biomass conversion technologies, diversification of feedstock sources, optimization of production processes, and expansion of market applications are shaping the market landscape and fostering opportunities for stakeholders across the value chain. However, challenges such as feedstock availability, production costs, regulatory uncertainties, and market competitiveness may pose barriers to market growth and deployment.

Regional Analysis:

The 2G Cellulose Ethanol market is witnessing growth across regions, with countries such as the United States, Brazil, Canada, European Union (EU) member states, China, and India leading the way in biofuel production, research, and policy support. Government policies, regulatory frameworks, and market incentives promoting renewable energy, decarbonization, and sustainable development are driving investments in 2G cellulose ethanol projects and infrastructure in these regions. Additionally, emerging economies in Asia, Africa, and Latin America present untapped potential for market expansion, given the availability of abundant biomass resources and growing energy demand.

Competitive Landscape:

Leading Companies in the 2G Cellulose Ethanol Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

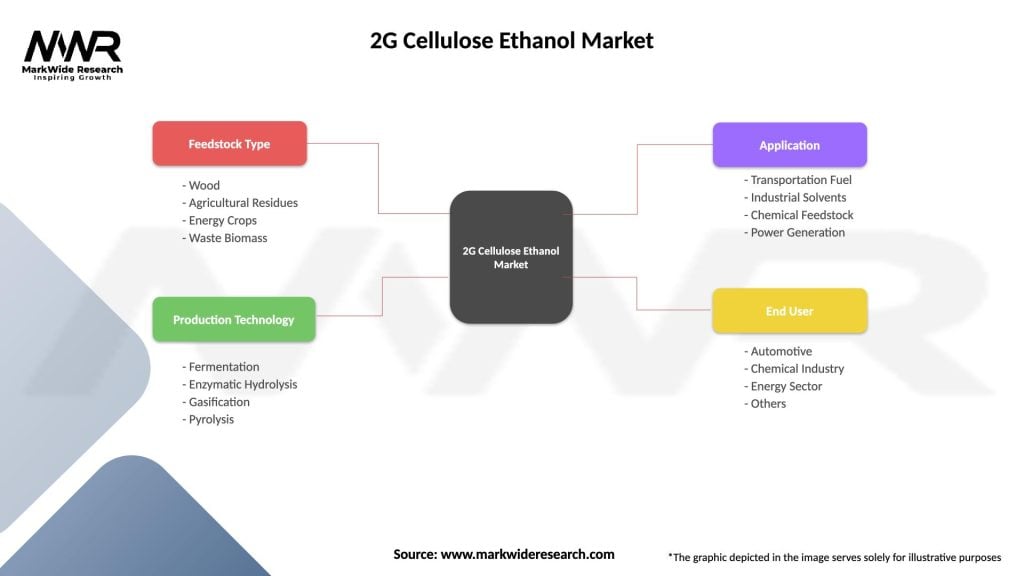

Segmentation:

The 2G Cellulose Ethanol market can be segmented based on feedstock type, production technology, end-user application, and geography. Feedstock types include agricultural residues, forest residues, municipal solid waste, and energy crops, each with unique characteristics and availability. Production technologies encompass biochemical conversion, thermochemical conversion, and hybrid processes, each offering advantages and challenges for biomass conversion. End-user applications span transportation fuels, industrial chemicals, and power generation, each with distinct market drivers and requirements. Geographically, the market spans regions such as North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa, each with unique market dynamics and growth opportunities.

Category-wise Insights:

Key Benefits for Industry Participants and Stakeholders:

SWOT Analysis:

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends:

Covid-19 Impact:

The Covid-19 pandemic has disrupted global supply chains, delayed project timelines, and dampened investment sentiments in the biofuels industry, including 2G cellulose ethanol projects. However, the pandemic has also highlighted the importance of sustainable and resilient energy systems, driving investments in renewable energy deployment, decarbonization, and biofuel production as part of economic recovery and resilience efforts. As economies rebound and rebuild, there is an opportunity to accelerate investments in 2G cellulose ethanol projects to support renewable energy goals, stimulate rural economies, and mitigate climate change.

Key Industry Developments:

Analyst Suggestions:

Future Outlook:

The future outlook for the 2G Cellulose Ethanol market is promising, with sustained growth anticipated as global energy demand rises, concerns over climate change intensify, and efforts to decarbonize the transportation sector accelerate. 2G cellulose ethanol technologies hold promise for providing sustainable and low-carbon alternatives to fossil fuels, reducing greenhouse gas emissions, and enhancing energy security and rural development. With advancements in technology, supportive policies, and market incentives, the market for 2G cellulose ethanol is poised for substantial expansion in the coming years, driving industry growth, innovation, and sustainability.

Conclusion:

In conclusion, the 2G Cellulose Ethanol market presents significant opportunities for stakeholders to contribute to the advancement of sustainable biofuels, decarbonization of the transportation sector, and mitigation of climate change. By leveraging abundant biomass resources, technological innovation, and supportive policies, 2G cellulose ethanol technologies offer a promising pathway to achieve renewable energy goals, stimulate rural economies, and reduce environmental impact. With collaboration, investment, and advocacy, the 2G Cellulose Ethanol market has the potential to drive industry growth, foster innovation, and accelerate the transition to a clean, sustainable, and resilient energy future.

What is 2G Cellulose Ethanol?

2G Cellulose Ethanol refers to second-generation bioethanol produced from lignocellulosic biomass, such as agricultural residues and wood chips. This type of ethanol is considered more sustainable as it does not compete with food crops for resources.

What are the key companies in the 2G Cellulose Ethanol Market?

Key companies in the 2G Cellulose Ethanol Market include POET, Inc., Abengoa Bioenergy, and DuPont, among others. These companies are involved in the development and commercialization of advanced biofuels derived from cellulose.

What are the growth factors driving the 2G Cellulose Ethanol Market?

The growth of the 2G Cellulose Ethanol Market is driven by increasing demand for renewable energy sources, government incentives for biofuel production, and advancements in conversion technologies. Additionally, the need to reduce greenhouse gas emissions is propelling market expansion.

What challenges does the 2G Cellulose Ethanol Market face?

The 2G Cellulose Ethanol Market faces challenges such as high production costs, technological barriers in biomass conversion, and competition from other renewable energy sources. These factors can hinder the widespread adoption of cellulose ethanol.

What opportunities exist in the 2G Cellulose Ethanol Market?

Opportunities in the 2G Cellulose Ethanol Market include the potential for innovation in enzyme technologies, partnerships for research and development, and expanding applications in transportation fuels. The growing emphasis on sustainability also presents new avenues for market growth.

What trends are shaping the 2G Cellulose Ethanol Market?

Trends in the 2G Cellulose Ethanol Market include increasing investment in research for more efficient production methods, a shift towards circular economy practices, and rising consumer awareness about sustainable fuels. These trends are influencing the future landscape of bioethanol production.

2G Cellulose Ethanol Market

| Segmentation Details | Description |

|---|---|

| Feedstock Type | Wood, Agricultural Residues, Energy Crops, Waste Biomass |

| Production Technology | Fermentation, Enzymatic Hydrolysis, Gasification, Pyrolysis |

| Application | Transportation Fuel, Industrial Solvents, Chemical Feedstock, Power Generation |

| End User | Automotive, Chemical Industry, Energy Sector, Others |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at